Pound rockets as parliament rejects a no-deal Brexit

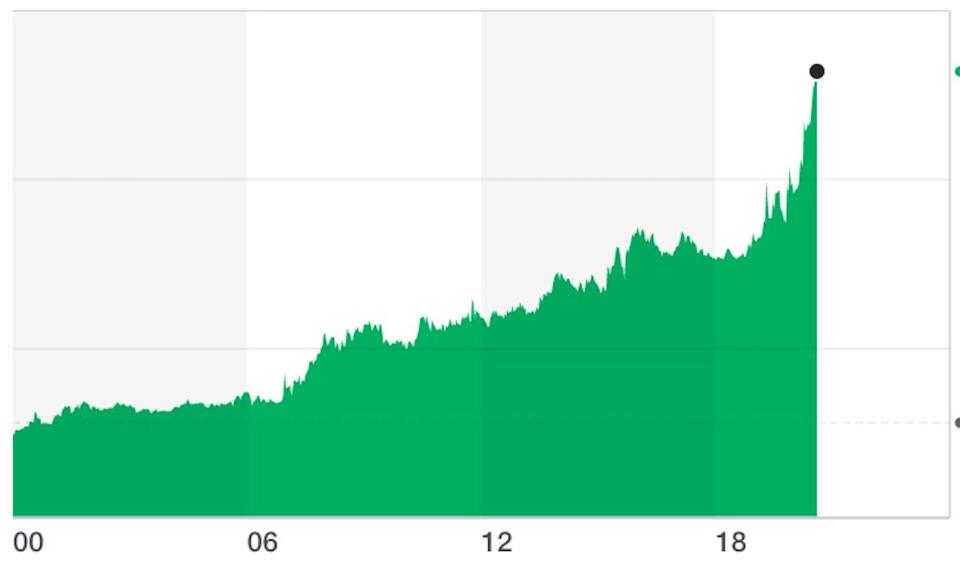

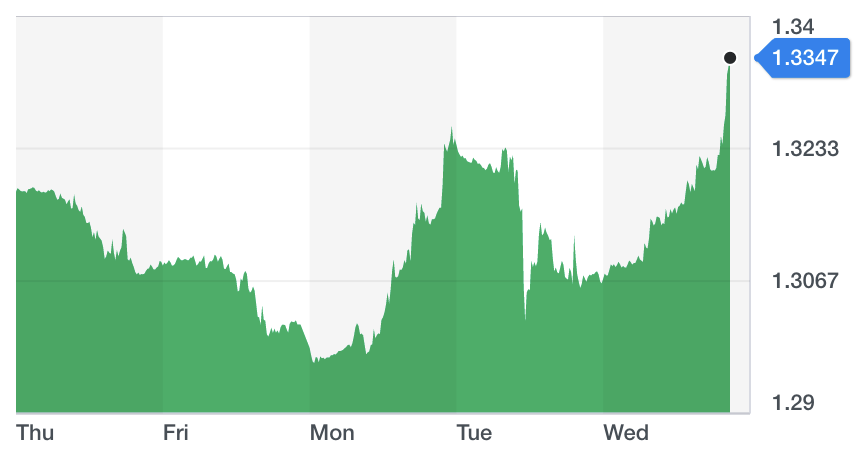

The pound against the US dollar (GBPUSD=X) rocketed in the immediate aftermath of parliament voting to reject leaving the European Union without a withdrawal agreement. But it was a close call — Members of Parliament (MPs) voted by 312 to 308 to reject a no-deal Brexit.

The pound broke past the $1.33 barrier by rising over 2.1% — which is significant considering how much pressure the currency was under when prime minister Theresa May’s deal was voted down for the second time, last night.

A no-deal Brexit means that the UK will leave the bloc on 29 March without any rules of regulations to replace those that were implemented during the EU membership. That is the worst case scenario for the economy because no one will know how to operate in the vacuum of no distinct rules and regulations governing trade or immigration.

The Bank of England said previously that a no-deal Brexit — also known as a hard Brexit and means no transition period — will be worse than a global financial crisis. The International Monetary Fund (IMF) also warned that Brexit is one of the biggest risks for global financial stability.

Yesterday, MPs released a report saying that the UK government’s preparations for a no-deal Brexit have been “rushed”, “risky,” and “over-optimistic.” The influential public accounts committee said it is not convinced government departments are ready to leave the European Union on 29 March without a deal.

READ MORE: The 11 possible outcomes Britain faces post-Brexit deal rejection

Today, the government outlined its plans to slash a majority of tariffs to zero in the event of a no-deal Brexit and chancellor Philip Hammond slashed the UK economic growth forecast for the year and warned of a no-deal Brexit.

However, the vote is not a legally-binding and there is still a distinct possibility that Britain could end up with a no-deal Brexit.

Next steps will mean that another vote will take place on Thursday to discuss whether Brexit needs to be delayed in order to secure a new deal. This would require extending Article 50 — the notification that Britain is leaving the EU.

“If the House finds a way in the coming days to support a deal, it would allow the Government to seek a short limited technical extension to Article 50 to provide time to pass the necessary legislation and ratify the agreement we have reached with the EU,” said May in her speech to parliament.

“But let me be clear, such a short technical extension is only likely to be on offer if we have a deal in place.

“Therefore, the House has to understand and accept that, if it is not willing to support a deal in the coming days, and as it is not willing to support leaving without a deal on 29 March, then it is suggesting that there will need to be a much longer extension to Article 50. Such an extension would undoubtedly require the United Kingdom to hold European Parliament elections in May 2019.

“I do not think that would be the right outcome.”

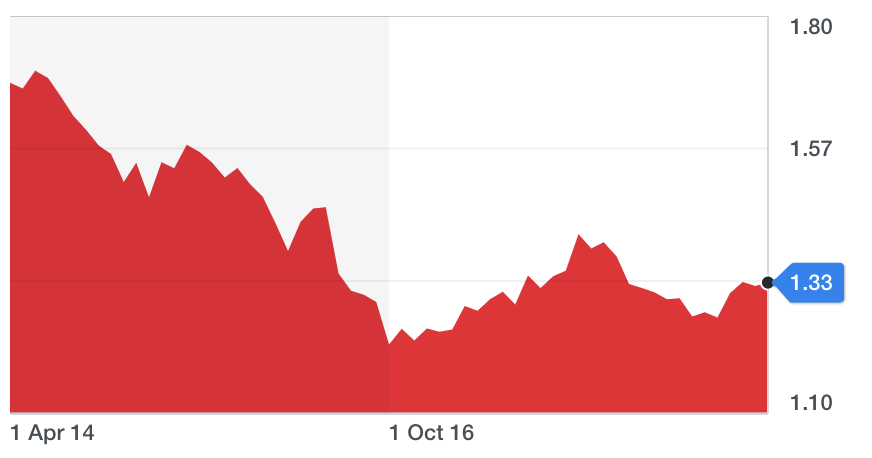

In the meantime, the pound has a long way to recovery against the dollar — especially since a no-deal Brexit is not fully off the table. The pound is still significantly lower than what it was before the EU referendum was announced:

Yahoo Finance

Yahoo Finance