US economic growth slows again ahead of Fed rate decision – live updates

STATESIDE SLOWDOWN?: US GDP growth beats estimates, but remains below Trump’s target

Annualised growth of 1.9pc in third quarter shows slowdown continued in three months to end of September

The Federal Reserve is expected to cut interest rates again later today

EUR-OH NO: Key eurozone confidence indicators miss, suggesting downturn may worsen

Economic confidence across currency bloc is lowest since early 2015

France beats expectation for third-quarter growth, in boost for Macron

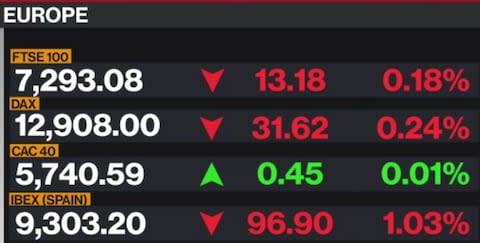

IN THE CITY: UK markets slip for second session as Britain braces for Christmas election

Pound hovers just under $1.29

Next shares slip as it warns rest of year may not match strong October

De La Rue shares tank after new profit warning

US GDP reaction: ‘Should be enough’ to ensure rate cut

Here’s reaction to that US GDP figure.

Capital Economics’ Andrew Hunter says the figure should be enough to secure a further cut by the Federal Reserve tonight. He writes:

The 1.9pc annualised gain in third-quarter GDP, down only marginally from the 2.0pc gain in the second, was a little stronger than we had expected. But it still pushed the economy’s annual growth rate down to a near three-year low of 2.0pc and should be enough to convince Fed officials to deliver another 25bp interest rate cut later today.

Oanda’s Edward Moya says US markets, which are set to open flat, might pick up later in the day when the Fed announces its decision on rates:

US stocks are little changed despite stronger than expected private payroll and GDP data, as markets await a pivotal Fed rate decision this afternoon. This [US] morning’s data likely confirms Fed Chair Powell’s belief that the economy is in a good place and expectations should grow for the Fed to deliver a hawkish cut this afternoon. While both the ADP private payroll number and headline third quarter GDP reading beat expectations, the trend is still weakening.

The Share Centre’s Tom Rossner adds:

Interestingly, these better than expected results have come out before the Federal Reserve meets later, where futures had predicted the probability of an interest rate cut to be over 90pc. However, this could come into question as the US economy appears to be reasonably robust. Does it really warrant another cut? In my eyes - no. Inflation is relatively subdued, economic growth has picked up slightly and the labour market is relatively tight. Further rate cuts will simply diminish the firepower the Fed has when a recession eventually occurs.

Next languishes as biggest FTSE 100 faller

With just over three hours of trading left, retailer Next (see 8:11am update) is still holding the dubious honour of biggest FTSE 100 faller. My colleague Laura Onita reports:

High street bellwether Next was boosted by the cold weather in recent weeks after shoppers previously shunned thicker clothes.

Last month chief executive Lord Simon Wolfson said that although he had concerns about fewer people buying clothes and shoes in stores, “as long as that decline is matched by growth online, we think we can get through it”.

Warm weather in September dented sales but this month they bounced back.

The company still expects profits for the year to be £725m.

NB: I have adjusted wording in a couple of earlier post to clarify that the US GDP figures are annualised. The equivalent raw quarter-on-quarter growth would have been 0.5pc.

Round-up: Airbus cuts delivery forecast, final Woodford fund may be wound up, Apple seeks to dodge monopoly row

Here are some of the day’s top stories:

Airbus cuts delivery forecast amid production problems: Production problems have forced Airbus to cut the number of planes it expects to deliver this year.

Neil Woodford’s last fund may also be wound up, supervisor warns: Neil Woodford’s corporate supervisor has not ruled out winding up his only remaining investment fund after blocking investors’ access to the scheme following the implosion of the fund manager’s investment empire.

Apple seeks to sidestep Big Tech’s monopoly row as investigations pile up: US tech reporter James Titcomb looks at the tech firm’s efforts to swerve antitrust efforts.

