Pound rises to one-month high as it approaches $1.30; FTSE 100 loses steam in afternoon

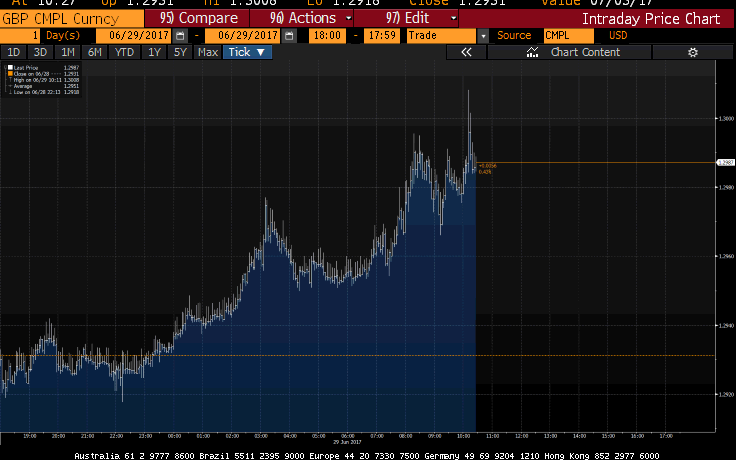

The pound briefly touches over $1.30 following hawkish comment from Bank of England chief economist Andy Haldane

FTSE 100 loses steam during the afternoon but banking and mining stocks remain strong

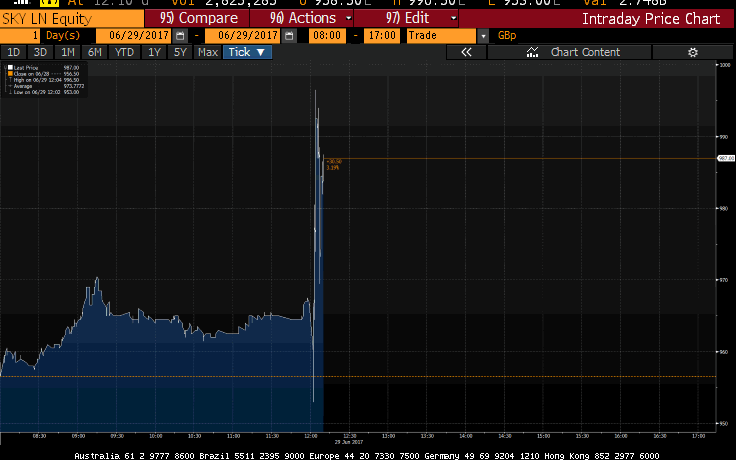

Sky's share price soars following government announcement that it is "minded to" refer takeover to watchdog

Summary

Round-up

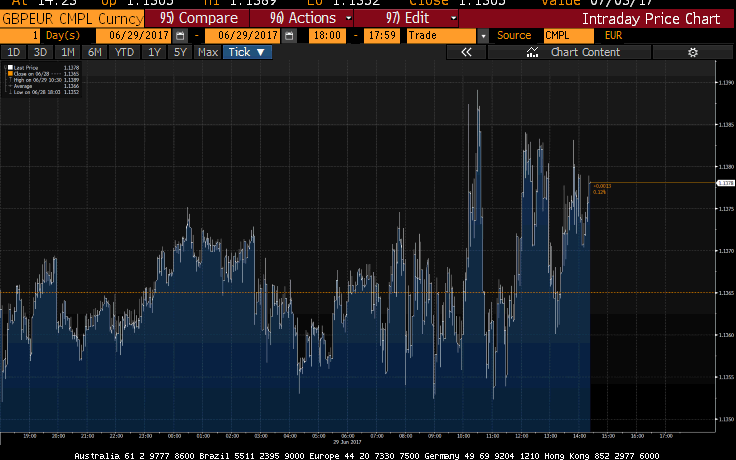

Pound briefly touches over $1.30 after another hawkish comment from Bank of England chief economist Andy Haldane. Pound is now flat against the euro following choppy trade during the afternoon.

