Pound under pressure as 'Brexit flotilla' reports fuel no-deal fears

The British pound is under pressure against the dollar on Wednesday, amid reignited fears about the possibility of a no-deal Brexit.

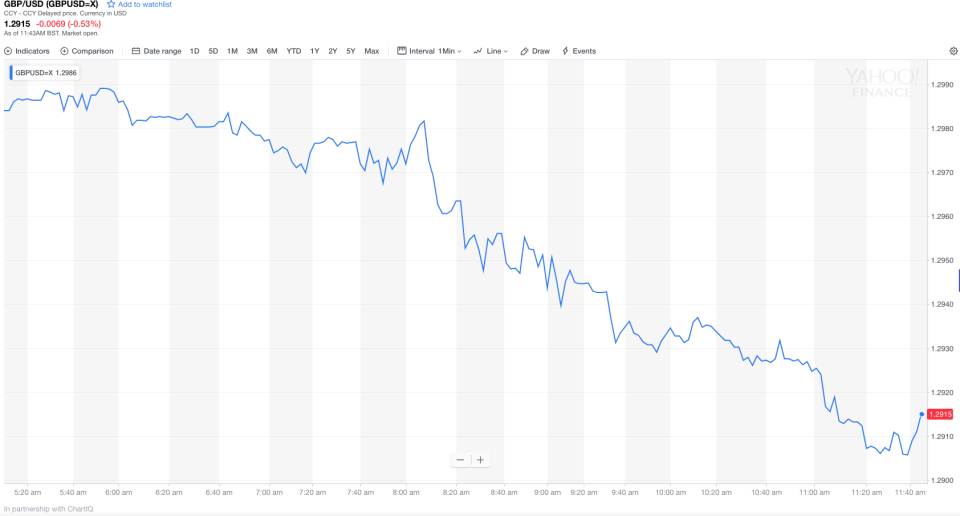

Sterling (GBP/USD) is down 0.44% against the dollar to 1.2926 at just after 10.40am GMT. Despite its weakness against dollar, the pound is up slightly against the euro (GBP/EUR), 0.04% higher at 1.13.

The three-week low for sterling against the dollar comes amid revived dollar strength and continued fears about the progress of Brexit negotiations in Britain.

Concerns are growing about the possibility and severity of a no-deal Brexit. Reports emerged late on Tuesday that the British government is drawing up plans to rent boats that could be used to ferry emergency food and medicine if the UK fails to reach an agreement with the EU by next March. UK ministers are said to have been surprised by the plan.

Michael van Dulken, head of research at Accendo Markets, told Yahoo Finance UK: “The sands of time continue to fall towards an unclear Brexit outcome. Talk of a heated cabinet discussion about the state of negotiations adds to uncertainty about both the outcome of the divorce and perhaps even the UK leadership.

“Suggestions of a flotilla to ensure critical supplies doesn’t exactly inspire confidence.”

European parliament Brexit coordinator Guy Verhofstadt on Wednesday also said negotiations were “0% complete” with the issue of the Irish backstop still unresolved, suggesting a no deal Brexit could be likely.

Ken Odeluga, market analyst at City Index, said the “chances of some sort of event that could unravel PM Theresa May’s shaky leadership of the Conservative party appear to be heightened,” adding to pressure on the pound.

Odeluga told Yahoo Finance UK: “Theresa May’s appearance later at a meeting of the Conservative 1922 Committee, accurately or not, is being read as an inflection point for her leadership and consequently, for Brexit too.”

The 1922 Committee is an influential body within the UK Conservative party of backbench MPs that plays a role in appointing — and possibly challenging — party leaders.

“The PM wishes to re-state her case to the influential internal body now, possibly due to reports that 46 of the 48 letters to the chairman of the committee required to trigger a no-confidence motion had been submitted,” Odeluga said:

A strong dollar is also hurting the pound. The US dollar index, which measures the dollar against a basket of major currencies, is at its highest level since August, up 0.33% on the day.

Van Dulken said: “More globally, the current bout of market uncertainty has only gone to help an already strong USD stay strong, buoyed by safe-haven-seeking that has failed to hinder renewed interest in the more traditional safe haven precious metals. This has put pressure on GBP.”

Yahoo Finance

Yahoo Finance