Brexit deal: Pound on a rollercoaster as DUP vows to vote against Johnson – live updates

DEAL!

Pound surges to stand above $1.29 for first time since May after UK and EU declare that a Brexit deal has been reached...

...but falls back again as DUP confirms it will vote against proposals, casting doubt over whether Boris Johnson can get past Parliament

UK stocks advance amid measured relief rally

Follow the latest Brexit updates on our politics live blog

WHAT DOES IT ALL MEAN?

£525m-a-week Brexit paralysis: The staggering cost of Parliament’s indecision

Russell Lynch: This deal doesn’t get Brexit done – it’s just the end of the beginning

IN THE CITY...

WH Smith accelerates US push with £300m deal for Marshall Retail

Domino’s Pizza to exit international markets

Second Woodford fund is suspended following investment firm’s collapse

Banks braced for last dose of PPI pain after late surge in claims

More than two million Britons joined a last-minute dash for PPI compensation this year, with a rush of complaints leaving banks "overwhelmed" in the run-up to an August deadline.

The City watchdog said there was a 34pc spike in payment protection insurance complaints in the first half of the year, piling fresh pressure on UK banks which are already expecting to shell out £50bn for the long-ruinning mis-selling scandal – five times the cost of the London 2012 Olympics.

Analysts said the final cost of the debacle were unlikely to be announced just yet given the volume of claims UK banks are sifting through. Big banks are due to annonuce their third-quarter financial results later this month.

Read Lucy Burton's full report here

How the pound compares to other currencies

G10 Currency Performance Update:#USD -0.39%#EUR +0.04%#JPY -0.20%#GBP -0.29%#AUD +0.52%#CAD +0.12%#CHF +0.38%#NZD +0.37%#SEK +0.37%#NOK -0.32%

— IGSquawk (@IGSquawk) October 17, 2019

Pound's rollercoaster ride...

Connor Campbell at SpreadEx says "it's a lot to take in".

"Starting the day in the red following the DUP’s initial rebuttal, the pound found itself tickling $1.30 for the first time since mid-May in the aftermath of the deal-announcement, only to drop back to $1.2836 as Arlene Foster and co. reaffirmed their unhappiness with what has been put forward.

"With the rest of the markets broadly positive – the Dow crossed 27100 with a 90 point increase – and its banking sector cheering the Brexit developments, the FTSE managed to rise 0.6pc That once against puts the UK index above 7200, a level it has struggled to escape with any longevity since its October-opening nosedive."

Union bosses head to Turkey for talks with British Steel buyer

A deal to sell British Steel to a Turkish business could be edging closer with union leaders jetting out to the country for meetings at a steel plant owned by the potential buyer, my colleague Alan Tovey writes. He says:

Roy Rickhuss, head of steelworkers’ union Community, and Paul McBean, who chairs the multi-union group at the Scunthorpe plant, have flown to Turkey to meet with Erdemir, the country’s largest steel business.

Erdemir is controlled by Ataer – the investment arm of Turkish military pension fund Oyak.

British Steel collapsed into insolvency in May, endangering the jobs of its 4,500 staff, and many more positions in its supply chain, after it failed to secure a £30m state bailout.

Good afternoon

I'll be with you for the final two hours of the blog, keeping you up-to-date with all the latest until markets close

Let's have a quick look at how things are doing...

London's benchmark FTSE 100 is currently trading 0.53pc higher while the FTSE 250 is up 0.37pc.

Wall Street stocks rose in early trade on positive Brexit news. The Dow Jones is0.4pc up and the broad-based S&P 500 has gained 0.6pc.

The tech-heavy Nasdaq is 0.7pc higher at 8,182.68.

Handover

The pound, which has been listing back upwards since its mid-afternoon is now narrowly positive, with the FTSE 100 and 250 both holding moderate gains currently.

You could say traders are on the edge of their seats, but given the next big movement may not be until Saturday, they might be sat there for a while. As it stands, a week of massive gains has seemingly now ground to a halt.

After an early start following the DUP dawn strike, I’m going to hand over to my colleague LaToya Harding, who will handle things from here until markets close. Thanks for following along!

Germany cuts growth forecast

Continued pressure from a struggling manufacturing sector has prompted Germany’s government to cut its growth forecast for 2020, from 1.5pc to 1pc.