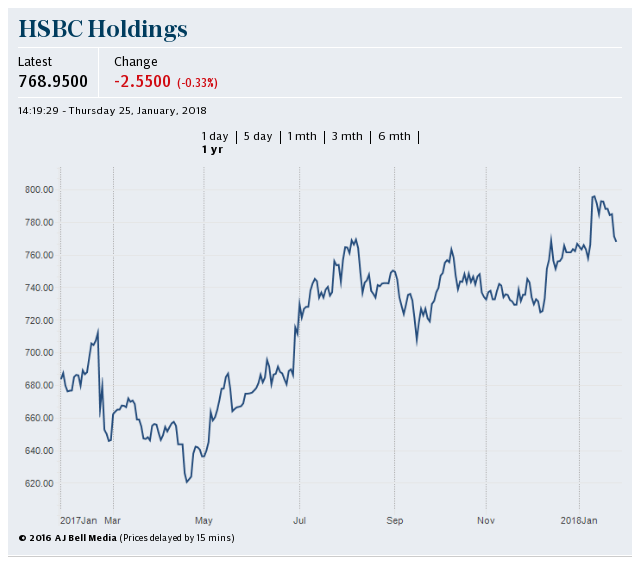

Hopes of an interest rate rise and positive stress test results from across the pond helped banking stocks soar as the strong pound weighed on the rest of the blue chip index. Mining shares rose and health care stocks dropped, continuing trends established yesterday. Markets in the United States have opened down with banking gains not enough to prop up the indices.

Sky shares rocketed 31.5p, or 3.3pc, to 988p following culture secretary Karen Bradley's address to parliament where she said that the government was "minded to" refer 21st Century Fox's £11.7bn of Sky to the competition watchdog.

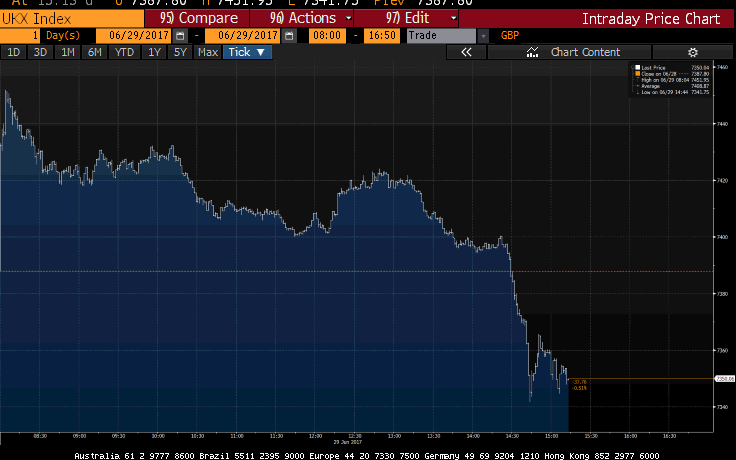

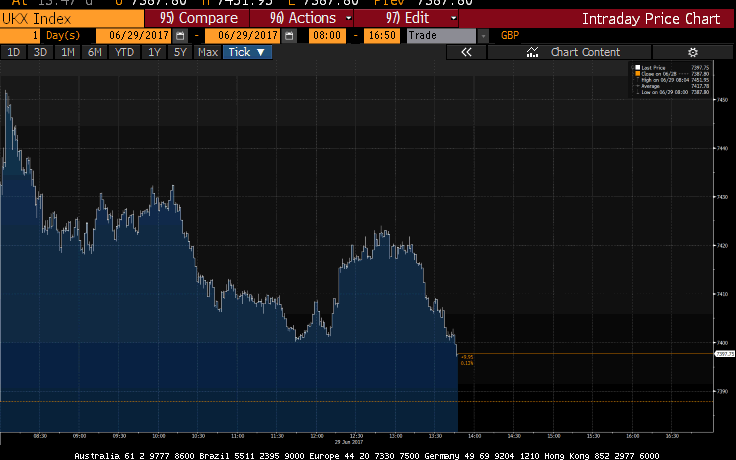

Josh Mahony, IG market analyst, said that the FTSE 100 "has declined sharply into the close" after the "resurgent pound hit the highest level against the dollar in more than a month".