Personal consumption props up US growth

A strong showing by US consumers helped the US economy beat forecasts for the third quarter, with annualised quarter-on-quarter growth of 1.9pc beating estimates, as polled by Bloomberg, of 1.6pc.

The Bureau of Economic Analysis said:

The increase in real GDP in the third quarter reflected positive contributions from personal consumption expenditures (PCE), federal government spending, residential fixed investment, state and local government spending, and exports that were partly offset by negative contributions from nonresidential fixed investment and private inventory investment.

Consumer spending, the biggest part of the United States economy, increased at an annualised rate of 2.9pc over the period.

The figure come ahead of a Federal Reserve meeting, at which policymakers are expected to deliver another cut to interest rates. More on that later...

Break: US GDP growth better than expected

Just in: US annualised GDP growth in the third quarter was 1.9pc (equivalent to 0.5pc quarterly), beating expectations. That was a slightly slowdown from the second quarter, and still below Donald Trump’s target.

Coming up: US GDP data

At 12:30pm, we’ll get third-quarter GDP growth data for the United States. Donald Trump is already building some hype...

The Greatest Economy in American History!

— Donald J. Trump (@realDonaldTrump) October 30, 2019

...but the consensus is the figures will have slipped slightly, from 2pc in the second quarter to 1.6pc. The President’s budget predicted growth of 3.2pc, which it appears certain has been missed,

The slowdown reflects trade war pressures and weak overseas demand, which have both weighed on internationally-exposed companies in the US.

Ahead of the results, ADP data has said US firms added 125,000 jobs in October, ahead of estimates of 110,000. There was a significant revision to September’s figures however, which were 42,000 lower than previously though, at 93,000.

Glaxo beats estimates for earnings per share

UK pharma giant GlaxoSmithKline has beaten all estimates for its earnings per share in the third quarter, and raised its outlook for the full year, in results likely to delight investors.

The company highlighted its strong research and development pipeline as it reported adjusted earnings per share of 38.6p, sharply clearing the average estimate (as polled by Bloomberg) of 33.3p. Its revenue for the period was £9.39bn, while its operating profit was £2.79bn.

Emma Walmsley, its chief executive, said:

GSK has made further good progress in Q3, with sales growth across all three businesses, and we have today upgraded our full-year EPS guidance. This quarter we have continued to strengthen our pipeline and have advanced assets in Respiratory, HIV and, notably, Oncology, where we are on track to file three innovative medicines by year end, following positive pivotal trial data.

The company’s shares are up nearly 3pc currently.

Think-tank says Johnson’s Brexit deal is worse than further uncertainty

With a General Election date of December 12 set, brace for plenty of arguments about who should be in charge of the country’s finances.

In an early blow against Boris Johnson, however, the highly-respected National Institute of Economic and Social Research (Niesr) think tank has said the Prime Minister’s Brexit deal – which passed an initial hurdle in the Commons last week – would hurt the UK’s economy more than continued uncertainty would.

Niesr said that the economic impact of a more distant relationship with the EU was greater than the potential benefits of ending uncertainty. Arno Hantzsche, one of its economists, said:

We don’t expect there to be a ‘deal dividend’ at all. A deal would reduce the risk of a disorderly Brexit outcome but eliminate the possibility of a closer economic relationship.

My colleagues Russell Lynch and Tim Wallacereported:

Niesr expects the economy to grow by 1.4pc this year and in 2020, with growth then rising gradually each year to reach 1.8pc in 2024.

It warned there will be no “deal dividend” from a Brexit agreement, scotching hopes that an agreement will encourage firms to start investing again. Even if the Tories' deal is passed, Britain's future trade relationship with the EU will not be known for some time.

Overall the economy will suffer a permanent loss from Brexit, Niesr said. It expects the economy to be permanently 3.5pc lower under Boris Johnson’s new deal than it would have been if the country had not voted to leave the EU in 2016.

This is marginally worse than the 3pc that would have been lost with Theresa May’s deal, but is significantly smaller than the 5.6pc expected hit from a no-deal Brexit.