The country already expects economic growth in 2019 to be the worst in fix year, amid some poor activity figures, and a contraction in the second quarter.

Speaking in Berlin, economic minister Peter Altmaier said:

The outlook may currently be dampened, but there’s no threat of an economic crisis. Economic stimulus packages, in the traditional sense of triggering a flash in the pan, are not the right instruments.

IMF chief welcomes deal

Kristalina Georgieva, the recently-anointed Managing Director of the International Monetary Fund, has welcome news of the Brexit deal.

Speaking to reporters in Washington, the Bulgarian economist said:

I saw the news and jumped. Great! We would like to see the agreement being reached. My hope for the next few days is that the will holds in all quarters.

Northern Irish business leaders offer cautious backing to deal

Northern Irish business leaders have issued cautious support for Boris Johnson's Brexit deal, my colleague James Rothwell reports.

Stephen Kelly, the head of Manufacturing NI, which represents more than 100 firms in the region, said:

We give a guarded welcome to the agreement between the UK and the EU.

It removes the risk of a catastrophic no deal and set a new floor below which NI could not fall providing a solid foundation from which to press up from should the UK and EU not speedily conclude a new relationship.

It is now critically important that Parliament approves a deal and that work is escalated to secure a new positive long term free trade relationship between the UK and the EU.

Can a Brexit deal turn around a slowdown in the housing market?

That’s the question Telegraph Money’s Adam Williams has set out to answer. He writes:

In the three years since the vote there has been a reduction in the number homes being put up for sale, ever-growing transaction times and a decline in annual house price growth as negotiations between Britain and the European Union have dragged on.

However, with the relative certainty presented by a deal, analysts believe that buyers and sellers will soon return to the market.

Read more here: Why the Brexit deal will reverse Britain’s property market slump

Experts: UK markets to snap back if deal passes

Here’s some reaction to the current Brexit situation from analysts.

Luca Paolini, chief strategist at Pictet Asset Management, says:

Brexit has left UK equities as the cheapest of all the global stock markets, while sterling is also undervalued. With plenty of bad news priced in, any resolution to the country’s political turmoil is likely to see a big snap-back. We figure there’s the prospect of a 20 per cent upside to the market.

Deutsche Bank’s Oliver Harvey says:

There will be much focus on upcoming votes in Parliament on Saturday, and whether Mr Johnson's deal receives ratification (discussed in more detail below). But the important point from the market’s perspective is that avenues to a no deal Brexit have been largely closed off. The only prospect of a no-deal Brexit in the next three to six months would arise if a general election resulted in the Brexit Party performing sufficiently strongly to be needed to support a Conservative minority government.

Dean Turner of UBS adds:

As has typically been the case with Brexit newsflow in the past, moves within the UK equity market are likely to remain more significant than moves to the overall UK equity market. On sterling, we retain our overweight position versus the US dollar in our FX strategy.

If a deal is at last reached, we may even see GBPUSD rally to 1.35. If MPs do not agree on a deal after all and we are faced instead with an extension, followed by a General Election, we would more likely see GBPUSD settle between 1.26 and 1.32. The looming no-deal Brexit scenario, which could have flung GBPUSD as low as 1.12, now appears the least likely outcome.

Credit crunch looms

Bad news for businesses: Firms face the biggest crunch in lending since the financial crisis as banks prepare to slash risk-taking and rein in credit in the coming months. My colleague Tim Wallace reports:

The availability of finance has held steady for the past four years after a recovery from the credit crunch and eurozone crisis.

But companies could suddenly find their easy access to debt drying up, according to the Bank of England’s quarterly credit conditions survey.

The proportion of banks expecting to cut access to credit over the rest of this year now outweighs those anticipating easier access to loans by a margin of 13.5pc, indicating the final three months of the year will see the sharpest tightening in financial conditions since 2008.

Read more here: Credit crunch fears mount as banks cut business lending

Pound falls as DUP confirms opposition to deal

It’s on – but may already be clearly off. The DUP have confirmed they will vote against the Brexit deal on Saturday, rather than simply abstaining. That makes it incredibly difficult for Boris Johnson to win a vote at this time.

DUP officials confirm there is NO chance of them abstaining on the vote. They are voting it down.