He added:

"In a week that has been dominated by wildly conflicting accounts across the central bank sphere, there has certainly been a more hawkish tilt to UK and eurozone monetary policy.

"For the BoE it comes down to whether they are driven by their core mandate of price stability or whether they are willing to tolerate a bout of above target inflation with the aim of remaining supportive of the economy during a testing transitional period. "

European stock markets at close of play

FTSE 100: 7,350 (-1.82pc)

FTSE 250: 19,346 (-0.67pc)

Euro Stoxx 50: 3,471 (-1.82pc)

DAX: 12,416 (-1.83pc)

CAC 40: 5,154 (-1.88pc)

FTSE 100 Risers

HSBC (+4.24pc)

Sky (+3.29pc)

Rio Tinto (+2.44pc)

Glencore (+2.24pc)

Antofagasta (+2.09pc)

FTSE 100 Fallers

Micro Focus International (-3.79pc)

Coca-Cola (-3.64pc)

IAG (-3.57pc)

Shire (-3.36pc)

Fresnillo (-3.34pc)

Exchange rates

GBP/USD: $1.2983 (+0.40pc)

GBP/EUR: €1.1368 (+0.03pc)

Purplebricks reports soaring revenues as it prepares to break America

Online estate agency Purplebricks has halved its pre-tax losses and reported soaring revenues as it embarks on a quest to break America.

In its first full year results since listing on AIM, the UK's junior stock market, it reported a pre-tax loss of £6m, up from £11.9m last year. During this period it has also launched in Australia, prepared to set up shop in California after a £50m round of funding from the City.

The chief executive, Michael Bruce, said: "We are on track to be the most successful estate agent in UK history." The company, which is also backed by fund manager Neil Woodford, commands a 72pc market share of online agents.

Shares are currently 23.75p up to 422.75p.

Read Isabelle Fraser's full report on the Purplebricks results here

Mortgage market stabilises as house prices slowdown comes to an end

Mortgage lending is bouncing back as the slowdown in the housing market appears to be at an end.

Prices slid earlier this year but buyers are back - a total of 121,464 mortgages were issued last month, reversing some of the falls in April, according to the Bank of England. More than half of those loans went to people purchasing homes.

By value total mortgage debt rose by £3.5bn, the fastest pace in more than a year. As a result mortgage lending grew by 2.9pc on the year, accelerating a touch from the levels seen in March and April.

“May’s mortgage data pointed to lacklustre but stable housing market activity,” said Howard Archer, chief economic advisor to the EY Item Club.

Read Tim Wallace's full report here

Markets analysis

European markets affected by dollar's weakness

Spreadex analyst Connor Campbell commented that there has been a "splenetic reaction" from the FTSE 100 and DAX this afternoon in response to the pound and euro's strong performances against the dollar.

He added:

"Though it couldn’t quite match its $1.30-plus morning high, cable [dollar and pound exchange rate] continued to push ahead this afternoon, climbing 0.4%.

"Dollar weakness – the greenback didn’t even get a boost from the revised US Q1 GDP reading – combined with the hawkish rumblings from the Bank of England are fueling cable’s rise, leaving sterling at its best price since before the election."

The FTSE 100 is now in negative territory for the first time today. Health care and consumer stocks are weighing heaviest on the index and banking shares' gains have been slightly dampened by trading this afternoon.

Queen's Speech

A potential hiccup for sterling this afternoon is the Queen's speech. It is, however, very likely that the DUP will support the Conservatives and the vote will pass.

Given the likelihood, Caxton currency markets analyst Alexandra Russel-Oliver believes that the pound "may have a muted reaction or see a small rise" following the vote.

Mark Carney has 'spooked the gilt market'

Jonathan Platt, Head of Fixed Income at Royal London Asset Management, has commented that the bond markets may have "been caught unprepared for a tightening of monetary policy".