Dangerous ground?

Pantheon Macroeconomics’ Samuel Tombs points out that the UK economic confidence score is the weakest recording ahead of a General Election in recent times. Could that spell danger for Prime Minister Boris Johnson?

Consumer confidence is lower than before ALL of the LAST EIGHT general elections - including those in 1992 and 2010 just after big recessions.

People are more pessimistic about the outlook for both the economy and their own finances.

Fertile ground for the Opposition parties? pic.twitter.com/igZ9cpv1Ij— Samuel Tombs (@samueltombs) October 30, 2019

Germany, UK, Finland and Italy all ‘at risk of recession’

The Economist Intelligence Unit (EIU) says four EU countries are at risk of recession by the end of year.

The EIU’s Global Forecast says Germany will enter recession after the release of third-quarter data, while the UK, Italy and Finland all face a risk of entering a technical recession, and are predicted to grow just 0.1pc each.

Here are the EIU’s predictions for the G7 and BRICS economies:

The research group said:

The Economist Intelligence Unit expects third-quarter GDP growth to be weak across most of the world’s biggest economies. Of the G7 and BRICS economies, only India and the UK are expected to post third-quarter results that show an acceleration from the second quarter. In the case of the UK, however, there is limited cause for celebration, as this only represents a recovery from a disastrous second quarter.

Focusing on Europe, it added:

The release of third-quarter data should cause Germany to enter recession. We expect growth of -0.1pc in that period, after an outturn of -0.1pc in the second quarter. Most EU economies will also grow sluggishly: we expect Italy’s economy to remain flat, and that of the UK to grow by only 0.1pc as Brexit-related uncertainty continues to take its toll on business investment. The bright spot in Europe continues to be France, which should continue its run of being the fastest-growing major EU economy.

We’ll find out third-quarter GDP change for the UK early next month. The chances are that a technical recession (two quarter of successive contraction) has been avoided, but the figures are likely to show slow growth or even stagnation amid Bresxit uncertainty.

Nikkei falls victim to $29m fraud

Bad news for Nikkei, the Japanese media organisation that owns the Financial Times. The company says one of its employees fell victim to “fradulent instructions”, leading them to transfer $29m of Nikkei America funds to a “malicious third party”. The company says it is working with lawyers and US authorities to recover the money.

Insolvencies hit highest level since 2014

The number of companies in England and Wales who were left unable to pay their debts hit its highest level since 2014 during the past quarter, the Insolvency Service said.

Between July and September, 4,355 companies became insolvent, while administrations jumped by 20pc.

The Insolvency Service said:

Full report: De La Rue finds printing money is not as good as it sounds

My colleague Simon Foy has a full report on banknote- and (former) passport-printer De La Rue, which is down about 19pc currently after a profit warning this monring. he writes:

De La Rue shares plunged again on Wednesday after warning that annual profits will be “significantly lower” than previously expected.

The embattled banknote and passport printer said operating profit for the six months to September would be in the “low-to-mid single digit millions”, meaning the annual result would also be much lower than expected.

Investors also took flight in July after the Serious Fraud Office opened an investigation into De La Rue over “suspected corruption” in Africa.

Read more here: De La Rue shares sink on new profit warning

Some reaction from Twitter

Here’s Pictet’s Nadia Gharbi, who says the Swiss wealth manager’s calculations suggest European countries are preparing to loosen their fiscal policies and raise spending.

���� Calls for fiscal policy to take the lead have become louder. National governments have submitted their 2020 draft budget plans to the European Commission earlier this month. Our calculation suggest a modest aggregate fiscal easing of 0.3 percentage point (pp) of GDP in 2020. pic.twitter.com/Q3FJb6P3O7

— Nadia Gharbi (@nghrbi) October 30, 2019

EY’s Howard Archer notes that UK economic sentiment has come off its September floor, but is still pretty low.