— Laura Hughes (@Laura_K_Hughes) October 17, 2019

Govt confirms plan for straight deal or no deal vote on Saturday - but almost bound to be orher amendments put down by MPs too

— Laura Kuenssberg (@bbclaurak) October 17, 2019

That’s sent sterling down on the day – what a rollercoaster!

This is European style politics. It's NEVER really over! #GBP sinks from a high of almost 1.30 against the #USD. pic.twitter.com/H9PuII3hXK

— jeroen blokland (@jsblokland) October 17, 2019

“act in haste, repent at leisure” https://t.co/u5OufrP5Et

— Garry White (@GarryWhite) October 17, 2019

European gains looking muted

Things are still a fairly healthy green across Europe stock markets, but the gains we saw earlier have not hung around.

Wall Street set to rise at open

With just under two hours until trading opens on the US markets, Wall Street is currently set for moderate gains based on futures trading.

Though Brexit hopes are spilling over the Atlantic, there are plenty of other things that may be on traders’ minds – for instance, this letter from Donald Trump to Turkish President Erdogan, leaked overnight:

EXCLUSIVE: I have obtained a copy of @realDonaldTrump’s letter to #Erdogan. @POTUS warns him to not “be a tough guy! Don’t be a fool!” Says he could destroy Turkey’s economy if #Syria is not resolved in a humane way. Details tonight at 8pm #TrishRegan#FoxBusinesspic.twitter.com/9BoSGlbRyt

— Trish Regan (@trish_regan) October 16, 2019

Brexit: Five things to read right now

It’s Brexitshambles out there, with the pound now back to almost flat on the day, the FTSE 100 and 250 both looking a bit more neutral at around 0.5pc up, and DUP sources confirming they will not back Boris Johnson’s deal on Saturday.

Cutting through the noise, here are five things you should read to understand what is going on, and where the UK goes from here:

Can Boris Johnson get his deal through Parliament without the support of the DUP?

The DUP says it cannot support Boris Johnson’s deal on customs and consent – what does it mean?

Russell Lynch: This deal doesn’t get Brexit done – it’s just the end of the beginning

Allister Heath: This may be Leavers’ last, realistic chance to achieve a proper Brexit

Money: What does the Brexit deal mean for your personal finances?

FSB: Focus needs to move to future relationship if deal passes

The Federation of Small Business’s leader Mike Cherry has welcomed news of a deal, but added:

We have been here before, however, and although both the UK Government and EU have shown determination and a willingness to progress negotiations and deliver this breakthrough – we now need to see this continue if we are to reach a successful Brexit endgame. The Government and Parliament must now work together to ensure this is best deal for the UK small business community.

If the deal is passed – focus needs to turn quickly to the future relationship and ensuring that lessons are learnt from the experience of the last three years.

Many small businesses are just about surviving - not only do they desperately need certainty but they also need the Government to get back to business and focus on meeting the many domestic challenges that have fallen behind Brexit.

Don’t Bank on it: Deal throws rate cut into cut

With a deal on the table, belief is ebbing that a no-deal exit could occur. That has reduced expectations that the Bank of England may soon have to cut interest rates.

Threadneedle Street officials have doggedly held the bank rate in recent months, saying they would rather wait until the impact of Brexit is clear before they begin a process of monetary easing aimed at stimulating the economy.

Bloomberg reports:

Just two days ago, the market was pricing a full 25 basis-point decrease by November 2020 after policy maker Gertjan Vlieghe said continued Brexit uncertainty would probably require further monetary stimulus.

Now money markets see only a 60pc chance that the central bank will lower its benchmark interest rate by 25 basis points by that time, according to MPC-dated Sonia swaps data from TP ICAP.

Last month, the nine-strong Monetary Policy Committee elected to hold rates at 0.75pc.

Pound back under $1.29 as doubts linger

After soaring to a fresh five-month high against the dollar and the as news of the deal broke, the pound has weakened slightly.

It is currently sat just below $1.29, having broken that barrier for the first time since May earlier. Traders – like the rest of us – have two questions on their minds:

Can this deal pass through Parliament?, and:

If not, what happens next?.

It’s a good moment to reflect on how far the currency has shifted: since sinking to a 34-year low of $1.17 at the start of September, the currency has mounted a steady comeback, with foreign exchange desks buoyed by the assumption that a no-deal exit is off the table.

