Pound falls sharply on legal advice over May's 'new' Brexit deal

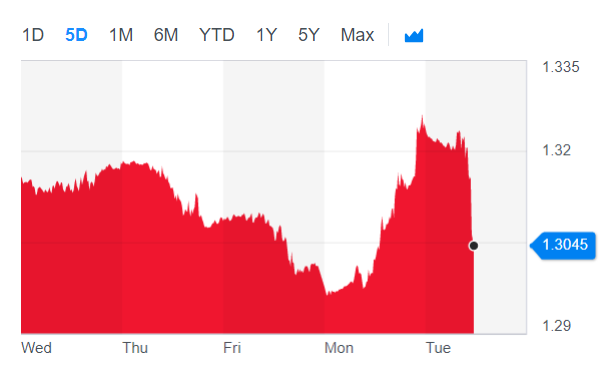

The pound rose before falling sharply against the dollar (GBPUSD=X) on Tuesday morning (12 March), after new legal advice set back May’s hopes of winning over MPs with her ‘new’ deal with the EU.

UK prime minister Theresa May announced yesterday that she had secured a “new” deal with the European Union, prompting a rally for the pound.

Sterling against the dollar had risen to almost $1.33 after rallying overnight, as investors acted on the calm before the storm.

But the rally came to a sharp halt as doubts grew about whether the changes are enough to win May the votes she needs to get her deal approved by MPs.

The pound was down more than 1.2% to just over $1.30 by late morning. It also fell by 1% against the euro.

All eyes were on Britain’s attorney general Geoffrey Cox this morning, with hopes he would change his official advice about the legal risks of the UK being stuck in the so-called backstop.

But he said the legal risks remained unchanged despite new assurances made by the European Union after last-ditch talks with May in Strasbourg, according to Reuters.

“GBP has since pared some of its overnight gains as doubts remain that the legally binding assurances secure by PM May will suffice to sway Eurosceptic MPs (and the DUP) ahead of tonight’s Meaningful Vote 2.0,” said Michael Van Dulken, head of research at Accendo Markets.

Today (12 March), UK parliament will vote on whether to accept May’s Brexit deal or not.

In November last year, the EU approved May’s Brexit deal but her agreement with the bloc was unceremoniously rejected by members of her own party, as well as the opposition.

Her ‘new’ deal agreed last night appeared to cut the chances of an “indefinite backstop” — the key sticking point for many hard-line Brexiteers who May must win over.

READ MORE: ‘Rushed, risky and over-optimistic’: damning report on no-deal planning

She said the new agreement — or “instrument” — could be used to start a formal dispute against the EU if it tries to keep the UK tied to the backstop. The “Irish backstop” is an insurance policy that will ensure there is no hard border in Ireland.

But the fact Cox has not changed a key part of his advice on the risks of the UK being unable to leave the backstop throws into doubt whether many Brexiteers will be willing to support the deal.

“Nothing like leaving it to the last minute — May has extracted something like a revised deal from the EU. The question is whether it’s enough to get the hard core of the ERG to back her,” said Neil Wilson, chief market analyst for Markets.com.

He added before the release of Cox’s memo: “Sterling’s refusal to move beyond 1.32 really betrays the doubts that remain. Specifically the wording of this new deal is somewhat opaque on Britain’s ability to unilaterally exit the backstop arrangements.

“One feels right now that it won’t be enough to persuade Brexiteer MPs to budge as the text seems well caveated in favour of the EU. Comments from Labour leader Jeremy Corbyn have not been encouraging for May to secure the majority she needs.”

Additional reporting by Tom Belger.

Yahoo Finance

Yahoo Finance