Pound retreats from two-month high against euro on weak UK business investment data but French political nerves still weigh

UK's economy accelerated at the end of 2016

Enthusiastic British shoppers boosted the economy in the final three months of last year, pushing growth up to 0.7pc in the quarter, faster than was first thought.

GDP growth accelerated in the last quarter of the year, speeding up from the 0.6pc initially estimated by the Office for National Statistics.

The economy had already proved resilient since the Brexit vote, with growth of 0.6pc in the quarter before, and the quarter after, the referendum.

Now growth has accelerated a touch, speeding up as confident households increased their spending before Christmas.

GDP growth for 2016 as a whole was revised down, however, as extra data showed the economy got off to a slower start in the first quarter than previously thought. GDP grew by 1.8pc over the year, not the 2pc initially estimated.

Read the full story here (Report by Tim Wallace)

French political nerves continue to weigh on sentiment

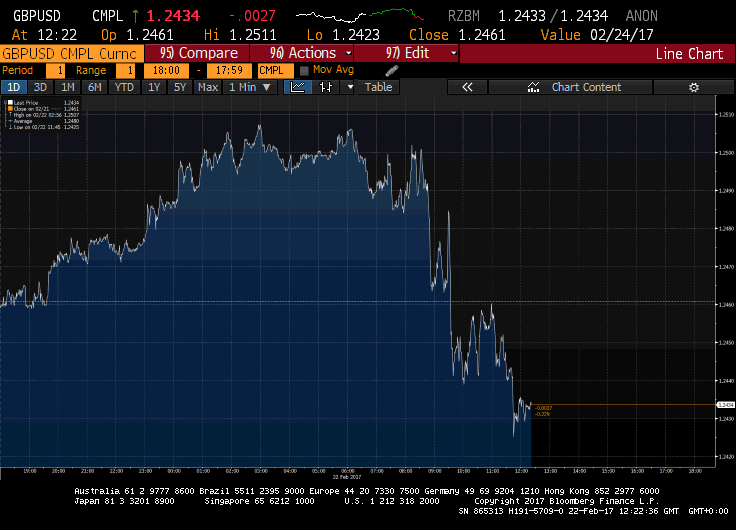

In early trade, French political nerves drove the pound to a two-month high against the euro. It hit 84.12p per euro, marking its strongest level since December 21.

Worries about a Le Pen victory in the French presidential election continue to bubble as she is now the front-runner to win the first round of the election and her prospects are also improving for the second round. Kathleen Brooks, of City Index, said: "Victory for Eurosceptic Le Pen could spell the end for the single currency."

Pound retreats from two-month high on weak UK business investment data

After rallying to a two-month high on French political nerves, the pound has since retreated from December 21 highs on the back of weak UK business investment data.

Although UK Q4 GDP was revised up, business investment fell 1pc in the last three months of the year compared with the previous quarter, the first fall since the start of the year. Household spending growth also slowed.

In its wake, the pound slipped from €1.1901 to €1.1846, up just 0.2pc on the day. Against the US dollar, it dipped 0.15pc to $1.2440.

Other key highlights:

European bourses mixed despite upbeat corporate earnings

French political nerves rattle investors

German-US bond yield gulf last seen at dawn of millennium

Eurozone inflation confirmed at 1.8pc in January

Euro spikes after Bayrou says he will not stand in French presidential election

Market Report: Fevertree fizzes to record high on bullish broker note

A bullish broker note proved to be “just the tonic” for shares in upmarket drinks manufacturer Fevertree.

The London-listed group fizzed to an all-time high of £14.31 after RBC Capital Markets began covering the stock with an “outperform” rating and a price target of £17.

Analysts think the upmarket tonic water maker is well positioned to deliver double-digit growth for the “foreseeable future” in its established markets. The bank also believes the sugar tax and Brexit are not a major concern for the company, as around 29pc of group sales currently fall under the UK sugar tax.

In the event of a ‘hard Brexit’ with trade tariffs, the bank says Fevertree has flexibility to “easily outsource” its production to continental Europe.

Micro Badocco, of RBC, said: “Given the premium nature of the brand we think the company is in a good position to pass this on to the consumer if needed.”

Separately, Berenberg hiked its price target to £14.50 as it believes there is great potential for Fevertree to increase its exposure to different spirits and expand further in the long-term. Shares rallied by 47p, or 3.5pc, to £13.95.

On the broader market, the FTSE 100 rose 27.42 points, or 0.38pc, to 7,302.25, led higher by Unilever. Shares leapt 204.5p to £37.91 after the blue chip company said it will conduct a comprehensive review of its options, just days after Kraft-Heinz abandoned its £115bn takeover bid. It also sees 2017 profits coming in at upper end of its guidance.

The withdrawn Kraft Heinz-Unilever deal spurred the latest round of fantasy M&A. Exane BNP Paribas added Imperial Brands to its M&A target list and assigned a 70pc probability of a deal by next year. Analyst David Finch said: “We see a takeout as increasingly likely.” In the near term, the bank sees a bid for Imperial led by Japan Tobacco. Shares in Imperial advanced 30.5p to £37.85.

Imperial Brands share price 1yr

Lloyds was also among the risers, up 2.9p to 69.7p, after it reported its highest full-year profit in a decade of £4.2bn.

Ian Gordon, of Investec, said: “Today it feels like Lloyds is only just emerging from a 16-year nightmare, and the market hasn’t quite been ready to embrace its recovery… We think it will now.”

Housebuilder Barratt Developments bounced 2.5p higher to 517p on the back of a 9pc rise in half-year pre-tax profits, while Capital & Counties Properties rose 12.1p to 309.3p despite Numis cutting its rating to “hold”.

Elsewhere, weaker metals prices dragged miners into the red. Anglo American fell 41.5p to £13.09, BHP Billiton lost 38p to £13.68, Antofagasta dropped 17.5p to 851p and Rio Tinto finished down 37.5p at £36.08.

British Airways owner IAG lost altitude, 4p lower at 506.5p. Previewing the company’s full-year results, which are due for release on Friday, Goldman Sachs said it expects IAG to confirm a below-consensus capital expenditure target for this year.

On the mid-cap index, British events and market company UBM surged to a 17-year high, up 32.5p to 759p, after it reported a 19.2pc jump in full-year profits, buoyed by recent bolt-on acquisitions and better growth in China.

Meanwhile, Liberum began covering engineer IMI with a “buy” rating as it believes the recovery is underway. The bank’s earnings estimates are 15pc ahead of consensus. Nevertheless, shares dropped 22p to £11.93.

