FTSE 100 closes at record high and pound hits two-month low against euro as Conservatives' lead narrows in latest poll

Pound hits three-week low against dollar as Conservatives lead shrinks

Oil edges up after sharp slide following Opec output cut extension

European shares open in negative territory

China stocks end week higher after Moody's downgrade

FTSE 100 closes at record high

The FTSE 100 has closed at a new record high, cementing five straight weeks of gains, as the pound dropped to a two-month low against the US dollar.

It finished the trading session up 0.4pc at 7,547.63, surpassing its previous peak of 7,533.

Meanwhile, European bourses ended the day lower as banking stocks weighed. The German DAX fell 0.19pc, the CAC 40 in Paris lost 0.1pc and the IBEX dipped 0.13pc.

Expect a quiet start to the new week

Chris Beauchamp, of IG, previews the week ahead:

"With holidays in the US and UK on Monday we are in for a quiet start to the new week, although the upcoming US jobs report should focus attention very quickly, not least because it forms a prelude to the key Fed meeting that follows in mid-June. Dollar bulls appear to be gathering already, sensing that the market has got too bearish on the outlook for the US economy, with the greenback now due a rebound."

US consumer sentiment weakens by more than expected in May

US consumer sentiment weakened this month by more than expected, a private survey showed this afternoon.

Data from the University of Michigan Surveys of Consumers revealed that its preliminary May consumer sentiment index was 97.1, below an early May reading of 97.7. However, it was little changed from April's reading of 97.0.

Forecasts pointed to a reading of 97.5.

University of Michigan Consumer Sentiment: 97.1 vs exp 97.5; prev 97.7

— Sigma Squawk (@SigmaSquawk) May 26, 2017

Dollar index extends gains after US GDP revised upwards

The dollar index has extended its gains this afternoon after first quarter GDP growth was revised upwards.

Gross domestic product increased at a 1.2pc annual rate instead of the 0.7pc pace reported last month, the Commerce Department said in its second estimate.

The dollar index, index which measures the greenback's value versus a basket of six major currencies, climbed 0.22pc to 97.474.

Mountain Warehouse reports 20 years of uninterrupted growth

Mountain Warehouse has reported record profits, marking 20 years of uninterrupted growth.

The UK’s largest outdoor clothing business said that sales were up 30.8pc in the year to the end of February, to £184.4m, with pre-tax profits up 22pc to £19.8m from £16.2m last year.

The company's total sales have increased every year for the last two decades. Founder and chief executive Mark Neale said: “The downturn in 2008 allowed us to start growing really quickly when stores became easier to find and customers were looking for fantastic value.

"We passed 100 stores in 2010 and have been on a steep climb since then with online and international playing a bigger and bigger part in the business.”

Read the full story by Isabelle Fraser here

US stocks little changed at opening bell

US stocks opened flat this afternoon as investors remained on the sidelines ahead of a three-day holiday weekend.

At the opening bell:

Dow Jones: -0.04pc

S&P 500: -0.05pc

Nasdaq: +0.03pc

Upward revision to US GDP strengthens case for Fed rate hike next month

Richard de Meo, Managing Director of Foenix Partners, reckons the upward revision to US first quarter GDP strengthens the case for a Fed rate hike next month.

He said: "Yellen will find the 0.6pc quarterly uptick in consumer spending to be particularly pleasing ahead of what is being enthusiastically priced in by fixed income markets – the implied probability of policy action was above 80pc at the last count. Unless Donald Trump repeats his NATO tactics and shoulders his way into the headlines and barring any shock disappointments in the data calendar, no market event appears capable of preventing a mid-June US interest rate hike."

US first-quarter GDP revised up to 1.2pc

US economic growth slowed less sharply in the first quarter than initially thought, but the weakness was likely an aberration amid a strong labor market that is near full employment.

Gross domestic product increased at a 1.2pc annual rate instead of the 0.7pc pace reported last month, the Commerce Department said in its second estimate on Friday.