He added on European government bonds:

Hints this week that Mario’s ‘Magic Money Tree’ might begin to be tapered led to a tumultuous sell-off in European government bonds, which was partly reversed as the ECB clarified comments on Wednesday.

While bond yields are enjoying something of a resurgence of late, the ongoing fall in incomes from fixed income mean that dividends remain in high demand. The prospect of higher payouts from financial stocks could well provide yet another tailwind for the broader market rally, just as it began to look stagnant.

Chris Beauchamp, IG

Bond markets at a turning point?Yields across euro zone up almost 10, yes TEN basis points today https://t.co/Q9ZikOlGagpic.twitter.com/SStcWhrVpE

— Dhara Ranasinghe (@DharaRanasinghe) June 29, 2017

European stock markets lose steam

The FTSE 100 is losing steam as we approach the closing bell this afternoon. Banking and mining stocks continue to keep the index in positive territory. Along with HSBC and Barclays, Sky is one of the top risers on the blue chip index following the government's announcement that it is "minded to" refer 21st Century Fox's takeover of the company to the competition watchdog. Its shares have jumped 39.5p, or 4pc, to 996p this afternoon. Despite paring early gains this afternoon, the FTSE 100 is still faring better than its European counterparts, which have struggled after lunchtime.

#FOX / #SKY news not as priced in as thought: Fox +2% despite bid facing full investigation. Sharehldrs pleased a huge outlay delayed? ^KO

— Ken Odeluga (@Ken_CityIndex) June 29, 2017

On the FTSE 250, JD Sports continues to struggle as does index newcomer Sirius Minerals, which updated the market on its potash mine in North Yorkshire this morning.

The pound's momentum against the dollar has continued into the afternoon but it's only slightly up against the euro in choppy trade.

City watchdog pauses spreadbetting probe as Europe regulator steps in

The City regulator has pressed pause on a major trading crackdown after the European markets watchdog unveiled its own plans to do so.

Spreadbetting firms were expecting the Financial Conduct Authority to announce the results of its consultation into complex derivative products known as contracts for difference (CfD) this month, after the regulator outlined proposals for the sector in December amid concerns ordinary investors were losing money.

However the European Securities and Markets Authority has now weighed in, announcing that it is considering using its "product intervention powers" to introduce new rules in this area from January 2018.

Ready Lucy Burton's full report here

Blow to Murdoch takeover of Sky as Government says competition investigation is needed

Read Christopher Williams' full report on the Sky takeover here

Lunchtime summary

The pound briefly touched over $1.30 against the dollar this morning after Bank of England chief economist Andy Haldane said that the central bank needs to "look seriously" at raising rates. It's now hovering around the $1.2970 mark.

Banking shares have been boosted by news overnight from the United States that all of their banks passed the Federal Reserve's stress tests and will now increase shareholder returns in response. The recent increased hawkish sentiment on monetary policy at the Bank of England is also lifting the shares this week.

In the last half an hour, the culture secretary has delayed the government's decision on 21st Century Fox's £11.7bn takeover of Sky. Ms Bradley said that she is "minded to" refer the deal to the competition regulator.

FTSE 100: 7,402 (+0.20pc)

FTSE 250: 19,502 (-0.12pc)

Euro Stoxx 50: 3,522 (-0.37pc)

DAX: 12,602 (-0.38pc)

CAC 40: 5,215 (-0.72pc)

Currencies

GBP/USD: $1.2974 (+0.33pc)

GBP/EUR: €1.1381 (+0.15pc)

Culture secretary is minded to refer Sky takeover deal to competition authorities

Culture secretary Karen Bradley has just told parliament that she is minded to refer 21st Century Fox's £11.7bn takeover of Sky to the competition authorities.

Here is part of her statement:

"On the basis of Ofcom’s assessment, I confirm that I am minded-to refer to a Phase 2 investigation on the grounds of media plurality.