October modest pick-up in #UK#economic sentiment from Sep's lowest level since May 2012 reported by European Commission primarily due to some recovery in #industry sentiment after Sep plunge. But #services sentiment lowest since Dec 2012 & #consumer and #retail confidence down https://t.co/skSyNDkpz4

— Howard Archer (@HowardArcherUK) October 30, 2019

UK sentiment remains weaker than eurozone

Before anyone cracks out the tiny Union Jack flags, however, it’s worth noting that economic sentiment in the UK, as measured by the European Commission, remains sharply below that of the eurozone as a whole (though it increased slightly in October). Danske Bank has the chart:

����#UK economic sentiment remains significantly below sentiment in the euro area despite stabilisation in October#Brexit uncertainty continues to weigh on businesses, explaining why the UK has been in an investment recession for ~2 years pic.twitter.com/M8dEsEtzWv

— Danske Bank Research (@Danske_Research) October 30, 2019

Will eurozone leaders now heed calls for higher fiscal spending?

Will those poor sentiment figures prompt European leaders to increase spending to stimulate their economies?

That’s what outgoing European Central Bank president Mario Draghi has been calling for, in a sentiment that his successor Christine Lagarde looks likely to take up.

Mr Draghi has repeatedly called for those countries who have the headroom to maneuver to loosen their purse strings and raise spending, using his final speech earlier this week to say monetary policy can only go so far.

Ms Lagarde echoed those comments earlier this week, saying several countries had the space to increase spending. She said:

We are of course thinking of countries that have chronic budget surpluses like the Netherlands and Germany and a few others in the world. Why not use this fiscal surplus and invest in infrastructure? Why not invest in education, in innovation to have a better re-balancing in the face of current imbalances?

Construction bucks downbeat trend

It its report on eurozone economic confidence, the EC said:

The deterioration of euro-area sentiment resulted from lower confidence in industry, services, retail trade and among consumers, while confidence improved markedly in construction. Amongst the largest euro-area economies, the ESI remained broadly unchanged in Germany (-0.2), France (-0.1), Italy (+0.1) and the Netherlands (+0.2), while it saw another significant decrease in Spain (-3.0).

Here’s how those misses look

That eurozone figures figure are the latest in an increasingly long line of disappointing reports for the currency bloc, after the European Central Bank turned the taps on with fresh monetary stimulus last month.

Economic confidence stood at 100.8 (survey 101.1, prior 101.7)

Industrial confidence stood at -9.5 (survey -8.8, prior -8.8)

Services confidence stood at 9.2 (survey 9, prior 9.5)

Consumer confidence stood at -7.6 (survey -7.6, prior -7.6)

#Eurozone economic sentiment lowest level since Feb 2015 in October as confidence in #industrial sector fell to more than 6-year low. Worryingly, #services sentiment down to lowest since mid-2015; #consumer confidence at 10-month low. #Retail sentiment down but #construction up https://t.co/G4zvPfHLpm

— Howard Archer (@HowardArcherUK) October 30, 2019

Eurozone confidence slides

Just in: Economic and sector confidence in the eurozone has unexpectedly fallen, in a sign the downturn across the common currency area may get worse.

Confidence figures for the services and industrial sectors, released by the European Commission, undershot expectations:

Overall economic confidence also dropped more than anticipated, and is just above a negative reading:

Facebook drops appeal over Cambridge Analytica fine

Facebook has dropped its appeal against a £500,000 fine over data misuse as part of the Cambridge Analytica data scandal.

The UK Information Commissioner’s Office slapped the social media giant with a monetary penalty notice last year, over “suspected failings related to compliance with the UK data protection principles covering lawful processing of data and data security”.

In a statement this morning, the ICO said:

Facebook and the ICO have agreed to withdraw their respective appeals. Facebook has agreed to pay the £500,000 fine but has made no admission of liability in relation to the MPN.

You can read more about the settlement here

Computacenter shares jump after solid third quarter

In an update that Stifel analysts have labelled “bang tidy”, IT services firm Computacenter has reported a “good” third quarter.

The company told investors:

At the group level, both revenue and profitability remain well ahead of our 2018 Q3 year-to-date performance on a like for like basis before the positive impact of acquisitions.