Outsourcer Serco suffered its worst day in more than two years, slumping 29.2p to 118.5p, after its full-year trading profit tumbled 14pc to £82m.

On Aim, radiation detection technology group Kromek jumped 4.1pc after it secured its first long-term contract in the security screening market in a deal worth $3.1m.

Finally, insurer GBGI enjoyed its first day of trading on London’s junior market closing at 150p.

With that, it's time to close for this evening. Thanks for following our markets coverage today.

Steve Caunce to succeed John Roberts as AO World CEO

John Roberts has stepped down as AO World chief executive with immediate effect. Steve Caunce chief operating officer will replace Roberts, who is moving to a new executive role.

Mr Roberts will transition to a new role on the Board as Founder, Executive Director. Mr Caunce will lead the Company as CEO, accountable for strategy and performance delivery, while Mr Roberts will focus on innovation and inspiring AO's people.

Commenting Steve Caunce, AO Chief Executive Officer, said:

"I am looking forward to leading AO as its CEO. AO is an exceptional business and as CEO, working as closely as ever with John and with the whole team, I am focused on our mission to become the best electrical retailer in Europe. We will continue to do things the 'AO Way' - building our brand by offering consumers the very best customer experience, based on great choice, price and service. Our unique culture means that the passion of our people has never been stronger as we change the way Europe buys its electricals, simply by caring more and executing brilliantly."

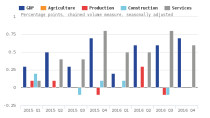

European bourses mixed by close despiteupbeat results

European bourses were mixed at the closing bell despite a raft of upbeat corporate earnings.

At the closing bell:

FTSE 100: +0.39pc

DAX: +0.18pc

CAC 40: -0.02pc

IBEX: -1.04pc

Joshua Mahony, of IG, said all eyes now turn to the US, where the release of the latest monetary policy minutes from the Fed are sure to push the dollar back into the limelight.

"Janet Yellen's appearance in Washington went a long way to determining a market position over when we will see the Fed act, raising the option-derived probability of a March hike. The big question is whether Trump's initial actions and promises have shifted market estimates, with some members being open to a hawkish shift in the event of a upward shift in UK growth projections."

Gold prices steady as market awaits Fed minutes

Gold prices held steady today as investors awaited for new signals on whether the US central bank would hike rates next month.

Traders are waiting for the minutes from the US Federal Reserve's last meeting, due at 7pm. Ahead of the release, gold edged down slightly to $1,234.50.

Michael Hewson, of CMC Markets,said: "Gold prices have held their ground despite the expectation that this evenings Fed minutes are likely to be on the hawkish side. It is not immediately obvious what they can add to the overall narrative given recent hawkish comments from a number of Fed policymakers which have been made in the period since the Fed meeting took place."

Euro spikes after Bayrou says he will not stand in French presidential election

The euro spiked to $1.0537 against the US dollar this afternoon after French centrist politician Bayrou says he will not stand in the presidential election.

Instead, he says he will back Macron.

Meanwhile, France's 10-year government bond yield extended its falls to 1.02pc after he pulled out of the presidential race. It is now down 6.5 basis points on the day.

BREAKING: EUR rallying as Bayrou not standing in French election

— Anthony Cheung (@AWMCheung) February 22, 2017

Politics is currency and currency is politics. Going to be an excruciating year

— World First (@World_First) February 22, 2017

Britain faces 'legal void' if it fails to strike EU trade deal, warns ex-ambassador Sir Ivan Rogers

Former ambassador to the EU Sir Ivan Rogers says Britain should push for "the biggest free trade agreement ever". Our economics correspondent Tim Wallace has the details:

Britain must seek “the biggest free trade agreement ever” with the EU and risks falling into “a legal void” if it fails to strike any new trade deal, the UK’s former ambassador to Brussels has warned.

Sir Ivan Rogers emphasising that you can not replicate full benefits of Single Market Membership via a Free Trade Agreement

— Jonathan Edwards (@JonathanPlaid) February 22, 2017

A comprehensive trade deal covering goods and services, eliminating tariffs and recognising standards could mean Britain keeps many of the trading advantages of the EU, but remains free to control migration and strike external trade deals, Sir Ivan Rogers said.

Sir Ivan Rogers tells Brexit Select Committee that no major economy, including the USA, deals with EU solely on the basis of WTO rules.

— Pat McFadden (@patmcfaddenmp) February 22, 2017

“What the UK ideally may want with the EU is the biggest free trade agreement ever struck, which covers not only goods and tariffs, but also covers services in a way that goes far deeper than for the EU-Canada [deal] or EU-South Korea,” he told the Brexit committee of MPs.

“It has got to be an unprecedentedly good and bespoke deal."

US existing home sales hit 10-year high in January

Over in the US, existing home sales surged to a 10-year high in January.

Data from the National Association of Realtors showed existing home sales jumped 3.3pc last month to a seasonally adjusted annual rate of 5.69m units, marking its highest level since February 2007.

Forecasts suggested sales would rise 1.1pc to a 5.54m-unit pace in January.

#UnitedStates Existing Home Sales at 5.69M https://t.co/tMYF5masJupic.twitter.com/dI5NIvw4aq

— Trading Economics (@tEconomics) February 22, 2017

Demand for housing is being underpinned by a strengthening labor market, which is improving employment opportunities for young adults and, in turn, boosting household formation.

BREAKING: US existing home sales hit 10-year high in January https://t.co/JGIO6PYsjp

— CNBC Now (@CNBCnow) February 22, 2017

Unite to build 7,500 more rooms for UK students as development plans hot up

Shares in Unite Group jumped 3.1pc today after it increased its full-year dividend by 26pc to 12p. Rhiannon Bury has the details:

Student accommodation developer Unite plans to spend more than £300m creating around 7,500 student rooms in the next three years, as it looks to realise its ambition of partnering with more of the UK’s top universities.

The company announced this morning that it had bought a development site in Manchester city centre, the latest in a string of acquisitions in major university cities, which adds 450 beds to its plans.

Chief executive Richard Smith said the company continued to target towns and cities with high-performing universities to build on its 49,000-bed portfolio.

“We’re reasonably selective about where we want to be,” Mr Smith said. “Around 84pc of our revenue is from strong institutions.”

Wall Street slips at opening bell as investors eye Fed's FOMC January meeting minutes

US stocks slipped into the red this afternoon as investors awaited the minutes of the Fed's most recent policy meeting for clues on the timing of the next rate rise.

Energy stocks also came under pressure, weighing on indices.