US GDP grew 1.2% ann in Q1 2017, revised up from 0.7% and also way faster than expected 0.9%. Euro dropped <$1.12. pic.twitter.com/QRFhqdyF4l

— Holger Zschaepitz (@Schuldensuehner) May 26, 2017

That was the weakest performance since the first quarter of 2016 and followed a 2.1pc rate of expansion in the fourth quarter. The government revised up its initial estimate of consumer spending growth, but said inventory investment was far smaller than previously reported.

The sluggish first-quarter growth pace is, however, probably not a true reflection of the economy's health. GDP for the first three months of the year tends to underperform because of difficulties with the calculation of data that the government has acknowledged and is working to resolve.

Economists polled by Reuters had expected GDP growth would be revised up to a 0.9pc rate.

Report from Reuters

FTSE 100 sets another new record peak

After pulling back from earlier, the FTSE 100 has stormed higher to another fresh record high as the pound extended its losses this afternoon against the US dollar.

The blue chip index is now up 0.37pc on the day at 7,545.18.

US stocks flat ahead of GDP data

US stocks are expected to open little changed this afternoon as investors await US GDP data, which is expected to show the US economy grew slightly more than previously thought in the first quarter.

A second reading on the GDP is expected to come in at 0.9pc, slightly higher than the 0.7pc growth estimated earlier.

Here are the opening calls courtesy of IG:

US Opening Calls:#DOW 21058 -0.09%#SPX 2411 -0.14%#NASDAQ 5775 -0.03%#IGOpeningCall

— IGSquawk (@IGSquawk) May 26, 2017

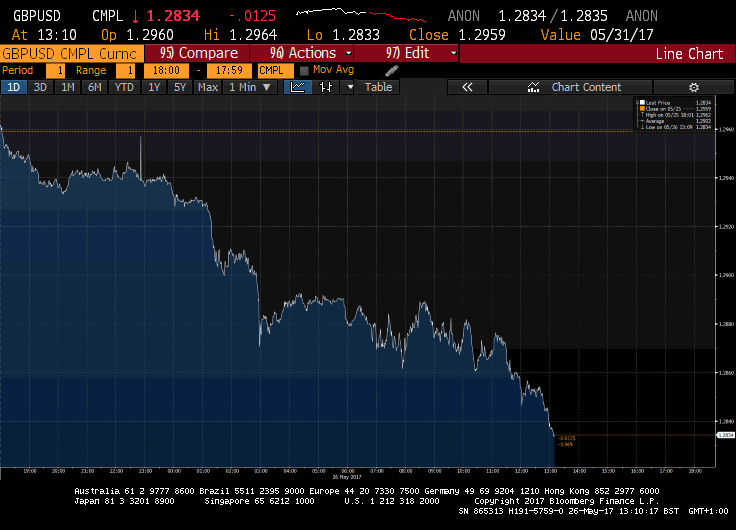

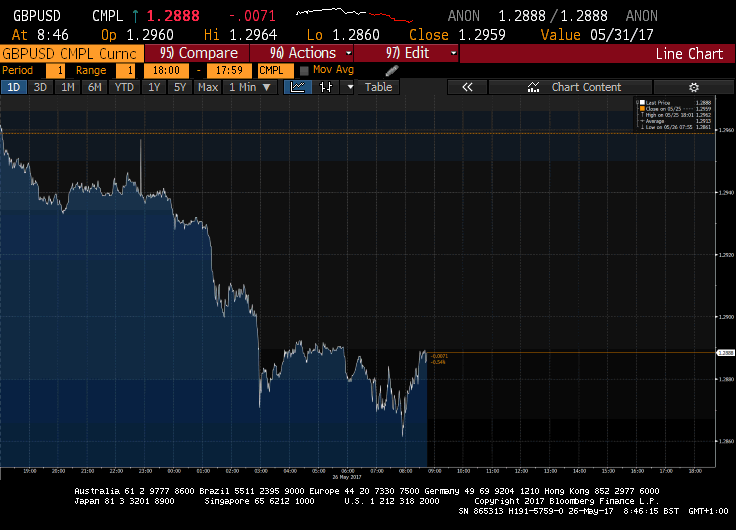

Pound slumps to one-month low against US dollar

The pound has extended its losses against the dollar this afternoon to hit a one-month low.

It is now trading down 1.1pc at $1.2812 against the US dollar as election jitters wreak havoc on investor sentiment.