It added:

Well-publicised, challenging economic conditions are affecting some of our customers however, to-date, this has been more than compensated by the drive to digitalise across the entire marketplace.

Computacenter said the fourth quarter remained its “most crucial”, but said its board was confident it would hit its current expectations.

That has sent share up about 7pc, the biggest jump in three months:

France beats expectations for third-quarter growth in boost to Macron

France’s economy grew by 0.3pc in the third quarter, beating expectations in a coup for President Emmanuel Macron.

GDP grew by 0.3pc for the second quarter in a row, defying global trade pressures and fears of a slowdown in the European economy. Analysts surveyed by Bloomberg had expected 0.2pc growth.

Domestic demand drove growth most strongly, adding 0.5 points, while trade gave 0.4 points of drag. Spending within French households picked up during the quarter.

Capital Economics’ Jessica Hinds said the numbers showed trade issues put some pressure on the numbers:

The breakdown showed that household spending growth picked up a bit while investment growth remained robust. But net trade acted as a drag on growth and manufacturing output contracted for the second consecutive quarter in Q3, suggesting that French industry is not immune to the global manufacturing slowdown.

France has ramped up its spending over the past year in reaction to the yellow-vest protests that have been roiling the country. With tax cuts and higher spending both on the cards, Mr Macron’s approach has led Paris to break EU budget rules.

Convatec shares rise after company sticks to expectations

Medical devices supplier Convatec is the biggest riser on the FTSE 250 currently, up nearly 9pc after saying its third-quarter performance had been in line with expectations and maintaining its guidance for the rest of 2019.

The company said its total revenue for the three months to the end of September had risen to $462.9m, 2.4pc higher than over the same period last year.

All of its units grew, with the company hailing particularly strong performances across Europe, the Middle East, Africa and Latin America.

Karim Bitar, its chief executive, said:

I am pleased we have reported a solid performance in Q3, but this is a small step on the significant journey ahead of us as we focus on pivoting to sustainable and profitable growth.

Sports Direct lashes out at competition watchdog

There are two things you can be certain of: Brexit and Mike Ashley feuds. Handily, we have both in spades today.

My colleague Simon Foy reports:

Sports Direct has hit out at the competition watchdog for publishing “inaccurate estimates” of the company’s market share while investigating JD Sports’ £90m takeover of smaller rival Footasylum.

The pile-them-high-sell-them-cheap sportswear retailer said the Competition and Markets Authority (CMA) “wrongly suggest” in their investigation that Sports Direct would have comparable share of supply to JD Sports and Footasylum if the merger went ahead.

Mike Ashley, the tracksuit tycoon who owns Sports Direct, said: “I have been watching this from the side lines to date and now having had the opportunity of considering the CMA decision, I would now welcome the opportunity to provide the CMA with the correct market data.”

Investors don’t seemed overawed by this latest move, with Sports Direct shares down around 1.6pc:

Brexmas: What the commentators are saying

Looking at the biggest picture for the UK, there’s once again just one story story in town today, with a Christmas General Election serving as the latest manifestation of the nation’s Brexit agony.

In what has already been dubbed – horrifyingly – the ‘Brexmas’ election, parties will go head-to-head in a ballot that, on paper, should be all about the terms of Britain’s withdrawal from the EU.

Polling is strikingly split currently, and though Boris Johnson’s conservatives currently have a lead, the outcome of 2017’s vote (when Theresa May blew a poll lead and lost the majority won by David Cameron) will still be fresh in the minds of many.

Add to that other factors that could introduce chaos, not least the nature of a Christmas election itself, and you have a recipe for potential surprises.

SpreadEx’s Connor Campbell says:

It took him four attempts, but Boris Johnson now has his pre-Christmas ballot – the first general election to take place in the final month of the year since 1923.

The fact sterling hasn’t freaked out suggests the currency is hoping for increased political clarity heading into 2020, a result that would give one party a workable majority and allow the Commons to avoid the repeated Brexit deadlock that has become the norm post-referendum. Yet if the last few UK votes are anything to go by, that hope might be a bit naïve...

