Pound leaps on politicians voting to seize control to block no-deal Brexit

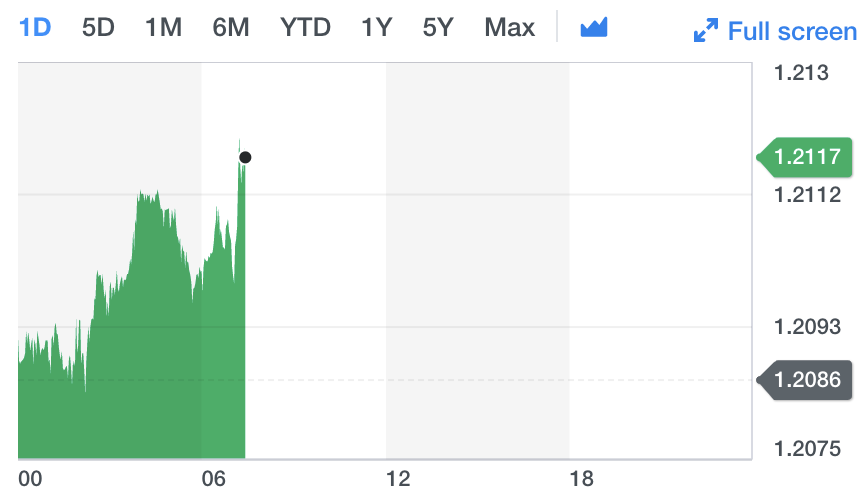

The pound jumped against the US dollar (GBPUSD=X) in early trading on Wednesday after members of parliament moved to seize control over blocking a no-deal Brexit.

The pound rose by over 0.26% to reach over $1.21 after initially sinking to a 34-year low (if you don’t count the ‘Flash Crash’ of 2016) yesterday after UK prime minister Boris Johnson implicitly threatened to call another snap general election if MPs blocked his ability to drag Britain out of the European Union without a deal.

“The pound edged higher as Boris Johnson's Brexit strategy appeared in disarray,” said Neil Wilson, chief market analyst for Markets.com.

“The PM lost 328-301 in a key vote that hands control to parliament. He will now table a motion to call an election, however it is unclear whether Labour will play along. Do they fall into the 'elephant trap', or do they prefer to watch the new Tory regime implode? With rebels having the whip withdrawn the government benches are now very much in the minority.”

By 1245pm local time, the pound continued its upwards trajectory, breaching the $1.22 mark:

Late Tuesday, Johnson lost his majority of one in parliament after MP Phillip Lee defected to the Liberal Democrats. In a surprise move, Lee announced his defection while John was delivering a speech in the House of Commons.

Losing the majority means that if Johnson tries to push through a motion, even if all Tory members agreed to back him, it wouldn’t get enough votes to get it through parliament.

On Tuesday evening, Johnson then launched the bid for an early general election — which would mark the third election and potentially a fourth prime minister for Britain in four years if he loses.

This came after he suffered a brutal defeat at the hands of MPs trying to block a no-deal Brexit.

MPs voted to take control of the House of Commons agenda, meaning they can now look to prevent the PM from taking the UK out of the EU without a deal in place.

Johnson accused parliament of being “on the brink of wrecking any deal” with the EU after the result was announced.

A total of 21 Conservatives rebelled against their party, despite warnings they will be expelled from the party and prevented from standing in future elections.

Why is the pound moving upwards when there’s a possible general election?

The biggest concern for investors is a no-deal Brexit.

This is because as soon as Brexit happens — apparently still on 31 October — all rules and regulations between the EU and UK cease to exist unless an agreement has been put in place.

A no-deal Brexit would leave a gap in rules on how businesses can function, trade, and even be taxed. The movement of people between Britain and EU countries would also be unclear.

Former prime minister Theresa May, who backed the campaign to Remain in the EU before the 2016 referendum, sealed a deal with the bloc but was repeatedly shut down by MPs in and outside her party. She managed to survive as Conservative party leader and prime minister for nearly three years but was eventually ousted by agreeing to step down and opening up the premiership to someone else.

Johnson won the Conservative party leadership race and, by default, became the next prime minister after being voted by Tory party members only.

READ MORE: Fears for UK economy as construction suffers sharpest slide in a decade

Johnson is an ardent Brexiteer and under his leadership a no-deal Brexit is highly likely. He has repeatedly said he would be happy with dragging the UK out of the EU without a deal, if the agreement didn’t tick all the boxes on UK demands.

“Johnson has undoubtedly suffered a significant defeat, while his controversial strategy was doomed to failure from the outset,” said Marc-André Fongern, FX & Macro Strategist at MAF Global Forex.

“The British pound, however, continues to be entirely confused as this political saga is likely to provide further surprises over the coming days.”

But the EU said on many occasions that it would not renegotiate the deal it had with May. Therefore, as it stands MPs may be able to block a no-deal Brexit now and give the City some breathing room.

Soon MPs will have to either agree to the existing deal or install a new government that will be able do so — or at the very least trust that a no-deal Brexit will be properly handled.

READ MORE: Here is the full list of 21 rebel Tory MPs who voted against no-deal Brexit

“The threat of no-deal remains high. An election has to happen sooner or later – surely it is better to happen now? Even if parliament gets its anti-no-deal legislation on the statute book before an election, a new parliament would be free to revoke,” said Wilson from markets.com.

“GBP-USD appears to have found something of a floor for the time being at $1.20 and was last pushing up to $1.2130 and close to $1.2140. Lots of short covering is no doubt in play.

“The move higher only serves to underscore the kind of headline risk and volatility we can expect to see over the coming weeks which will make sterling a tough currency to trade.”

Yahoo Finance

Yahoo Finance