"The reasoning and evidence on which Ofcom’s recommendation is based are persuasive. The proposed entity would have the third largest total reach of any news provider - lower only than the BBC and ITN - and would, uniquely, span news coverage on television, radio, in newspapers and online.

"Ofcom’s report states that the proposed transaction would give the Murdoch Family Trust material influence over news providers with a significant presence across all key platforms.

"This potentially raises public interest concerns because, in Ofcom’s view, the transaction may increase members of the Murdoch Family."

Ofcom’s report states that the proposed transaction would give the Murdoch Family Trust material influence over news providers with a significant presence across all key platforms.

Karen Bradley, culture secretary

Interestingly, #Bradley says Fox offered undertakings to protect independence of Sky News

— Amol Rajan (@amolrajanBBC) June 29, 2017

Shares in Sky have soared following the news. It's now up 26p, or 2.7pc, to 982.5p.

FTSE 100 slows as morning progresses

The FTSE 100 has slowed throughout the morning but banking stocks are still performing well with HSBC, which has the second-largest market cap on the index, 4.3pc up to 716.5p.

The blue chip index is currently at 7409 points, a 21.7-point increase. The FTSE 250 has, however, edged down 56 points to 19,420 with JD Sports being the biggest drag on the mid-cap index following its trading update this morning.

Spreadex analyst Connor Campbell said that JD "has every right to feel such vitriol is unfair", given that this morning's statement said that the company was on track to meet this year's expectations.

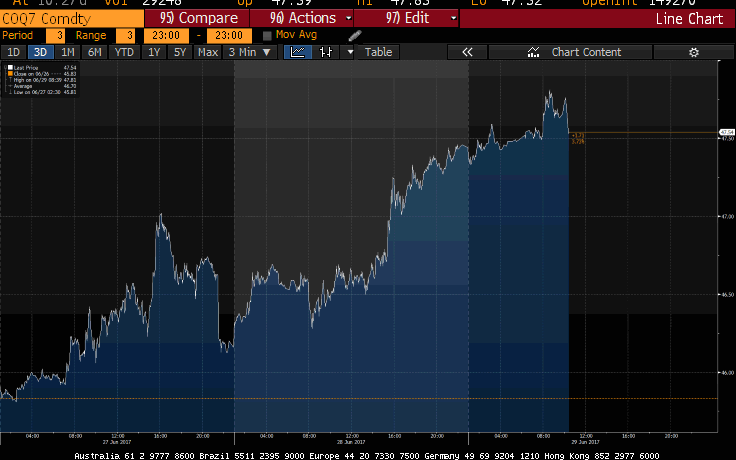

Brent crude buoyed by optimistic data

Brent crude is now entering its sixth day of gains after statistics from the Energy Information Administration overnight showed that although crude stocks increased by 118,000 barrels last week, production in the United States declined by 100,000, the biggest fall in just under a year.

The price wobbled earlier this week as inventory data from the American Petroleum Institute showed a surprise increase. The price has since recovered and is currently up 4.3pc for the week and is hovering around the $47.50 mark.

Accendo Markets analyst Mike Van Dulken said that the rally was being "aided further by the ongoing US dollar sell-off".

Shares in Africa-focused Tullow Oil have increased the most this morning among the large UK oil producers. The company said yesterday in a trading update that it has brought down its forecast spending for the year to $400m, a decrease from $900m the year before. Weakness in the oil market, however, means that that it will face a non-cash impairment charge of $600m in its mid-year report.

Andy Haldane comment sends pound briefly above $1.30

The pound has broken through the $1.30 barrier for the first time this month as Andy Haldane says that the Bank of England needs to "look seriously" at raising rates.

GBP pops above $1.30 briefly as Chief Economist Haldane throws more mud into the water as he says "Yes but no" to rate hikes pic.twitter.com/XBYgWdc8Gf

— Sigma Squawk (@SigmaSquawk) June 29, 2017

Consumer credit surge explains Bank of England action

Consumer credit continued to grow at a double-digit pace in May, underlining why Bank of England officials took action to protect banks against the risk of a debt bubble.