Intertek cashes in as companies look for help testing their products

Shares in Intertek have dipped 0.6pc to £42.92 this afternoon despite reporting a 14.2pc rise in revenue for the four months to April 30. Rhiannon Bury reports:

Intertek, which tests and certifies products such as mining equipment and food, has grown revenues in the first four months of the year to £882.5m.

The company said it was on course to hit its 2017 targets after revenues rose 14.2pc, or 1.8pc if currency effects are stripped out.

The firm’s products and trade divisions, which make up more than 90pc of the business, grew by 5.5pc thanks to new contract wins.

However, revenues for the resources arm, which provides services to oil and gas and mining firms, dropped 15.4pc. This was a result of a “lower volume of investments in exploration activities from [its] clients,” Intertek said, as well as price pressures in the industry.

Legal & General to move some operations to Ireland post-Brexit

British insurer Legal & General will move some of its investment management operations to Ireland as part of its strategy to ensure it can continue to serve its customers after Brexit, it said on Friday.

In a win for Dublin's campaign to attract firms in the wake of Brexit, L&G's asset management division, Legal & General Investment Management (LGIM), will move the operations subject to regulatory approval.

IDA Ireland welcomes Legal & General Investment Management's decision to choose Ireland for part of its operations. https://t.co/olS4qABooV

— RTÉ Business (@RTEbusiness) May 26, 2017

It said it foresaw no impact on operations and staff in other LGIM locations. LGIM is one of the biggest investors in the UK stock market.

"This is yet another very important signal to the market that financial services companies can come to Ireland quickly and service their European customers, with minimum disruption to their business," Martin Shanahan, the head of the Irish state agency that attracts foreign investment, said in a statement.

Report from Reuters

Sterling extends losses as Conservatives lead shrinks

The pound has extended its loss this afternoon, hitting a three-week low against the US dollar, after the first opinion poll in days showed Prime Minister Theresa May's lead down to just 5 percentage points over the opposition Labour Party.

Currency markets have assumed May's party will win handsomely at the election on June 8.

However, today it came under pressure. The local currency is now down 0.95pc on the day at $1.2835 against the US dollar.

FXTM Research Analyst Lukman Otunuga said: "The threat of Theresa May failing to secure a landslide election victory should weigh heavy on Sterling moving forward as anxiety heightens over her ability to strengthen her hand in the Brexit negotiations. With political uncertainty likely to heighten ahead of the UK general election on June 8, Sterling could become even more attractive to bears."

Sales slip at Restaurant Group amid turnaround plan

Shares in Restaurant Group rallied 10pc today after an upbeat trading update. Rhiannon Bury reports:

Restaurant Group has reported another period of declining sales as the firm pushes ahead with plans to revitalise the business.

The parent company of high streets brands such as Frankie & Benny’s and Chiquito said sales in the 20 weeks to May 21 had fallen 1.8pc on a like-for-like basis, despite good weather driving more people to its pubs.

New chief executive Andy McCue, who joined Restaurant Group from bookmaker Paddy Power in September, has made price cuts and simplified menus as he seeks to lure customers back to the struggle chains.

And despite the dropping sales, the business said it was on track to deliver profits for the full year in line with expectations.

Shares in the company opened 10.59pc higher on Friday, at 351p.

Half-time update: European shares dragged lower by banks

European shares were dragged lower this afternoon by banking stocks, while the FTSE 100 remains in positive territory after touching a fresh record higher earlier today.

Here's the current state of play:

FTSE 100: +0.03pc

DAX: -0.7pc

CAC 40: -0.99pc

IBEX: -1.2pc

Mike van Dulken, of Accendo Markets, said: "Equity remain mixed into the week-end, the UK's FTSE once again the lone gainer. This comes by way of a narrowing in the UK election race pushing GBP lower for a welcome translational boost. This helps offset an OPEC-inspired oil price sell-off, odd lessons in diplomacy from Trump, as well as Europe-wide banking sector weakness on political concerns that sees the German DAX underperform. The FTSE 100 is buoyed by Pharma (broker upgrade on GSK; weaker GBP), BATS & ULVR (weaker GBP), WPP (Blackrock using big data for ad targeting) as well as RIO (oil) and BT."