Look in the longer term though, and the pound’s weakening through the age of Brexit is still apparent: last year, we saw peaks above $1.40, and it was about $1.50 for much of 2015 – numbers that feel pretty far away right now.

Five charts that shows how a Brexit deal will boost the economy

What happens now that a deal in on the table?

Well, if it passes (that’s a bit if), it could mean more than three years of market volatility, stunted growth and political paralysis could be finally coming to an end, my colleagues Tom Rees and Tim Wallace write:

Now that a draft departure deal has been struck, the economy faces a renaissance, unleashing pent-up investment, sending sterling higher and giving growth a much-needed shot in the arm.

They’ve put together five charts that show how the economy is set to be boosted if Boris Johnson can get his Brexit deal over the line. Here’s a taster:

Read more here: How a Brexit deal will boost the economy – in five charts

Here’s a reminder of what lies ahead:

Relief sends European stocks upwards

European investors has welcomed news of a Brexit deal, send major indices upwards (though the gains aren’t staggering – a lot of the energy may have been blown earlier this week).

Responding to the deal, Food and Drink Federation chair Ian Wright said:

The UK’s food and drink manufacturers will welcome the news that a deal has been struck. They will hope that this means, definitively, that a no-deal exit on 31 October cannot happen.

Our focus now switches to whether this deal can command the support of the UK Parliament, and what the detail of the deal means for our members. Their objectives are securing frictionless trade and regulatory alignment with the EU, our largest market. They also must have access to the workers our industry needs.

OANDA’s Craig Erlam said:

Anyone hoping that the process will be straightforward now is kidding themselves. With Labour whipping for a second referendum on the deal and the Lib Dems unlikely to support anything, there is still a good chance we're heading for an extension and election, in order to get this over the line. Nothing in Brexit is ever simple.

It's going to be a wild weekend which will make the market open next week all the more unpredictable. If the deal gets through Parliament, the pound could perform extremely well at the start of next week, despite having already rebounded more than 8pc from the lows a month ago.

Markets are elated, but there is still everything to play for

With Boris Johnson on his way to Brussels to finalise the deal with EU leaders, he leaves behind markets pumped up by Brexit-deal excitement.

There is still a huge amount of doubt, however. The DUP are standing by their statement from earlier, and Mr Johnson will still need to win over hard-liners within his own party, who have said they will withhold judgement until they see the final text of the deal.

The parliamentary maths is ugly for the PM – he has to face a Commons that repeatedly rejected Theresa May’s deal (one that was arguably superior to the special Northern Ireland customs arrangements integral to Mr Johnson’s offering), possibly without the DUP’s support:

...but are the DUP behind the deal?

A potentially massive sting in tale amid this news though – which has slighlty clipped the pound’s wings (though it is still over $1.29):

Not clear if DUP is actually on board or No 10 is trying to bounce them

— Laura Kuenssberg (@bbclaurak) October 17, 2019

Looks like Boris Johnson is calling the DUP's bluff. Strong move. https://t.co/JvjR3hKo5e

— Sebastian Payne (@SebastianEPayne) October 17, 2019

�� Is a deal on or not?! https://t.co/IkauJrZiTi

— Kate McCann (@KateEMcCann) October 17, 2019

But are the DUP on board?? https://t.co/e7OsacaLtF

— Tom Newton Dunn (@tnewtondunn) October 17, 2019

Juncker: Where there is a will, there is a deal

EU Commission president Jean-Claude Juncker tweets:

���������� Where there is a will, there is a #deal - we have one! It’s a fair and balanced agreement for the EU and the UK and it is testament to our commitment to find solutions. I recommend that #EUCO endorses this deal. pic.twitter.com/7AfKyCZ6k9

— Jean-Claude Juncker (@JunckerEU) October 17, 2019

The FTSE 250 is up 1.22pc now, with the FTSE 100 climbing 0.62pc despite pressure for the surging pound.

Of course, though excitement is pouring over the markets currently, a deal still had to get through Parliament – and that might be the biggest challenge yet:

Pound surges to five-month high against dollar

The pound has leapt following those reports, leaping past $1.29. It is at a five-month high against the dollar by my reckoning.

