Pound falls on UK construction's worst month since crisis as Brexit bites

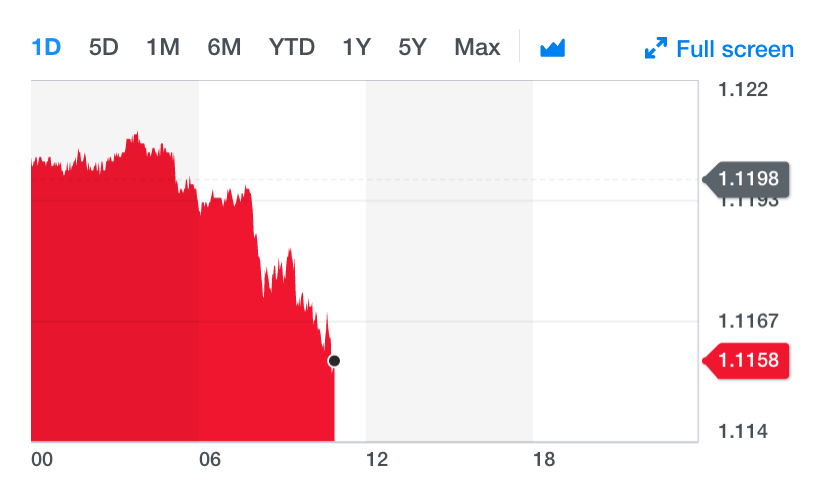

The pound dropped to a two-week low after figures revealed the UK’s construction industry suffered its worst month since the financial crisis, with a sharp decline well below most forecasts.

One analyst said the construction sector’s June decline was “less of a slide than a sledgehammer,” while another said the latest bleak figures on the UK economy “scream rate cut.”

Markets also appeared to be nervous after preparations for a potentially catastrophic no-deal Brexit by Jeremy Hunt and Boris Johnson, the two candidates for UK prime minister, dominated the headlines on Monday.

The latest numbers are one of several warning signs for the UK economy in recent days, with new data also showing growth spluttering in the housing market and small firms holding back on investment.

READ MORE: Property prices in Britain are almost flat

The monthly IHS Markit/CIPS index released on Tuesday showed a reading of 43.1 for June, down from 48.6 in May. Figures below 50 represent contraction and above 50 indicate growth.

Construction work dried up in housebuilding for the first time in 17 months, as well as declining commercial and civil engineering projects. One analyst said stalling property prices are now dragging down residential building work.

The worst dip in more than a decade saw sterling fall almost 0.2% against the dollar and more tha 0.3% against the euro, as economists had expected contraction to ease to 49.2. The pound was trading at just over $1.26 at 10am local time.

‘Less of a slide than a sledgehammer’

“The latest survey reveals weakness across the board for the UK construction sector, with house building, commercial work, and civil engineering activity all falling sharply in June,” Tim Moore, associate director at IHS Markit, said.

“Delays to new projects in response to deepening political and economic uncertainty were the main reasons cited by construction companies for the fastest drop in total construction output since April 2009.”

Blane Perrotton, managing director of property consultancy Naismiths, said the news would send a “chill down many builder’s spines” after a grim start to 2019, despite the brief Brexit stockpiling boom.

“This is less of a slide than a sledgehammer. After licking its wounds from a lean May, the construction industry has once again been ambushed by plummeting investor demand,” Perrotton said.

“What work there is, is dominated by the completion of existing projects rather than new ones, and barring some Brexit miracle, only the pathologically optimistic will expect a turnaround any time soon.”

READ MORE: Funding Circle shares crash as small UK firms stop investing

The slump in Markit's construction PMI in June points to a worrying step change in the impact of Brexit uncertainty on the economy. Builders unambiguous that Brexit/political risks are to blame for caution among clients. But don't panic, I'm sure Boris & co have a plan... pic.twitter.com/QKn9miX2RG

— Samuel Tombs (@samueltombs) July 2, 2019

Samuel Tombs of Pantheon Macroeconomics tweeted that building firms were “unambiguous” that Brexit was to blame for the industry’s troubles.

“There is no sugar-coating these numbers, they are awful,” Michael Hewson, chief market analyst at CMC Markets UK, said.

Hewson said the numbers “scream rate cut,” calling into question the Bank of England’s apparent view that a rate rise is more likely than a cut.

Alarm bells for the UK economy

READ MORE: Jeremy Hunt plans £6bn war chest for no-deal Brexit

Other widely used indicators on the health of the UK economy make for equally bleak reading.

On Tuesday, the Nationwide house price index showed national property prices inched up just 0.1% between May and June, with London suffering losses for another month. The data left investors disappointed, if not would-be homeowners looking to get on the ladder.

Separate data from the Federation of Small Business (FSB) also released on Tuesday showed small firms struggling to invest, hire, and increase productivity while the future of Brexit remains in limbo.

More than seven in 10 small firms surveyed said they did not expect to raise capital spending in the next quarter, the highest figure in two years.

Four in 10 companies also said new credit was “unaffordable,” with the FSB suggesting lenders were pushing up premiums amid increased wariness of risks from Brexit and sluggish economic growth.

READ MORE: Investors still stranded as Woodford fund remains frozen

Yahoo Finance

Yahoo Finance