At the opening bell:

Dow Jones: -0.13pc

S&P 500: -0.18pc

Nasdaq: -0.13pc

Unilever hikes profit guidance

Another statement from Unilever this afternoon. This time it hikes its profit guidance for 2017:

"The management of Unilever now expects Core Operating Margin improvement for 2017 to be at the upper end of its 40-80 basis points guidance."

Less than an hour ago, it said it will conduct a comprehensive review of its options.

Shares are now 2.8pc higher at £36.88.

Some thoughts from our retail editor Ashley Armstrong:

Straight out of the M&A defence playbook - Unilever announces a review to consider all options following Kraft Heinz withdrawal.

— Ashley Armstrong (@AArmstrong_says) February 22, 2017

Unilever presses SOS button: "The events of the last week have highlighted the need to capture more quickly the value we see in Unilever"

— Ashley Armstrong (@AArmstrong_says) February 22, 2017

And Unilever have managed to find some margin gains down the back of the sofa too - isn't that helpful? (Guiding margins to be upper end)

— Ashley Armstrong (@AArmstrong_says) February 22, 2017

FOMC meeting minutes in focus

The Fed's FOMC January meeting minutes will be released at 7pm this evening.

Previewing the release, FXTM Research Analyst Lukman Otunuga, said:

"The improving sentiment towards the U.S economy, prospects of higher US rates and the relentless “Trump effect” have made the Dollar king again. Today’s main focus will be the FOMC meeting minutes this evening which has the ability to fuel the current bull rally or potentially limit gains. If the FOMC minutes are in harmony with the recent hawkish comments from Fed official, then the Greenback may be installed with further inspiration to trade towards 102.00."

Yesterday, #Fed's Mester said "we don't want to surprise markets" => supports our view that March is off the table given no guidance pic.twitter.com/GpeE5traHc

— Danske Bank Research (@Danske_Research) February 22, 2017

Hotel Chocolat shares enjoy sugar rush on profit surge

Shares in Hotel Chocolat bounced 5.8pc higher today after it reported a 28pc increase in half-year pre-tax profits. Our retail editor Ashley Armstrong reports:

Hotel Chocolat shares enjoyed a sugar rush after the upmarket confectionery chain beat City estimates with a 28pc jump in profits.

The company revealed that pre-tax profits had risen to £11.2m in the six months to December 25 compared to £8.8m the year before.

Angus Thirlwell, co-founder and chief executive, toasted a "very successful" Christmas which helped to lift sales by 14pc to £62.5m during the period.

Hotel Chocolat shares were up by 15.8p, or 6.2pc, to 271.8p in midday trading, meaning the shares are 83.1pc higher than its listing price in May last year.

The company's festive hampers, which cost between £50 and £500, were up 80pc on the year before while its advent calendars sold out before the start of December.

Unilever will conduct comprehensive review of options

Shares in Unilever jumped 3.2pc minutes after the FTSE 100 company said it will conduct a comprehensive review of its options.

Unilever sounding rattled: "he events of the last week have highlighted the need to capture more quickly the value we see in Unilever."

— Jon Yeomans (@JonLYeomans) February 22, 2017

Here's the statement:

"Unilever is conducting a comprehensive review of options available to accelerate delivery of value for the benefit of our shareholders. The events of the last week have highlighted the need to capture more quickly the value we see in Unilever.

"We expect the review to be completed by early April, after which we will communicate further."

It comes three days after Kraft Heinz abandoned its £115bn takeover bid.

US stocks to slip at opening bell

US stocks are poised to drop at the opening bell as investors await the Fed's FOMC January meeting minutes.

The Fed will release the minutes this evening at 7pm, which may offer clues about whether the central bank could hike rates in March. The odds of a rate rise next month are 22pc.

Here are the opening calls courtesy of IG:

US Opening Calls:#DOW 20696 -0.18%#SPX 2358 -0.25%#NASDAQ 5339 -0.18%#IGOpeningCall

— IGSquawk (@IGSquawk) February 22, 2017

Metro boss eyes parts of Co-op Bank but rules out full bid

The boss of Metro Bank has signalled he will look at parts of rival Co-operative Bank that come up for sale if the ailing lender fails to find a buyer for its entire business.

Craig Donaldson, the chief executive of challenger bank Metro, said he was interested in taking customers from the struggling, loss-making lender if it is eventually broken up.

“I’m certainly not interested in buying the bank,” he said, as Metro posted narrowing annual pre-tax losses of £17.2m in 2016, from £56.8m a year earlier. “I must admit I’ll wait to see what they come out with on chunks of it.

“We are an organic growth model, it doesn’t mean to say we won’t look at opportunities.”

He added, however, that he would “much prefer to win” customers from Co-op Bank than buy them.

Read the full story here (Report by Ben Martin)

Sterling pressured by bears

FXTM Research Analyst Lukman Otunuga says sterling has found itself exposed to steep losses today following the mixed economic data from the UK which revived some Brexit anxieties.

It is currently trading down 0.21pc at $1.2135.

He said: "Although Britain’s economic growth accelerated faster than previously assumed in the final quarter of 2016 at 0.7pc, the noticeable decline in business investment in the same quarter has already triggered concerns of how the rising uncertainty will impact investment this year. Sterling remains heavily influenced by the Brexit developments with further weakness expected as uncertainty haunts investor attraction towards the currency.

"The Sterling/Dollar remains heavily pressured on the daily charts and a breakdown below 1.2400 could encourage a further decline towards 1.2300."

Serco poised for biggest one-day drop since November after slump in profits

Shares in outsourcer Serco are poised for their sharpest one-day fall since November after it reported a 14pc fall in its full-year trading profit to £82m.

Revenues from continuing operations fell to £3.01bn, in line with forecasts, as Serco continued to whittle down its portfolio to concentrate on those which make money.

Meanwhile, the company said in a statement: "Our guidance is for margins to reduce in 2017, but we would expect to show some modest improvement year-on-year in 2018."

In its wake, Liberum cut its rating to "sell" from "hold" to reflect the weaker than expected results.

Shares plunged 14.6pc to 126.1p.

Had to do a double take there - Serco shares plunge 14% today. pic.twitter.com/mEWglqFiCl

— Jamie McGeever (@ReutersJamie) February 22, 2017

European bourses mixed on corporate earnings

After an upbeat to the day, European bourses are mixed at lunchtime despite positive earnings updates.

Just after midday:

FTSE 100: +0.02pc

DAX: +0.12pc

CAC 40: -0.10pc

IBEX: -0.49pc

Mike van Dulken, of Accendo Markets, said: "European equities are mixed this morning, with fresh US dollar strength helping both European and UK equities via reciprocal GBP and EUR weakness. This comes after US bourses made fresh records on their return from a long weekend, still bullish about the future. In London, Lloyds profits at 10yr highs and continued interest in a range of defensive names is offsetting understandable weakness among Miners whose wares are hampered by the dollar's rally."

