Pound too hot to handle as Brexit talks go down to the wire

As Brexit talks once again go into overtime, investors are handling the pound with care.

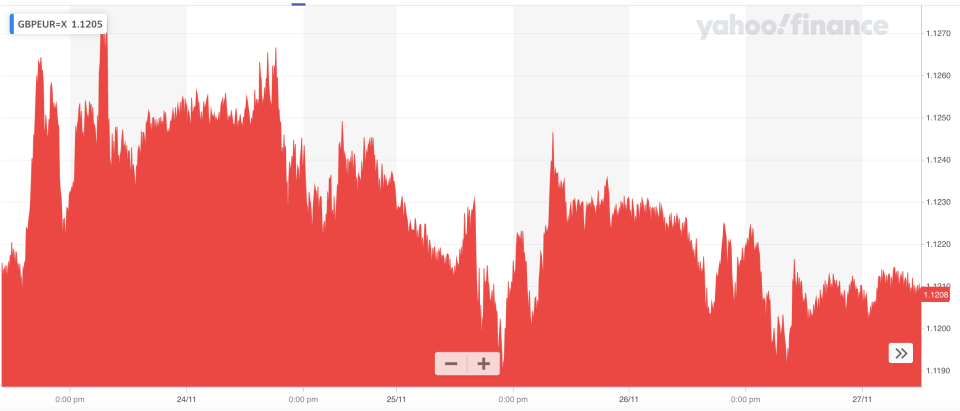

Sterling has been trading in a tight range against the euro and dollar this week as a relative information dearth on Brexit talks has left investors wary about taking big positions.

“It's not that the market doesn't care - it just doesn't know,” Kit Juckes, a macro strategist at Societe Generale wrote in a note earlier this week.

Recent data shows speculative investors remain net short of sterling but have trimmed back their exposure in recent weeks.

“The net short is about half of its average post-referendum level and indeed, the total positioning is 60% of its post-referendum average,” Juckes said.

The declining speculative interest — combined with the Thanksgiving holiday in the US — has left the pound largely directionless this week. Sterling was flat against the euro (GBPEUR=X) at €1.1209 on Friday morning and up just 0.1% against the dollar (GBPUSD=X) to $1.3369. The performance against the dollar was largely down to weakness of the greenback.

Sterling’s direction of travel continues to be determined by Brexit negotiations. Trade talks continue with little sign of a breakthrough on key issues and few statements of much note.

Michel Barnier tweeted on Friday morning that he would travel to London later today to resume face-to-face talks. However, he warned that the “same significant divergences persist.”

Barnier will brief EU leaders and the European parliament on the progress of negotiations before he travels to London. Reports suggest he has called an emergency meeting of EU leaders on fisheries, one of the key sticking points in talks.

WATCH: Brexit briefing — 34 days until the end of the transition period

“Sterling continues to nervously wait for signs that the current Brexit talks are going to finally produce a deal before the end of the year,” said Connor Campbell, a financial analyst at SpreadEx. “It’s not looking too promising.”

Time is fast running out to reach a deal that can be ratified by UK and EU leaders before the transition period ends on 1 January 2021. Reuters reported that the EU will not make a decision on whether to allow UK financial service access the EU market before the deadline, citing unnamed sources.

If a trade deal can be reached, analyst think the pound could pop.

“There could be a statement over the weekend when markets are closed that is material, which may lead to gapping on Sunday night when FX markets reopen down under,” Neil Wilson, chief market analyst at Markets.com, said.

Both Wilson and Juckes believe sterling could climb to $1.40 if a comprehensive trade deal is agreed.

However, a failure to secure a deal has “big downside risks”, Wilson said. The market appears broadly optimistic and sterling could drop to $1.25 if one doesn’t materialise, Juckes said.

WATCH: EU chief says no-deal Brexit still possible

Yahoo Finance

Yahoo Finance