Unsecured lending rose 10.3pc from a year earlier, the same as in April and close to its fastest rate since 2005, the UK central bank said on Thursday. It grew £1.7bn pounds on the month, the biggest increase since November last year.

The BOE this week responded to the rapid buildup of credit by ordering lenders to hold billions of pounds of extra capital in case the economy turns sour and customers cannot pay back their debts.

While consumer credit accounts for just a fraction of total household debt, people are much more likely to default on unsecured loans than they are on their mortgages, financial-stability officials warned. Of particular concern is car lending, which has grown by about 20pc a year since 2012.

Borrowing on credit cards grew an annual 9.1pc in May, boosted by interest-free periods now lasting over 40 months in some cases as competition between providers intensifies. Lending including vehicle finance, personal loans and overdrafts rose by 10.9pc.

Report by Bloomberg

'Other forces at play' in pound's strength against the dollar

Spreadex analyst Connor Campbell commented that there were "other forces" impacting the pound's strength against the dollar and its "less than robust showing against the euro is evidence of that.

He added:

"Cable [exchange rate between the pound and the dollar] is being somewhat flattered by the dollar’s weakness, the greenback softened up by the latest healthcare reform delay and subsequent suggestion that Donald Trump may not be able to implement a single one of his election promises domestically.

"The euro, on the other hand, has been bolstered by Mario Draghi’s own hawkish hints, lifting the currency to a fresh 14 month high against the dollar while preventing the pound from gaining any real traction."

Financial watchdog launches probe into PwC over BT accounting scandal

The financial watchdog has launched an investigation into PricewaterhouseCoopers over an accounting scandal in BT's Italian arm.

The Financial Reporting Council said it had begun a probe into audits by PwC of BT for three years of financial statements.

The investigation concerns BT's reports in 2015, 2016 and 2017, and follows the telecoms giant's revelations of accounting issues in its Italian operations.

Read Sam Dean's full report here

FTSE 100 banks boosted by US banks easing through stress test

The boost seems to have been the halo effect from the US

Neil Wilson, ETX Capital senior market analyst

Last night all the US banks passed the Federal Reserve's stress tests for the first time since they began after the financial crisis. The banks have responded by announcing plans to increase shareholder returns.

ETX senior market analyst Neil Wilson said that banking shares have "jumped on the open after regulators in the US gave the greenlight to higher dividends and buybacks, whilst the hints of a shift in tone from central bankers towards tightening is spurring hopes of higher interest rates again".

Renewed confidence in the US financial sector has translated to the UK this morning with banks leading the FTSE 100. HSBC is up by 4.7pc to 718.6p and Barclays has risen 1.6pc to 206.7p. Financials are also up on the European stock markets which haven't started today's session as strongly as the FTSE 100.

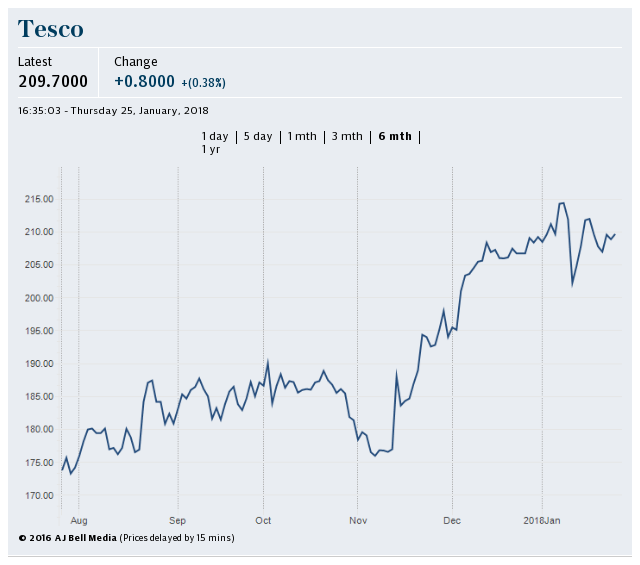

Tesco asks CMA to speed up Booker takeover review

Tesco has requested the competitions watchdog speed up its review of the supermarket's planned takeover of food wholesaler Booker.