Markets.com’s Neil Wilson added that markets may be stable on early expectations of a Conservative win:

Polls showing a Tory majority win is net positive as it would mean leaving with Boris’s deal, while anything else is net negative as it implies new uncertainty.

CMC Markets’ Michael Hewson said sterling is likely to be whipped around as campaigning gets underway:

While expectations are high that we could see the Conservatives win a majority, as we know from 2017 the eventual outcome is likely to be unpredictable. Party loyalties no longer matter as much as to whether you voted leave or remain, and the prospect of another hung parliament, or a Labour government is still a significant risk in what is a highly volatile political climate.

Against that backdrop and changes in the opinion polls the pound is likely to be susceptible to some significant swings in the weeks ahead.

Markets mixed

Once again, a mixed open to markets today, with the FTSE 100 slipping amid pressure from a rising pound, and the FTSE 250 more or less flat as the UK prepares for its third election in four years.

De La Rue shares tank after second profit warning

Shares in specialist printer De La Rue are tanking this morning, down around 20pc after the company – which used to make British passports – warned full-year profits would be “significantly lower” than it had previously expected.

In an update to the City, De La Rue said:

...adjusted operating profits for the half year ended 28th September 2019 to be low-to-mid single digit millions. Full year 2019/20 adjusted operating profit will be significantly lower than market expectations.

The company said it would update further on its restructuring plans next month. It recently appoint Clive Vacher, a turnaround specialist, as it new boss.

Smurfit Kappa hails ‘strong performance’

Also rising on the FTSE 100 today is packaging firm Smurfitt Kappa, which is up more than 2pc after an update to the City, in which it said its performance over the first nine months of the year had been “strong”.

The company said its earnings before interest, tax, depreciation and amortisation rose 11pc in the nine months to the end of September, which organic growth in the Europe and the Americas.

Its chief executive Tony Smurfit said:

While there have been, and continue to be, obvious macro-economic and political challenges, SKG's very strong performance against this backdrop shows, once again, the quality of our business and the benefits of our geographic diversity.

StanChart profits jump

Standard Chartered reported a 16pc rise in third-quarter profit, beating expectations, as it managed to offset pressure from unrest in Hong Kong and trade tensions through strong corporate performance.

Underlying profit at the lender, which focuses on emerging markets, was $1.24bn, ahead of analysts’ estimates of $1.1bn. It underlying return on tangible equity, a mesaure of profitability, stood at 8.6pc for the first nine month of the year.

The company warned: “there are growing headwinds from the combination of continuing geopolitical tensions and expectations of declining near-term global growth and interest rates.”.

Bill Winters, its chief executive, said:

Our strategy of the last few years has progressively created a stronger and more resilient business as evidenced by a 16pc increase in underlying profits in the third quarter.

The bank’s shares are up more than 2pc currently:

Pound struggles to stay above $1.29

Sterling, which reached as high as $1.30 last week as hopes of a Brexit deal surged, has been fairly flat for several days, with $1.29 acting as an apparent barrier every time the currency looks to have found some legs. It is currently around $1.287.

Online sales help Next maintain momentum

Year-on-year full-price sales at Next rose slightly during the third quarter, as growth in the retailer’s online offering offset a decline at its high-street stores.

The group’s in-store sales fell by 6.3pc over the period, but sales from its website increased by 9.7pc.

The figures, released in a trading update, suggest the retailer managed to stabilise a little during the third quarter after a shaky performance earlier in the year.

Next said its business saw a significantly improvement during October due to colder weather, leading to 5pc sales rise compared to the same month last year.

Liberum analysts kept Next’s shares at a hold rating, saying:

Today’s solid Q3 update extends Next’s very credible run of reporting and leaves guidance unchanged. The usual trend of online sales growth outweighing stores’ decline continues.

The group’s share price has slipped slightly this morning, down around 2pc currently.

Fiat Chrysler and Peugeot in talks over $50bn merger

Following the big business story from overnight, Italian American car maker Fiat Chrysler has confirmed it is in talks with PSA Group – owner of Peugeot-Vauxhall – over a possible tie-up that would create one of the world’s leading automotive companies.