Barclays: Firms appear to be cautious as fixed investment remains weak

A cause for concern this morning in the UK GDP figures comes UK business investment, which shrank by 1.0pc quarter-on-quarter.

Andrzej Szczepaniak, of Barclays, said: "Although fixed investment appears to have printed stronger than we have forecast for some quarters, it is important to highlight that fixed investment growth for 2016 is nonetheless only 0.5%, materially lower than its average of 3.7pc each year since 2010.

"Business investment surveys remain in contractionary territory and so suggest continued weakness in investment going forward into 2017."

TUC: Annual decline of 1.5pc in business investment requires response in budget

The UK GDP Q4 figures showed that annual business investment fell by 1.5pc in 2016 – the first annual decline since the recession.

TUC General Secretary Frances O’Grady said:

“It’s very worrying to see that business investment is already falling with the challenges of Brexit ahead. If this trend continues, working people will pay the price through weaker wages and fewer jobs.

“Despite a modest boost to public investment last year, UK investment still lags behind the world’s leading industrial nations. With private sector investment in retreat, the Chancellor must focus on closing the gap with our competitors in next month’s budget. This would help protect jobs and wages, and it would give a much needed boost to business confidence.”

The level of business investment in the UK fell last year for the first time since the financial crash. pic.twitter.com/iuBSXRZMEB

— Ian Jones (@ian_a_jones) February 22, 2017

Disturbing signs dotted in UK GDP figures

Although UK Q4 GDP was revised up, Connor Campbell, of SpreadEx, said there were disturbing signs dotted about here and there within the economic release from the ONS.

"First and foremost, for 2016 as a whole the UK’s growth now sits at 1.8pc, not the 2.0pc floated a few weeks ago, meaning the country is no longer the best performer in the G7 – that honour goes to Germany, with its 1.9% annual growth.

"Business investment in the UK also fell by 1pc in the final quarter of last year while there are signs that consumer spending (the main driver of growth) is beginning to flag."

UK GDP grew at its fastest pace for eight quarters in the three months of 2016.

Graphic via The Independent. pic.twitter.com/wu7Jn19B4c— Robert Kimbell (@RedHotSquirrel) February 22, 2017

@CapEconomics says its more bullish on UK GDP than most but flags biz investment & consumer spend falls as negative #brexit effects to watch pic.twitter.com/LvBnCXBc1w

— Gemma Felicity Acton (@GemmaActon) February 22, 2017

BAE Systems chief Ian King to step down in the summer

Shares in BAE Systems are subdued this morning after it was announced that boss Ian King would retire in July. Industry editor Alan Tovey has the details:

Ian King, the long-serving boss of BAE Systems, is to retire from the defence giant in the summer.

He will officially step down on June 30 with chief operating officer Charles Woodburn taking the reins on July 1.

The handover of power has been expected since it was announced last February that Mr Woodburn would be joining FTSE 100-listed BAE in the newly created post from oil services group Expro.

He was seen as a bold choice, having no experience of the byzantine world of defence, but insiders say the appointment was intended to bring a fresh perspective into the business.

The management shake-up comes a day before BAE posts its annual results, which are expected to show the company has turned a corner after several years of uncertainty caused by constrained military spending. Revenues are forecast to have grown by 4pc to £18.7bn, with pre-tax profits more than 10pc higher at at £1.23bn.

UK no longer world's fastest growing advanced economy in 2016

Growth may have been revised upwards in the final three months of last year, but the UK has lost its title as the world's fastest growing advanced economy in 2016.

The UK has lost its title as the world's fastest growing advanced economy in 2016, despite a Q4 growth upgrade https://t.co/fmFQ9mtjfYpic.twitter.com/STLLWgE7Ku

— fastFT (@fastFT) February 22, 2017

Signs of weakness in retail continued into 2017

ommenting on today’s GDP figures, Head of GDP Darren Morgan said:

“The economy grew slightly more in the last three months of 2016 than previously thought, mainly due to a stronger performance from manufacturing.

“Overall, the dominant services sector continued to grow steadily, due in part to continued growth in consumer spending, although retail showed some signs of weakness in the last couple of months of 2016, which has continued into January 2017.”

Commenting on today’s GDP figures, Head of GDP Darren Morgan said: https://t.co/TyteeubqoRpic.twitter.com/sTZdjBCdGe

— ONS (@ONS) February 22, 2017

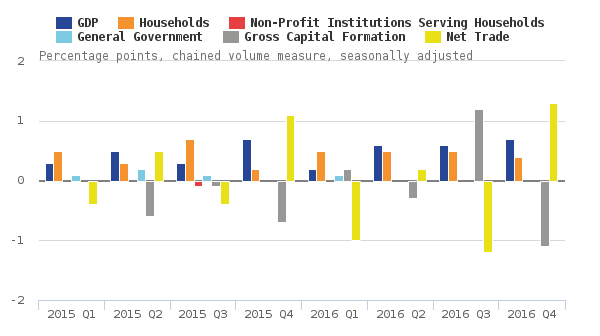

UK economic growth in 2016 entirely driven by household spending

Sky's Ed Conway highlights that UK economic growth was entirely driven by household spending last year:

Maybe the most striking thing from GDP revisions today is detail on where growth is coming from. 2016 entirely driven by household spending

— Ed Conway (@EdConwaySky) February 22, 2017

UK GDP breakdown shows real household spend up 0.7%, even though employees' compensation grew by just 0.1%. This is not sustainable growth

— Samuel Tombs (@samueltombs) February 22, 2017

Pwc: UK Q4 GDP a 'mixed bag', but doesn't change big picture UK economy grew steadily after Brexit vote

John Hawksworth, chief economist at PwC, said today's revised GDP data were a mixed bag of good and bad news, but this doesn't change the big picture that the UK continued to grow steadily during the six months following the Brexit vote.

“Estimated fourth quarter GDP growth was marked up slightly from 0.6pc to 0.7pc due primarily to stronger estimated growth in manufacturing. This was linked also to a combination of stronger export growth on the back of a more competitive pound and a gradually strengthening world economy.

“Consumer spending growth also remained solid in the fourth quarter as a whole, although the latest retail sales figures suggest that this has shown signs of tailing off in December and January.

“Less positively, estimated annual GDP growth in 2016 was revised down from 2pc to 1.8pc, pushing the UK slightly below Germany (1.9pc) in the G7 growth league, though the difference is well within the margin of error on any such early GDP estimates.