The Telegraph’s Peter Foster reports:

So it's done - DUP on board with #Brexit deal, per EU sources.

— Peter Foster (@pmdfoster) October 17, 2019

BREAKING: A Brexit deal has been reached

Everything going wild on Twitter, on reports a Brexzit deal has been reached:

Looks like the Brexit deal has been done.

— James Crisp (@JamesCrisp6) October 17, 2019

BREXIT - white smoke from the Berlaymont....

— Bruno Waterfield (@BrunoBrussels) October 17, 2019

A deal has been done

— Tony Connelly (@tconnellyRTE) October 17, 2019

Woodford: Which stocks will be hit, and why are some investors rushing to the fallen star trader’s defence?

With Brexit once again drowning out most other news, let’s not forget that, for the City, this week may well be best remembered as the one when Neil Woodford’s investment empire finally buckled.

Alongside my colleague Harriet Russell, the Telegraph Money team has been putting in heroic work all week, covering all the key angles on the story, and explaining what it means for investors.

Here’s the latest from Money’s Sam Meadows and Jonathan Jones on the aftermath of the star trader’s collapse:

Retail sales hold up in face of Brexit chaos

This morning’s retail figures show that consumer demand held up in September despite the Brexit crisis.

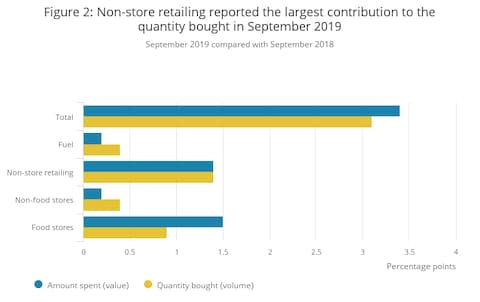

With the quantity of goods sold rising 0.2pc from August, and staying flat when fuel is excluded, it was a double expectations beat by the British consumer. Here’s how those numbers look:

Non-store retailing was the biggest contributor to the quantity bought:

The ONS notes:

In September 2019, all four main sectors contributed positively to the amount spent and quantity bought, resulting in a year-on-year growth of 3.4 and 3.1 percentage points respectively.

Brexit: Barnier says deal ‘almost completed’

Just before we get back to retail details: EU chief Brexit negotiator Michel Barnier has said Northern Irish consent is not a barrier to a deal, and said a deal text is “almost completed”.

That has pushed the pound back up above $1.28.

Meanwhile, the twitters are saying an extension to ratify a deal is possible:

Senior EU official: consent is a key question. Is it the issue which remains open at the level of negotiators? That issue was discussed and there was agreement. But of course nothing is agreed until everything is agreed. But Barnier was clear that on consent there was agreement

— Tony Connelly (@tconnellyRTE) October 17, 2019

Senior EU official keeps open possibility of another Brexit summit before Halloween.

"Always an option to have a summit by the end of October"— James Crisp (@JamesCrisp6) October 17, 2019

Break: Retail sales flat month-on-month

Just in: UK retail sales including fuel were flat month-on-month from August to September.

Here are the key takeaways from the Office for National Statistics:

More follows...

Building supplies firms suffer after Grafton warns on operating profit

This morning’s warning from Grafton has spilled onto the sector, as investors worry slower demand may spread more widely across the sector.

Howden Joinery, Travis Perkins, Kingfisher and SIG have all lost ground, with Travis Perkins falling as much as 8.4pc.

SIG has fallen the least of the bunch, possibly because it already took a hit earlier this month after warning a slowdown in the UK and Germany would hit its profits.

Here’s how the groups have performed this month:

Analysis: Netflix war with rivals heats up

In an important piece of US tech-sector news last night, Netflix said its user growth had had missed forecasts for a second quarter, though its profits rose from $403m to $665m.

US Tech correspondent James Titcomb has taken a look at the figures, and assessed the state of the company, which dominated the nascent streaming scene but finds itself facing increasing competition from rivals.

He writes that, while the group’s position has previously been that “a rising tide lifts all boats” in the streaming sector:

On Wednesday, Netflix’s stance appeared to waver, at least a little. Delivering financials for the third quarter of the year, it predicted “some modest headwind to our near-term growth”. The culprits: Apple and Disney, which will push the button on their respective streaming services within 12 days of each other in November. In the UK, BritBox, a joint venture between the BBC, ITV and Channel 5, is due to launch by the end of the year.