My colleagues Michael O’Dwyer and Alan Tovey report:

Fiat Chrysler Automobiles (FCA) said on Wednesday it “confirms there are ongoing discussions aimed at creating one of the world's leading mobility groups” with PSA. Fiat did not provide any further details. PSA made a similar statement.

The merger, if it goes ahead, would create a company with a market value in the region of $50bn (£39bn).

The talks come just months after Fiat’s efforts to merge with PSA’s French rival Renault fell apart following resistance from the French government, a major shareholder in Renault.

The merger has potentially major implications for the future of both firms, including, for FCA, an opportunity for it to play catch-up in the race to develop electric vehicles.

PSA shares have risen the most this year at open following confirmation of the talks.

Agenda: Markets gear up for December election

Good morning. The pound pushed slightly higher yesterday evening after Parliament agreed to hold a general election on December 12 that could break the Brexit deadlock.

However, the FTSE 100 is set to open in the red after uncertainty surrounding the election put pressure on the gauge yesterday.

Meanwhile, markets await the US Federal Reserves policy decision later today. The Fed is widely expected to announce another interest rate cut.

5 things to start your day

1) Global demand for ketchup is being squeezed as both global warming and a trade row between the US and Canada takes a toll and millennials fall out of love with the red sauce. Demand for the tomato condiment weakened as consumption in Canada – the world’s biggest importer – fell by a fifth in the first four months of 2019.

2) In an unprecedented move, the Office for Budget Responsibility (OBR) will publish updated borrowing numbers of its own accord next week despite Chancellor Sajid Javid’s decision to cancel the Budget. It believes so many changes have been made to the finances since March that the nation must be given correct figures. It came as economists separately warned that state borrowing will surge next year to £73bn, almost four times previously predicted levels, as slowing growth and spiralling spending send the deficit skyward.

3) The government has given the green light for Inmarsat, Britain’s largest satellite company, to be acquired by private equity bidders. Connect Bidco, a consortium including buyout giants Apax Partners and Warburg Pincus, put forward a number of “voluntary undertakings” earlier this year in order to secure a deal with the British government, after it came under scrutiny from regulators relating to national security.

4) Why electric vehicle battery production could be the saviour of UK automotive: Figures from the Faraday Institution, a battery research centre backed by the government, suggest that unless the UK starts investing the billions of pounds needed to build large-scale manufacturing plants for electric vehicle batteries, 114,000 jobs in Britain’s automotive sector could be lost by 2040.

5) Fiat Chrysler and Peugeot in talks over mega-motor-merger: The deal would create Europe’s second-biggest car company after VW group, with talks about a potential combination first reported by the Wall Street Journal.

What happened overnight

Stocks in Asia were mixed on Wednesday, with markets in a holding pattern awaiting the Federal Reserve’s policy decision.

Share gauges in Tokyo ended little changed, while equities retreated in Hong Kong, Shanghai, Seoul and Sydney. European and American stock futures were flat. The S&P 500 Index on Tuesday edged back from a record high amid a raft of earnings in a lackluster session. The pound was little changed after UK Prime Minister Boris Johnson won backing in Parliament for a December 12 election.

The Fed is widely expected to lower rates again Wednesday, having already cut in July and September. For markets, the key will be the tone of Chairman Jerome Powell’s press conference later in the day, with investors trying to ascertain the trajectory of policy heading into next year.

Coming up today

There are two big stories expected today, with GlaxoSmithKline, the pharma firm, posting interim results, and Next, the retailer, a trading statement. Happily, both have tended to be solid performers recently, with Glaxo seeing demand for new drugs make up for losing exclusivity to some of its older products. Next, meanwhile, has had a fairly solid year despite wider wobbles and worries on the high street.

Interim results: GlaxoSmithKline, LivaNova, Noble Corporation, nVent Electric

Trading statement: Computacenter, ConvaTec, Next

Economics: Business confidence (eurozone), employment (US)

Yahoo Finance

Yahoo Finance