Quarterly GDP growth accelerated at the end of 2016. And surveys suggest that a decent amount of momentum was maintained at start of 2017. pic.twitter.com/YyDUq6lDQ0

— Capital Economics (@CapEconUK) February 22, 2017

“The main reason for the downward revision seems to have been weaker North Sea oil and gas production during the first half of 2016; however, this is a sector-specific trend that does not really reflect the underlying strength of the UK economy. Excluding oil and gas output, estimated UK GDP growth might actually have been revised up in 2016.

“Looking ahead, we still expect some slowdown in UK growth to an average of around 1.5pc in 2017 and 2018 as higher inflation bites into consumer spending power, which in turn reduces incentives for increased business investment and hiring in consumer-focused sectors. But there could be some offset to this from stronger export growth as the world economy continues its gradual recovery and the pound remains at competitive levels for UK exporters.”

UK's economy accelerated at the end of 2016

Here's our full report on UK Q4 GDP by economics correspondent Tim Wallace:

Enthusiastic British shoppers boosted the economy in the final three months of last year, pushing growth up to 0.7pc in the quarter, faster than was first thought.

GDP growth accelerated in the last quarter of the year, speeding up from the 0.6pc initially estimated by the Office for National Statistics.

The economy had already proved resilient since the Brexit vote, with growth of 0.6pc in the quarter before, and the quarter after, the referendum.

Now growth has accelerated a touch, speeding up as confident households increased their spending before Christmas.

GDP growth for 2016 as a whole was revised down, however, as extra data showed the economy got off to a slower start in the first quarter than previously thought. GDP grew by 1.8pc over the year, not the 2pc initially estimated.

Eurozone inflation confirmed at 1.8pc in January

Euro zone inflation rose to an annual rate of 1.8pc in January, the European Union statistics agency said this morning confirming its earlier estimates.

On a monthly basis, consumer prices in the eurozone fell by 0.8pc, in line with market expectations.

No change to euro area final January HICP except for a 4bp downward revision to services inflation. pic.twitter.com/wkFvU7OpEQ

— Frederik Ducrozet (@fwred) February 22, 2017

Stripped of the volatile components of energy and unprocessed food, an indicator closely watched by the European Central Bank, the annual inflation rate in January was 0.9pc, confirming Eurostat's earlier estimate and the market consensus.

The rise of annual inflation was mostly driven by energy prices which increased by 8.1pc in January year-on-year, jumping from a 2.6pc annualised increase in December.

Concerns about weak business investment

Ian Kernohan, Economist at Royal London Asset Management, said: "There were some signs that Brexit uncertainty is starting to have some impact on the corporate sector, with business investment down during the last three months, combined with slower growth in consumer spending."

Duncan Weldon, of Resolution Foundation, was also concerned about weak business investment:

Mixed UK GDP picture: decent net trade but weak biz investment.

— Duncan Weldon (@DuncanWeldon) February 22, 2017

Biz investment numbers here: https://t.co/XwuyCl5jeR - caveat that the first cut of this data is often revised.

— Duncan Weldon (@DuncanWeldon) February 22, 2017

Weak gross fixed capital formation is kinda a problem if you want to run a capitalist economy. Just saying. It's sort of important.

— Duncan Weldon (@DuncanWeldon) February 22, 2017

Expenditure breakdown of #UK Q4 GDP shows jump in contribution from net trade:strong exports but also weak imports after slump in investment pic.twitter.com/E1JYcD0Sxx

— Danielle Haralambous (@DHaralambous) February 22, 2017

UK Q4 growth: As good as it gets

Howard Archer, of IHS,also thinks it increasingly looks like the fourth quarter of 2016 was as good as it gets for some time for the UK economy.

"There is now mounting evidence that consumers are reining in their spending as their purchasing power is eroded by markedly rising inflation."

UK GDP growth revised up to 0.7% for 2016Q4, continued strong consumer spending +1.2% but business investment -1% https://t.co/QSXxlRtgaT

— Linda Yueh (@lindayueh) February 22, 2017

UK Q4 GDP reaction: The last impulse of momentum

After data from the ONS showed UK Q4 GDP was revised up to +0.7 pct quarter-on-quarter, compared to forecasts of +0.6pc, here's what the experts had to say:

Although UK GDP may have gained some momentum into the end of 2016, Jeremy Cook, chief economist at the international payments company, World First, said recent news from UK seems to have shown that that momentum has been lost in the early weeks of 2017.

"Services growth is set to slow, buffeted by rising inflation and slowing real wage gains and a consumer that is not waving but drowning, business investment remains poor given uncertainty over the negotiations between the UK and the EU following the Brexit vote last summer and while trade was stronger on the quarter this is purely a function of the devaluation of the pound."

"There is little within this release that suggests either stability or sustainability are intrinsic values of the UK economy anymore."

UK GDP revised up to 0.7% QoQ in Q4 - soft business investment weakness offset by large net trade boost: https://t.co/gD7rktr4Eapic.twitter.com/Qw5Q3grwRV

— Simon French (@shjfrench) February 22, 2017

Meanwhile, economist Shaun Richards points to forecast errors from the Bank of England:

UK GDP UK quarter 1 of 2016 only saw growth of 0.2% so since then the economy has picked up meaning the BoE was woefully wrong #GBP

— Shaun Richards (@notayesmansecon) February 22, 2017

David Cheetham, of XTB, said the reading is clearly a positive sign for the UK economy but hasn’t seen to big an impact in the markets possibly due to an accompanying decline in business investment.

"Overall this reading serves as further evidence that the UK economy is chugging along nicely and showing little by the way of ill effects due to the impending Brexit."

Britain's GDP rose 0.7% in the final quarter of last year - but it may be the last hurrah https://t.co/Hqb28azGI6pic.twitter.com/BFBjqL2HCa

— Bloomberg Brexit (@Brexit) February 22, 2017

Elsewhere, Danske Bank said the growth figures were solid, but it expects growth to slow this year:

����Solid #UK GDP growth after EU vote - however, we expect growth to slow this year eventually pic.twitter.com/fj9uPUBlIE

— Danske Bank Research (@Danske_Research) February 22, 2017

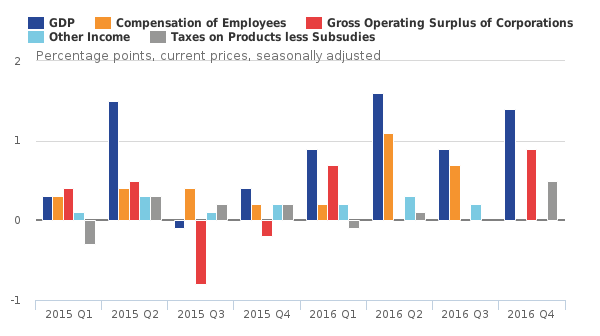

Samuel Tombs, of Pantheon Macroeconomics, thinks households clearly financed the increase in spending in Q4 by borrowing more; indeed, the compensation of employees rose by just 0.1pc quarter-on-quarter in Q4.