Extinction Rebellion activists pulled from top of tube trains as protests turn ugly

The backlash to the Extinction Rebellion (XR) demonstrations turned nasty on Thursday morning, my colleague Gareth Davies reports, when a protester was dragged from the roof of a Tube train by angry commuters:

Activists targeted Canning Town station as Londoners set about getting to work - a move that has been condemned by Mayor Sadiq Khan.

But two protesters climbed on top of the carriage to drive home their climate change message, despite the Tube being widely regarded as a relatively clean mode of mass transport.

As you can see in the video below, things turned ugly:

Shocking moment angry commuters drag two #ExtinctionRebellion protestors off the top of a train in Canning Town and attack them. pic.twitter.com/EZAMa9tT2t

— Mahatir Pasha (@mahatir_pasha) October 17, 2019

XR has targeted the City of London as part of efforts to highlight climate change.

Read more here: Commuters drag Extinction Rebellion protester from roof of train as activists target Tube

How would the economy look if Remain had won in 2016?

For today’s Think Tank, economics correspondent Tom Rees has taken a look at research Swiss bank UBS, where analysts have imagined what the UK economy would look like if Remain had won all those years ago. He writes:

The bank's analysis is not an indictment of the opportunities or threats of Brexit, but shows the hefty economic cost of attempting to force the most contentious issue for generations through a Parliament where no single party - let alone a united one - commands a majority.

They believe the “uncertainty costs” from the political quagmire since the referendum is equivalent to £525m every week or £990 per household every year. "To repeat, this loss occurs even though Brexit has not happened yet," says UBS economist Arend Kapteyn.

That uncertainty penalty comes from businesses reining in spending, consumers tightening their belts and foreign investors seeking calmer waters elsewhere. It can be devastating for an economy.

Grafton shares slump after it warns on profits

Building materials distributor Grafton is the biggest faller on the FTSE 250 today, after slashing its expectations for operating profit. Here’s Reuters:

Building materials distributor Grafton Group warned that its annual profit would be below market expectations because of weak demand in the UK and delays in new construction permits in the Netherlands.

The news follows a similar warning from smaller peer SIG last week, hit by a weak economic outlook in the UK and Germany.

The company said it expects full-year operating profit for continuing operations to be 4pc to 8pc below current consensus of about £193.5m.

In the backdrop of a multitude of uncertainties in Britain surrounding Brexit and global growth, the company said volumes were affected by weak underlying demand as Britons deferred spending on home refurbishment.

Here’s how Europe’s biggest stock indices stand...

Reaction: ‘Sterling remains one bad plot twist away from disaster’

Here’s some reaction to this morning’s political and foreign exchange moves, from Monex Europe’s Ranko Berich, who says the pound is in risky territory:

The latest pushback from the DUP has only slightly deflated sterling, which is currently trading marginally below the five month highs seen yesterday afternoon when hopes of a deal were at fever pitch. FX market participants are clearly discounting the risk of no deal heavily and in addition to sterling being higher, some of the extreme pricing spikes have receded from options markets, reflecting a lower cost of hedging sterling volatility. Combined with the positive but unsubstantiated noises coming from negotiations, this has been enough to drive sterling higher.

For now, hopes of a deal are likely to keep the pound buoyant but as always, sterling remains one bad plot twist away from disaster. We may yet see further concessions from the DUP, who could require more regional investment or strengthening of their ability to veto whatever customs arrangements Johnson has struck with the EU. However, with very little time for Johnson to seek further material compromises from the EU or the DUP there is still a strong chance we will see the Benn act tested this Saturday.

FTSE 250 falls at open, FTSE 100 flat

With markets having been open for a few minutes now, the FTSE 250 is about 0.3pc down, while the FTSE 100 is basically flat. Grafton shares have fallen sharply after it sliced full-year estimates: more on that in a moment.

Domino’s pulls the plug on Switzerland, Sweden, Norway and Iceland

My colleague Michael O’Dwyer has a full report up on Domino’s decision to pull out of international markets. He writes:

Domino’s Pizza is to pull out of its international markets saying it is “not the best owner” of the businesses as sales continue to fall.

