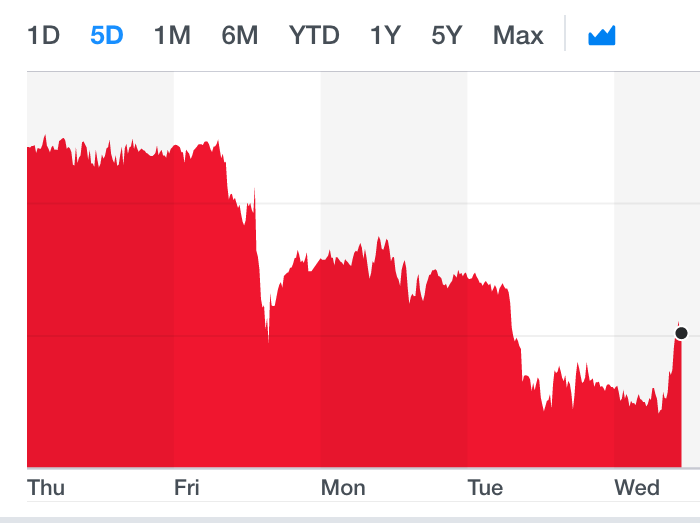

Pound at two-year low as UK GDP figures are released

The pound is hovering around a two-year low against the US dollar (GBP/USD), creeping up only marginally after better-than-expected GDP figures were released on Wednesday morning.

Sterling had dipped 0.1% when trading opened after a televised Conservative leadership debate on Tuesday night did nothing to quell fears of Brexit uncertainty.

But the pound had recovered by 0.2% to almost $1.25 by around 11am after official figures showed GDP increased 0.3% in the three months up to the end of May.

READ MORE: GDP grows 0.3% in May despite Brexit uncertainty

The currency has been sliding over the last week due to figures showing an alarming drop in consumer spending amid continued Brexit uncertainty. Bleak sentiment was compounded by a number of industries warning of the shortages they face amid a no-deal Brexit.

Last night, frontrunners to lead the Tories and become the next UK prime minister — Boris Johnson and Jeremy Hunt — clashed over who could be most trusted on Brexit.

READ MORE: Consumer spending is at its weakest since the mid-1990s

Both were repeatedly asked to prove that they would take the UK out of the European Union on the deadline of 31 October this year and protect business from a no-deal Brexit. However both were unable to provide substantial reassurance of an exit or plans for a deal.

Brexit uncertainty is currently damaging many industries, such as manufacturing, services, construction and retail sectors, which are rattling investors.

On Monday, Deloitte published a survey of chief financial officers and it showed that they are more nervous about risk than at any time since the collapse of Lehman Brothers during the 2008 financial crisis.

READ MORE: Economy set to shrink as UK service sector suffers 'worst month in decade'

Yahoo Finance

Yahoo Finance