Pound flip flops after May requests Brexit extension and takes the 'people's side'

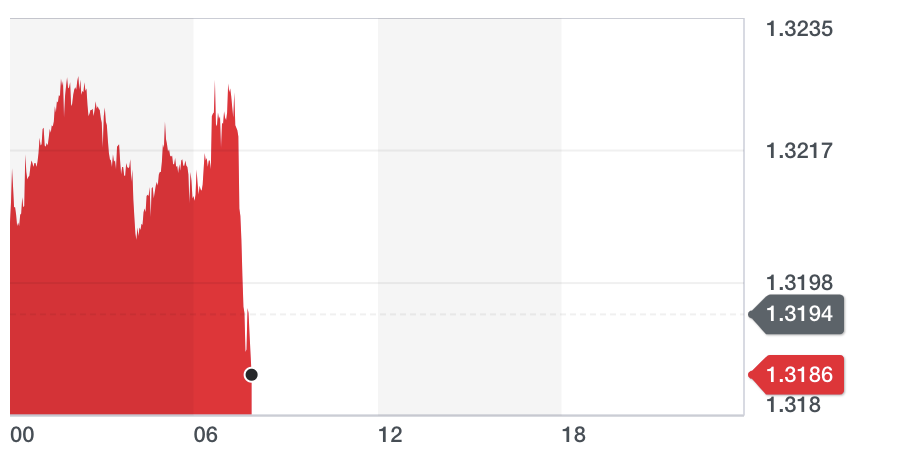

The pound versus the US dollar (GBPUSD=X) rose in early morning trading and then took a downturn after investors digest prime minister Theresa May’s speech from last night.

Against the dollar the pound inched up by over 0.2% at around 7.30am local time before taking a negative turn just before 8am.

Last night, May confirmed that Britain will not leave the European Union “on time” on 29 March, due to the back and forth in parliament to pass a deal.

May has tried to pass her Brexit deal twice in parliament — the first in January and again on 12 March. Both were voted down by large margins. She was tipped to put her deal in front of parliament again — dubbed “MV3” — this week but parliament speaker John Bercow blocked May from the move. He said the “government cannot legitimately … resubmit to the House [of Commons] the same proposition or substantially the same proposition as that of last week.”

She used her speech last night to rally the public and insist that it was parliament’s fault for the delay in Brexit because they wouldn’t, and won’t, pass her deal.

“This delay is a matter of great personal regret for me. And of this I am absolutely sure: you the public have had enough,” she said.

“You are tired of the infighting. You are tired of the political games and the arcane procedural rows. Tired of MPs talking about nothing else but Brexit when you have real concerns about our children’s schools, our National Health Service, and knife crime. You want this stage of the Brexit process to be over and done with. I agree. I am on your side. It is now time for MPs to decide.”

As a result, May also said that she is writing to the President of the European Council Donald Tusk to request an extension to Article 50 — the official notification that Britain is leaving the EU, setting a two-year date for the UK’s departure from the bloc.

May said she is “not prepared to delay Brexit any further than 30 June” and that “now you want us to get on with it. And that is what I am determined to do.”

Where will sterling go?

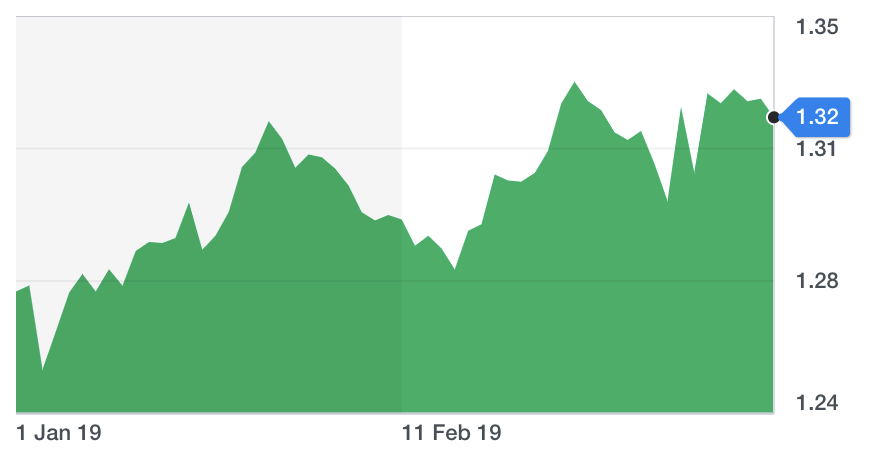

It has been a rocky road for sterling over the last month, where the pound versus the dollar is seen as barometer of how investors are viewing Brexit negotiations and progress being made in the UK gaining a deal that won’t smash the UK economy in its wake.

While the pound is still down over 20% since before the EU referendum was announced, it has made around 4% in gains this year.

On BBC Radio 4’s Today programme, George Godber, fund manager at Polar Capital, said that sterling versus the dollar could reach $1.40 and $1.50 if a deal is struck. However, he said the pound could sink as low as $1.20 if Britain crashes out of the EU without a deal.

“No one knows what’s going on so you get very jumpy events but [the markets] keep focusing back on the chance of a no-deal being highly unlikely,” he added.

Yahoo Finance

Yahoo Finance