"Consumers appear to have brought forward big-ticket purchases from the first half of 2017, because they expected prices to rise sharply this year. The collapse in retail sales over the last two months supports that story. This shift in the timing of consumption, alongside the intensification of the pressure on real incomes from rising inflation and slowing employment growth, suggests that household spending will grow only modestly over the next couple of quarters, depleting the economy’s overall momentum."

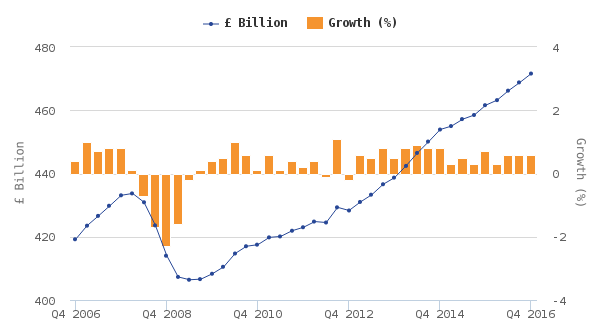

UK Q4 growth hits a one-year high but 2016 seen weaker than previously thought

Here's Reuters take on UK Q4 growth:

Britain's economy picked up speed to grow at the fastest rate in a year during the last three months of 2016, beating a preliminary estimate and showing how little immediate impact June's Brexit vote had on growth.

But business investment fell and there were signs that a tougher year lies ahead. Household spending growth slowed in the fourth quarter and separate data showed the dominant services sector expanded in December at the slowest pace in seven months.

The UK economy continued to grow at rates comparable with other G7 economies between Q4 2015 and Q4 2016 https://t.co/1Fcdk1oGWD#GDP

— ONS (@ONS) February 22, 2017

The Office for National Statistics said gross domestic product rose by 0.7pc in the fourth quarter compared with the previous three months, up from an initial estimate of 0.6pc.

The ONS also revised down its estimate for economic growth in 2016 as a whole to 1.8pc from 2pc.

A Reuters poll of economists had suggested the second reading would confirm the initial estimates of 0.6pc for growth on the quarter.

UK GDP Q4 (QoQ) = 0.7% vs 0.6% expected and 0.6% previously

— World First (@World_First) February 22, 2017

Business investment fell 1pc in the fourth quarter compared with the July-September period, the first fall since the first three months of the year, and was 0.9pc lower compared with the fourth quarter of 2015.

Companies are expected to rein in their investment plans as Britain negotiates its departure from the European Union.

More charts...

Chart 4shows the quarterly contribution of the expenditure components to the growth of GDP in chained volume measures.

Chart 5 shows the contribution made by income components to current price GDP. In Quarter 4 2016, the largest positive contribution to GDP came from gross operating surplus of corporations, which contributed 0.9 percentage points.

Chart 6 shows quarterly revisions between latest and previously published estimates of gross domestic product (GDP). Quarter 1 2016 is the first quarter open for revision in this release.

Chart 7: International GDP growth rates, quarter-on-quarter

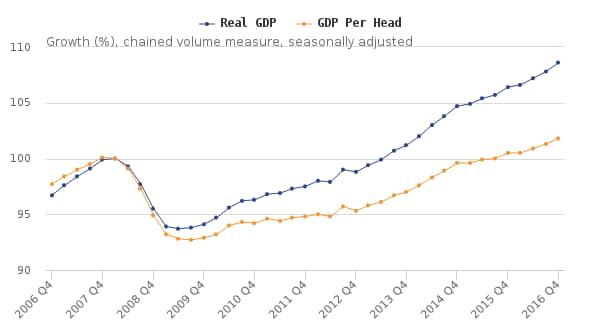

Key charts: UK Q4 GDP revised up to 0.7pc from a preliminary estimate of 0.6pc

Here are the key charts from the UK Q4 GDP data release:

Chart 1: Quarterly growth and levels of GDP for the UK

Chart 2: Quarterly growth of UK GDP and GDP per head for the UK, indexed to Quarter 1 (Jan to Mar) 2008

Chart 3 shows the services industry has dominated the GDP growth in Quarter 4 (Oct to Dec) 2016 and has contributed 0.6 percentage points to the 0.7pc quarterly growth. Within services, the largest contributor to growth was distribution, hotels and catering.

UK Q4 growth: Key points

Here are the key points from the ONS data released which showed that the UK economy picked up speed to grow at the fastest rate in a year in the final three months of 2016, beating expectations:

UK gross domestic product (GDP) in volume terms was estimated to have increased by 0.7pc between Quarter 3 (July to Sept) 2016 and Quarter 4 (Oct to Dec) 2016, revised up 0.1 percentage points from the preliminary estimate of GDP published on 26 January 2017. Upward revisions (due to later data received) within the manufacturing industries is the main reason.

UK GDP growth in Quarter 4 2016 saw a continuation of strong consumer spending which is in line with the Retail Sales Index for Quarter 4, which grew by 1.2pc (published on 20 January 2017) and strong growth in the output of the services sector with a notable contribution in consumer-focused industries. In Quarter 4 2016, there has been a slowdown within business investment which fell by 1.0pc, driven by subdued growth within the “ICT equipment and other machinery and equipment” assets.

Growth in 2016 is 1.8pc higher than that in 2015. This has been revised down by 0.2 percentage points from the preliminary estimate published on 26 January 2017.

GDP in current prices increased by 1.4pc between Quarter 3 2016 and Quarter 4 2016.

GDP per head in volume terms was estimated to have increased by 0.5pc between Quarter 3 2016 and Quarter 4 2016.

Breaking: UK GDP revised up to +0.7pc quarter-on-quarter

UK fourth quarter GDP has been revised up to 0.7pc quarter-on-quarter from a preliminary estimate of 0.6pc, data from the Office for National Statistics showed this morning.

The ONS also revised down its estimate for economic growth in 2016 as a whole to 1.8pc from 2pc.

0.7% growth in #GDP in Q4, revised up 0.1 percentage points from prelim estimate https://t.co/ZnCbaStRYo

— ONS (@ONS) February 22, 2017

More to follow...