Revenues from overseas operations slid 2.7pc, excluding currency fluctuations, in the third quarter of this year.

Following a review of its international businesses and “disappointing” sales, the company decided to pull the plug on its ventures in Switzerland, Sweden, Norway and Iceland.

“Although the financial results have stabilised, the performance of our international business remains disappointing,” said Domino’s outgoing chief executive David Wild.

Some Brexit reaction from Twitter...

#DUP > #GBP today... #Brexitpic.twitter.com/r6UwiOaxgF

— jeroen blokland (@jsblokland) October 17, 2019

In all the will-they-get-a-deal excitement, it feels like not a lot of attention is being paid to the fact that the deal's economic outcome over 15 years or so is probably going to be closer to No Deal than EU membership. pic.twitter.com/xhln2KMSJl

— Mike Bird (@Birdyword) October 17, 2019

WH Smith plots £300m Marshall takeover

Let’s swing back onto WH Smith, which is stepping up its plans to dominate retail in stations and airports.

The retailer has signed an agreement to buy Marshall Retailer Group, which bills itself as “America’s largest, independent specialty retailer in the airport and resort marketplace”. Marshall has 170 locations, of which 70 are in airports.

The takeover would double the size of WH Smith’s international travel business.

Outlining the reasons for the deal, WH Smith said it offers a:

Compelling opportunity to accelerate the growth of WH Smith's International Travel business in the $3.2 bn US airport travel retail market

The deal will be funded via a new £200m term loan, which the retailer has struck with banks, and a £155m equity placing. It will expand its revolving credit facility by £60m to £200m to reflect its increased size.

Read more here: WH Smith accelerates US push with £300m deal for Marshall Retail

Alongside the announcement, the group reported solid results for the full year, including a 7pc year-on-year profit before tax rise to £155m.

RBC analysts said:

We continue to favour WH Smith for its steady mix shift story and its higher growth Travel Retail business, which we think should put upwards pressure on its multiple over time, as it moves closer to the higher rated Travel pure play peers. Despite investor concerns around its Travel business, given slowing airline capacity additions, we estimate any slower trends should be gradual since WH Smith is fairly diversified. We see it as relatively well positioned in an uncertain political environment due to its low basket size and relatively low USD sourcing.

We’ll see how shares react in just over ten minutes.

How the pound has moved over the past week

The DUP’s statement has knocked the pound, which had touched four- and five-month highs against the dollar and euro respectively tomorrow.

Amid a week of big gains for the currency as deal hopes surge, this morning’s setback has wiped away most of the gains made yesterday, leaving the pound at about $1.275 and €1.152. Analysts expect it could leap as high as $1.35 if a deal is announced.

Here’s how sterling has shifted this week:

Here are the latest noises from Brussels:

France's Europe Minister has also responded that France is 'ready for all scenarios on Brexit' - meaning that France is ready for a no deal Brexit if need be. Subtext:'The EU has given a lot in this round of negotiations. If you push more, be ready that we may opt for no deal' /2

— katya adler (@BBCkatyaadler) October 17, 2019

Business round-up: What’s happening this morning?

We’ve had the first spree of business announcements this morning – here are some of the top lines:

Unilever has reaffirmed its full-year targets after reporting sales in the third quarter were beneath analysts estimates.

Domino’s Pizza grew like-for-like sales by 3pc in the third quarter. The group also said it would exit “four international markets” after a review with consultants.

WH Smith has unveiled a $400m plan to buy Marshall retail Group, a US travel retailer. It plans to fund the acquisition using new debt and equity.

Sources have told Bloomberg that British Gas-owner Centrica has picked Goldman Sachs for its $2bn Spirit Energy sale.

Grafton says its full-year operating profit will be 4pc-8pc lower than the current consensus.

National Express revenues rose by 14.5pc in the third quarter.

Follow the latest political updates on our sister blog

My colleague Tony Diver is steering things on our politics live blog, where you can find the latest political updates as they emerge all day.

Follow along here: Pound sinks as DUP says it cannot support current Brexit deal plans – live updates

Here’s the timeline for the days ahead:

Pound drops sharply after DUP comments

With London traders not yet at their desks, the pound has slid sharply following the DUP’s comments.

Telling the Government to “try and get a sensible deal”, the Northern Irish Party has said it cannot accept the current proposals over two points: customs and consent, and VAT.

