Pound rallies on news of a possible Brexit deal breakthrough coming next week

The pound rallied on Tuesday following news that the UK and European Union (EU) could strike a deal on their future trading and security relationship as early as next week, according to people familiar with the discussion who were cited by Bloomberg.

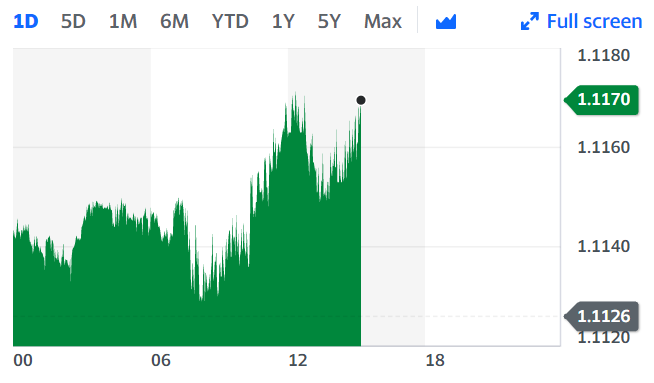

The pound was gaining against the euro (GBPEUR=X) and up 0.5% against the US dollar (GBPUSD=X) on Tuesday afternoon.

Talks are underway in Brussels, and officials are reportedly prepared for the breakthrough to be announced as soon as Monday, said Bloomberg.

“Sterling has flipped back to ‘buy the rumour’ mode today,” said Ranko Berich, head of market analysis at Monex Europe.

“Of course, such anonymous briefings should be taken with a grain of salt as they could well be part of a negotiation or spin strategy from one of the sides,” he added.

Despite the optimism around a potential deal, there are major sticking points, particularly around access to British fishing waters. The impasse on this issue has remained since the talks began in March.

Both sides have also largely been at loggerheads over business rules as well, including how the UK’s labour and environmental standards will change when it exits the bloc. How breaches of the overall deal will be penalised have yet to be determined, with the UK fighting the bloc’s efforts to include fisheries in the over-arching enforcement mechanism.

READ MORE: Travel stocks lose steam as FTSE rally slows

According to a survey of economists, sterling could fall 5% by mid-202 if the UK and the EU fail to reach an agreement.

“Our base case expectation remains that the UK and EU will indeed strike a narrow trade deal that avoids goods tariffs and a ‘disruptive’ transition to new trading arrangements in January,” said Berich.

“We suspect this is also the base case of most market participants, and hence the sterling upside will likely be fairly limited — in the order of 1-4% against the dollar and euro in the short run. Any euphoria for sterling due to a trade deal may be short lived, as attention quickly turns to uncertainty stemming from the trajectory of coronavirus and the economic scars of rising unemployment.”

Watch: What is inflation and why is it important?

Yahoo Finance

Yahoo Finance