Second estimate of Q4 UK GDP will be the highlight for sterling

The highlight for sterling today is the 2nd reading of UK GDP for Q4, Jeremy Cook, of World First, said this morning.

"Given the lack of strength seen in UK consumption numbers so far in 2017, any growth momentum is going to be important to output for the first quarter of this year. However, regardless of what this morning’s reading shows – and an upgrade is likely – we know that the more recent data has shown a substantial softening and therefore we think that GBP will remain a little unloved."

Momentum hard to come by - World First Morning Update Feb 22nd - https://t.co/WboFOmoGv8pic.twitter.com/14cJYroNXv

— World First (@World_First) February 22, 2017

Lloyds – back from the brink

Returning to Lloyds' full-year results. Profits were up 158pc to £4.2bn, which was largely down to PPI costs falling from £4bn to £1bn. The full year dividend was increased by 13pc and a special dividend was also paid.

Laith Khalaf, Senior Analyst at Hargreaves Lansdown, said Lloyds is returning to full health after being knocked for six by the financial crisis, since which time the bank has become safer, more profitable, and a good source of dividends for shareholders.

"PPI has really been the major factor behind the big swing in Lloyds’ profitability. Costs of £4bn in 2015 compare to just £1bn last year, and looking forward to 2017, Lloyds will be hoping it has drawn a line under the whole PPI affair, and profits will thus be unshackled from a millstone that has cost the bank dearly in recent years.

Lloyds CFO: Most Likely Month For Govt To Fully Exit Stake In Bank Is May, Extrapolating From Current Sale Rate - RTRS

— Livesquawk (@Livesquawk) February 22, 2017

"The bank has also been successful in cutting costs, though this has meant job losses and high street branch closures. Partly this is down to Lloyds cutting its cloth to adapt to banking in the post-crisis era, though it’s also partly due to the ongoing digitalisation of banking services, which is reducing the need for banks to have a physical presence on the UK high street.

"The fact that Lloyds has been able to increase its dividend, alongside shelling out £1.9bn for the MBNA credit card business, is a strong sign from the business and will raise jubilant cheers from shareholders."

Euro implied volatility rises on French election nerves

The cost of hedging against big falls in the euro over the next three months hit the highest in more than two months as fears about the French presidential election heightened.

The three-month euro/dollar "risk reversal", meanwhile, fell to minus 3.1pc, surpassing the lows it had hit in the aftermath of Britain's EU referendum.

This means investors are betting the euro will fall (puts), over calls, which indicate it will rise.

Three-month euro/dollar implied volatility, an option used to hedge against big price swings in the exchange rate, rose to 11.2pc, its highest since Dec. 19 and close to its highest since just after the Brexit vote.

German Ifo business climate index unexpectedly rises in February

German business morale unexpectedly rose this month, data from the Ifo economic institute showed this morning.

The German Ifo business climate index climbed to 111.0 in February, up from 109.9 in the previous month and well ahead of consensus forecasts of a reading of 109.6.

Improved #German#ifo buisness climate index for Feb follows significantly stronger #manufacturing & #services#PMIs. Q1 growth looking good

— Howard Archer (@HowardArcherUK) February 22, 2017

Meanwhile, the Ifo current conditions index rose to 118.4 this month, beating forecasts for 116.7, and the Ifo expectations index hit 104.0, up from 103.

Analysts eye UK GDP breakdown

Analysts are eyeing a breakdown of economic growth numbers for the fourth quarter for signs of a fall-off in business investment six months after the EU referendum. Forecasts suggest the second estimate of UK Q4 GDP are unchanged at 0.6pc quarter-on-quarter for a third consecutive quarter and 2.2pc year-on-year.

Here's what the experts have to say ahead of the release at 9.30am:

Simon French, of Panmure Gordon expects Q4 GDP to hold steady at +0.6pc QoQ the data revisions for construction and industrial production have been revised upwards since the first estimate so the balance of risk favours an upgrade over a downgrade.

"We expect business investment to remain under pressure but with inflationary pressures very muted in the services sector the index of services to push on in December and drive output expansion."

Connor Campbell, of SpreadEx, said: "Analysts are expecting the figure to remain unchanged at 0.6pc, though a few pieces of positive data from the end of last year does mean it could be revised higher to 0.7pc. If that is the case the pound may well absorb most of the market’s goodwill, something that could see it cross both $1.25 and €1.19 (while potentially keeping the FTSE away from 7300)."

Latest IP & construction data suggest Q4 GDP growth will be revised up today to 0.7% from 0.6%. Likely to boost £, given no-change consensus pic.twitter.com/MZoZcSqb78

— Samuel Tombs (@samueltombs) February 22, 2017

Elsewhere, Morten Helt, of Danske Bank, said the the second estimate of GDP will be "somewhat interesting", as the expenditure components such as private consumption and investments in Q4 are included for the first time in this release.

"While growth continued at the same pace in H2 16 after the EU vote, we think GDP growth will slow down eventually this year."

UK #GDP out at 9:30. We know that Q4 growth was solid. But how reliant was it on the consumer? pic.twitter.com/hhc0Vxjc1E

— Rupert Seggins (@Rupert_Seggins) February 22, 2017

German-US bond yield gulf last seen at dawn of millennium

The gap between short-dated German and US government bond yields stood at its widest in nearly 17 years this morning as the former fell to record lows and the latter nudged up in anticipation of rate increase signals.

In a move seemingly out of kilter with broader moves in euro zone bond markets, German two-year yields dropped to a record low of minus 0.88pc.

Analysts said jitters around upcoming French elections have stoked demand for an asset seen as one of the safest in the euro zone. Bottlenecks caused by the European Central Bank's bond-buying programme and upcoming regulatory changes have amplified the decline the yields, which move inversely to prices.

US two-year yields have been sneaking higher in recent days, reaching 1.24pc -- within sight of a seven-year high breached at the end of 2016 -- as investors start to price in an outside chance the Federal Reserve will raise interest rates next month.

The two-year's yield is some 212 basis points above its German equivalent, the biggest gap since early 2000.

US Federal Reserve Chair Janet Yellen said last week a rate increase in the world's largest economy would be considered at every policy meeting. Wednesday's release of the minutes of the central bank's last meeting are expected to provide more clues on the timing.

"There are a host of special factors driving two-year German bond yields lower and on the other side of the Atlantic we have the Fed contemplating another hike, which is driving up U.S. equivalents," ING strategist Martin van Vliet said.