The Competitions and Markets Authority (CMA) last month launched its investigation into the £3.7bn deal over concerns it could restrict choice for customers.

Tesco has now asked the body to 'fast track' its initial probe, which was due to be completed by July 25.

Read Sam Dean's full report here

A interest rate rise could come as soon as August, according to MUFG

MUFG currency analyst Lee Hardman believes that recent comments coming out of the Bank of England could mean a rate hike as soon as the August MPC meeting.

He commented:

We believe that the majority on the MPC is closer to raising rates than widely assumed. The recent surprise signal from previous arch dove BoE Chief Economist Haldane that he is close to raising rates has highlighted that opinions on the MPC can change quickly.

Overnight round-up and looking ahead

Overnight round-up

Overnight the pound held onto gains made against the dollar after Bank of England governor Mark Carney said that higher interest rates will be "necessary" if the global economy boomed. It was the second day in a row that the head of a central bank has been the focus of the markets with ECB president Mario Draghi stealing the show on Tuesday to boost the euro to a one-year high. Meanwhile last night the dollar hit its lowest level since October according to the Bloomberg Dollar Spot Index, which tracks the greenback's performance against a basket of the ten leading currencies.

This morning the pound has risen further to its highest level in over a month. It's up by 0.4pc on the dollar and is approaching the $1.30 mark.

ING's forex research team commented this morning:

"Speeches by the BoC, the ECB and the BoE over the last three weeks look to be a deliberate expectations management exercise, preparing the market for the removal of some of the emergency monetary measures put in place from 2015 onwards."

Good morning from Berlin on a Risk-On day. Stocks in Asia rise as investors see higher rates as a sign of stronger growth. Euro at 1y high. pic.twitter.com/oXPOUCaZcc

— Holger Zschaepitz (@Schuldensuehner) June 29, 2017

Financials were the top performers on the US markets last night with commodity equities boosted by the weak dollar's effect on prices. This helped the S&P 500 post its largest one-day gain in two months and technology shares recovered ground lost on Tuesday to lift the Nasdaq 1.4pc higher.

Asia

NKY: 20,220 (+0.45pc)

HSI: 25,945 (-1.02pc)

SHZ300: 3,668 (+0.62pc)

United States

Dow: 21,454 (+0.68pc)

S&P 500: 2,440 (+0.88pc)

Nasdaq: 6,234 (+1.43pc)

Asian equity markets sustained the momentum from US, where the S&P 500 posted its best day in 2 months

— RANsquawk (@RANsquawk) June 29, 2017

Looking ahead

The FTSE 100 has started the day strongly with the miners and banks taking their cue from US and Asian markets.

Online property portal Purplebricks' full-year results are the highlight of the corporate calendar, its first since listing on AIM.

We also have Culture Secretary Karen Bradley's decision on the Sky takeover due later today which is one to keep an eye on.

And for those who didn't get enough Mark Carney yesterday...

Update: BoE's Governor Mark Carney is being interviewed on Bloomberg TV at 11.30am... let's see what side of the bed he got out of today!

— Anthony Cheung (@AWMCheung) June 29, 2017

Full-year results: Purplebricks Group, Cohort, ReNeuron Group, Redcentric, Greene King, DS Smith

Interim results: Harwood Wealth Management

Trading update: JD Sports Fashion, John Laing, Wood (John) Group

AGM: Press Corporation, Independent Oil & Gas, P2P Global Investments, Trader Media East, JD Sports Fashion, Strat Aero, Westminster Group, Volvere, Rockrose Energy, World Trade Systems, Stobart Group, Strategic Minerals, Beowulf Mining, Richland Resources, Eland Oil & Gas

Economics: M4 Money supply m/m (UK), final GDP price index q/q (US), unemployment claims (US), final GDP q/q (US), Gfk consumer climate (GER)

Yahoo Finance

Yahoo Finance