Pound falls as Johnson faces down Brexit rebels and manufacturing slides

The pound has fallen as the UK government dashed MPs’ hopes of blocking a no-deal Brexit and figures showed British manufacturing slumped to a seven-year low.

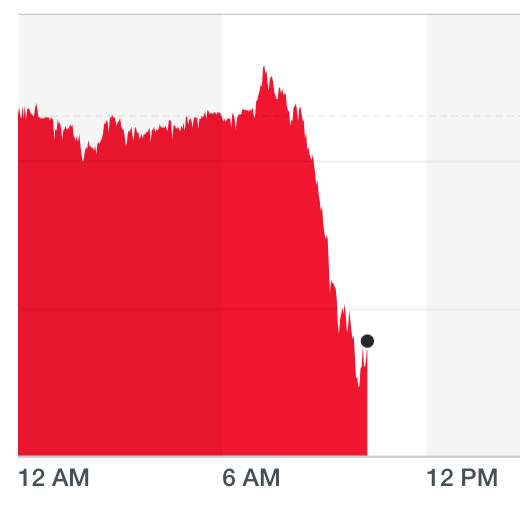

Sterling was trading 0.6% lower against the dollar (GBPUSD=X) at just under $1.21 at around 10am on Monday morning, as one analyst said the pound could slip below $1.20 this week. It was down 0.4% on the euro (GBPEUR=X) at just over €1.10.

It comes after a survey suggested UK manufacturers had suffered their worst month in seven years in August, with “immensely feeble” activity shrinking for a fourth consecutive month.

READ MORE: Global slowdown and Brexit uncertainty hit UK manufacturing hard

A closely followed purchasing managers’ index (PMI) for the sector showed managers reporting new orders, business confidence and employment levels had fallen.

“Traders took no time to push sterling lower,” said Naeem Aslam, chief market analyst at ThinkMarkets. “We are expecting sterling to fall below 1.20 by the end of this week, because there is no clarity whatsoever when it comes to Brexit.”

Neil Wilson, chief market analyst for Markets.com, said sterling “fell out of bed” over the manufacturing figures, blaming global economic slowdown and Brexit uncertainty for the sector’s “simply shocking” performance.

David Cheetham, chief market analyst at XTB, said the figures “raised alarm bells” for UK industry, but said the pound had already been falling on Monday morning.

He said economic data “remains very much of secondary importance for the pound at present,” with political uncertainty and the ticking clock until Britain’s departure from the EU far more significant.

“The pound was already sliding lower at the start of what could be a big week for the currency, with the coming days set to reveal how opponents to the government’s Brexit plan will respond,” Cheetham said.

Opposition MPs are set to launch a last-ditch legislative bid to force the government to delay Brexit this week, with efforts given fresh urgency by the controversial suspension of parliament from next week.

There are reports rebel MPs could move today in parliament as they return from their summer break, with Conservative MPs threatened with de-selection if they back opposition attempts to stop a no-deal Brexit.

But sterling had slid already in early trading after Michael Gove, the UK minister in charge of no-deal planning, refused to say if prime minister Boris Johnson’s government would obey parliament’s demands if they successfully passed the Commons.

The comments make it more likely Britain will crash out of the EU without a deal on 31 October, in a move widely expected to send shockwaves rippling through the UK economy as its close ties with Europe are broken overnight.

the PMI stupid. not a great start to the week. pic.twitter.com/2BWyvXXMqY

— Neil Wilson (@marketsneil) September 2, 2019

READ MORE: Johnson urged to back ‘Dig for Victory’-style allotment revolution to feed Brexit Britain

Yahoo Finance

Yahoo Finance