Report from Reuters

Profits rise at Barratt despite the UK's biggest housebuilder building fewer homes

Shares in house builder Barratt Developments have jumped 1.4pc this morning after it posted a 9pc rise in half-year profits. Sam Dean has the details:

Profits at the UK's biggest housebuilder surged by almost 9pc in the second half of 2016, despite building fewer homes.

Barratt Developments enjoyed a rise in profit before tax to £321m for the half year ended December 31, up 8.8pc from the same period in 2015.

It built nearly 5,000 fewer homes than in the half-year period in 2015, with total completions dropping from 7,626 in 2015 to 7,180 last year. However, it said completions outside London were at their highest level in nine years.

The FTSE 100 company announced a special dividend of £175m, to be paid in November 2017 and November 2018, while its half-year dividend has been raised by 21.7pc, from 6p to 7.3p.

"We have delivered another very strong first half performance," said chief executive David Thomas.

Pound hits two-month high against the euro

The pound gained as much as 0.4pc against the euro in early trade, hitting a two-month high, ahead of UK GDP growth figures and as French political nerves continued to weigh.

Just before 8am, the pound hit 84.12p per euro, marking its strongest level since December 21. Meanwhile, against the dollar it was trading up 0.25pc at $1.2491.

Investors are eyeing a breakdown of economic growth numbers for the fourth quarter for signs of a fall-off in business investment six months after the EU referendum.

Meanwhile, worries about a Le Pen victory in the French presidential election continue to bubble as she is now the front-runner to win the first round of the election and her prospects are also improving for the second round.

Kathleen Brooks, of City Index, said: "This has caused the spread between French and German yields to surge, and we expect this to continue. Political risk also weighed on the EUR/USD, which managed to hold above key 1.0500 support but still looks vulnerable as victory for Eurosceptic Le Pen could spell the end for the single currency."

Lloyds Banking Group posts biggest profits in 10 years

Shares in Lloyds bounced 4.2pc, nearing pre-Brexit levels, after it reported the highest full-year profit in a decade. Ben Martin reports:

Lloyds Bank posted its biggest annual profits in a decade after the lender took a smaller hit from the payment protection insurance mis-selling scandal, in a sign the company has almost recovered from its near-collapse during the financial crisis.

Pre-tax profits jumped to £4.2bn from £1.6bn in 2015 after provisions for PPI compensation dropped to £1bn, compared with £4bn a year earlier. The taxpayer’s stake in the bank has now fallen to less than 5pc, from 43pc following its bailout at the height of the crisis, and the Government is on course to return the business to full private ownership by May.

“The group’s performance demonstrates that our simple, low-risk, UK-focused, multi-branded model continues to be a source of competitive advantage,” said Lloyds boss Antonio Horta-Osorio.

Lloyds' total bill for the PPI scandal is about £17bn, the biggest of any British bank. However, the drop in provisions last year signals that the lender has almost put the controversy behind it.

European shares hit 14-month high buoyed by upbeat corporate earnings

Upbeat corporate earnings from Lloyds, Scor and Telefonica Deutschland lifted European shares to a 14-month high this morning.

Here's a snapshot of the current state of play:

Mike van Dulken, of Accendo Markets, said: "Calls for a firm open come after US bourses posted a solid return from a long weekend. Helped by corporate results, fresh record highs come via continued investor optimism about Trump policies that has now kept the S&P 500 Index from anything worse than a 1pc fall for more than 90 days. A stronger USD suggests expectations of hawkish Fed minutes banking up this view this evening. DAX called to open +0.3pc thanks to a weaker EUR."

Hong Kong stocks near 19-month high on GDP

Hong Kong stocks ended near19-month highs overnight, led by resource and property stocks, as sentiment was lifted by the city's firmer economic growth outlook and stronger China inflows.

The benchmark Hang Seng index ended 1pc up at 24,201.96, the highest since August 11 2015, while the Hong Kong China Enterprises Index gained 1.2pc, to 10,537.58.

Market confidence was lifted on news that Hong Kong handed out billions in tax cuts and poverty relief on Wednesday, to stimulate its economy that is expected to grow more strongly than expected at 2 to 3pc this year.

Good morning from Berlin. Asia stocks w/ exception of Japan gain as Wall St extends record rise. Euro remains weak as Le Pen's polls improve pic.twitter.com/hevNA6Oxpo

— Holger Zschaepitz (@Schuldensuehner) February 22, 2017

Investors were unfazed by official data showing that China's home price growth slowed for the fourth straight month in January as demand cooled further in the biggest cities.

A gauge of mainland property developers listed in Hong Kong rallied 3.2pc, hitting a nearly five-month high.

Report by Reuters

Agenda: Investors eye UK GDP breakdown

Good morning and welcome to our live markets coverage.

Today, attention shifts to the breakdown of UK economic growth figures for the final quarter of the year, which will be released at 9.30am. Investors will be eyeing the numbers for signs of a fall-off in business investment six months after the Brexit vote.

Forecasts suggest the second estimate of UK Q4 GDP are unchanged at 0.6pc quarter-on-quarter for a third consecutive quarter and 2.2pc year-on-year.

Previewing the release, Michael Hewson, of CMC Markets, said: "This effect is expected to be illustrated by today’s second iteration of Q4 GDP which is expected to be reconfirmed at 0.6pc, and an annualised 2.2pc.

"More importantly the weakness of the pound is expected to help exports contribute 2pc, while imports are expected to fall from 1.4pc to 0.5pc. Services are still expected to provide the majority of the expansion at 0.8pc, though a little worryingly business investment is expected to stall."

Looking ahead, highlights include FOMC meeting minutes, UK GDP, Eurozone inflation alongside API crude oil inventory reports

— RANsquawk (@RANsquawk) February 22, 2017

Elsewhere, we get the latest IFO survey of German confidence at 9am and a flash estimate of eurozone inflation for this month at 10am.

We finish the day with the release of the minutes from the Fed's FOMC January meeting. Mr Hewson noted that the minutes aren’t expected to add too much to the recent debate about a March rate rise given recent comments from senior Fed policymakers in recent days.

Also on the agenda:

Full-year results: UBM, Serco Group, Unite Group, Lloyds Banking Group, Indivior, Capital & Counties Properties, Petrofac, Weir Group

Interim results: Barratt Developments, Hays, Pan African Resources, McBride

Trading update: Metro Bank

Opening calls update - FTSE +6 - Lloyds up 3%, Barratt up 3%, Wm Hill -1-2%, UBM +2%, Petrofac +2%, Metro +1-2%, Hays +2%, Mcbride +3%,

— David Buik (@truemagic68) February 22, 2017

Yahoo Finance

Yahoo Finance