The first points (together) refer to the options for a Northern Irish government to withdraw consent for a special customs arrangement in the future, while the latter is over a dispute regarding how VAT would be charged in Northern Ireland after a deal.

Eeek. The final extraction of juice, or just a bridge too far? (Or NO bridge, perhaps).

Tho before @duponline gets stereotyped, this is a MASSIVE decision for them. It commits NI to another world v GB, however u dice it up. Maybe they have no choice now. But its a BIG choice. https://t.co/QgR1sXCmOr— Peter Foster (@pmdfoster) October 17, 2019

Agenda: Come on Arlene, or VAT’s all, folks?

Good morning. There’s one story in town today: Brexit. The latest news, from a few minutes ago, is that the Democratic Union Party, the group of Northern Irish MPs whose support is crucial, have said they cannot support a deal in its current form:

⬇️⬇️⬇️ pic.twitter.com/zpReVsavVu

— DUP (@duponline) October 17, 2019

Before we re-enter the fray, here are the key things you need to know from the world of business.

Overnight and yesterday, continued friction between the US and China over Hong Kong added to a weak international outlook, leaving London's blue-chip index down 0.6pc – its biggest fall in more than a week. The mid-cap FTSE 250 was similarly buffeted by news of an imminent Brexit deal, variously sinking and surging through the day.

5 things to start your day

1) The next Bank of England Governor must be positive about Britain’s future, encourage Government investment and keep interest rates above zero, Dame Helena Morrissey has said. She is a Brexiteer, star fund manager and potential candidate to replace Mark Carney, though she has not commented on her own chances of getting the job.

2) How the economy could have looked if Remain won the referendum: Economists at UBS have calculated an alternate reality - that could have emerged in a counterfactual history. The bank's analysis is not an indictment of the opportunities or threats of Brexit, but shows the hefty economic cost of attempting to force the most contentious issue for generations through a Parliament where no single party - let alone a united one - commands a majority.

3) The boss of Volvo has said that Sir James Dyson should “go back to making vacuum cleaners” following the British inventor’s aborted attempt to build an electric car. Håkan Samuelsson, chief executive of the Swedish car company, said the billionaire’s decision last week to abandon a £2.5bn move into the automotive world highlights just how difficult the sector is.

4) Ministers are laying the groundwork to renationalise one of Britain’s biggest train franchises, wrestling it from the clutches of Germany’s state rail operator. Transport secretary Grant Shapps told a parliamentary committee on Wednesday that the Government is planning to bring Northern rail into public ownership.

5) Dragons' Den TV star and businessman Peter Jones is mulling a rescue plan for the property arm of Jessops, having bought the collapsed camera chain six years ago.

What happened overnight

Asian stocks barely moved on Thursday as soft U.S. retail sales data raised fears about the health of the world’s largest economy, sucking the steam out of a five-session rally, while hopes of a Brexit deal kept sterling volatile.

South Korean, Australian and New Zealand indexes were all in negative territory. Chinese shares were mostly flat while Japan’s Nikkei ticked up and U.S. stock futures were barely changed.

That left MSCI's broadest index of Asia-Pacific shares outside Japan slightly higher with gains largely led by Hong Kong’s Hang Seng index.

The S&P 500 shed 0.20pc on Wednesday after data showed U.S. retail sales contracted in September for the first time in seven months, in a potential sign that manufacturing-led weakness could be spreading to the broader economy.

In Hong Kong, the Hang Seng index added 0.74pc, or 198.37 points, to 6,862.65.

Coming up today

Unilever is the one to watch today. The company has reported some solid results recently, suggesting the handover from Paul Polman to new chief executive Alan Jope came off without too many snags. With Mr Jope now firmly in the driving seat, investors will be looking for the Marmite-maker to be sticking on course for its full-year expectations.

Interim results: Unilever

Preliminary results: WH Smith

Full-year results: Blackrock

Trading statement: Avast, BHP Group, Domino’s Pizza, MoneySupermarket, National Express Group, Norcros, Petropavlovsk, Rank Group, Rathbone Brothers, Record, Rentokil Initial

Economics: Government borrowing (UK), housing permits and industrial production (US)

Yahoo Finance

Yahoo Finance