Alfa Financial Software makes a splash in London's biggest float of the year

The biggest flotation on the London stock market this year is set to bag its two most senior executives millions.

Alfa Financial Software is not only the biggest UK listing of 2017 so far but is also the largest technology initial public offering in London since cyber security firm Sophos sold shares in a deal that valued it at £1bn two years ago.

The two executives behind Alfa will net £254m after the systems supplier to the motor financing industry was valued at almost £1bn.

Andrew Page, the executive chairman and co-founder of the company, will take home about £230m because he is the majority shareholder and Andrew Denton, its chief executive, will receive the remainder.

It comes after the software supplier priced its shares at 325p a piece in its IPO, giving it a market capitalisation of £975m and making it eligible to enter the FTSE 250 index.

Alfa shares leapt by almost 31pc following their debut this morning, a surge that meant its market value swelled to about £1.2bn.

Read the full story by Ben Martin here

Oil edges up after dip on disappointing OPEC meeting outcome

Oil prices edged higher this morning as some investors were tempted back to a market that tumbled five percent in the previous session on disappointment that an OPEC-led decision to extend current production curbs did not go deeper.

At Thursday's meeting in Vienna, the Organization of the Petroleum Exporting Countries and some non-OPEC producers agreed to extend a pledge to cut around 1.8m barrels per day (bpd) until the end of the first quarter of 2018. The initial agreement would have expired next month.

Producers are confident of this plan bringing down crude oil stocks to their five-year average of 2.7bn barrels but oil investors had hoped for a last-minute agreement on more far-reaching action.

OPEC still has challenges to tackle, Goldman says after doubts about extension of oil cuts https://t.co/5OSaDIwyzWpic.twitter.com/G3BbdPfRyE

— Bloomberg (@business) May 26, 2017

"The problem is that investors look at impact today, while OPEC focuses on reaching stability in the coming 6-9 months, so the long squeeze yesterday was overdone a bit," said Hans van Cleef, senior energy economist at ABN Amro.

Clawing back some of Thursday's losses, global benchmark Brent futures LCOc1 were up 28 cents at $51.74 a barrel this morning.

U.S. West Texas Intermediate (WTI) crude futures CLc1 remained below $50, at $49.11, though up 21 cents from their last close.

"The front of the curve declined the most, which at least for now implies that the market doesn't quite believe that a tightening and/or backwardation is really coming," said analysts at JBC Energy.

Report from Reuters

General Election is the most powerful driver behind sterling, says RationalFX

Given the pound's stability in the wake of the Manchester terror attack earlier this week and disappointing economic data, Paresh Davdra, CEO and Co-Founder of RationalFX, said it is clear that the election is the most powerful driver behind the UK’s currency.

He added: "The next two weeks could see more volatility for sterling as polling figures in the run up to the election become more frequent. Analysts will be looking for any definitive signs that the Conservatives can win the election before the pound can consistently return to the levels seen recently.”

This is what the size of Theresa May's majority will mean for the pound

Here's a great graphic from Bloomberg explaining what the size of Theresa May's majority will mean for the pound:

This is what the size of Theresa May's majority will mean for the pound https://t.co/0oyr2hEhJapic.twitter.com/xRseUP4oJM

— Bloomberg Brexit (@Brexit) May 25, 2017

London bolstered as sterling slumps

The FTSE 100 and FTSE 250 have set new record peaks this morning as European markets come under pressure.

The German DAX is off by 0.32pc, the CAC in Paris has lost 0.63pc and the Spanish IBEX is down 0.76pc.

Chris Beauchamp, of IG, said: "Investors have been unsettled by the all-to-predictable end to the OPEC meeting yesterday; buck-passing was the main skill in evidence, as the cartel opted merely to extend its production cuts in time, but not in scope. Oil has fallen sharply as a result, and today’s dead cat bounce is not likely to last. On a day bereft of big news all that investors have to focus on is the G7, but this is mainly down to the hope that Donald Trump will engage in some more handshake wars with his fellow leaders."

Euro jumps against the pound on election jitters

#Euro jumps vs Pound to the highest since Mar on UK election jitters as Tory lead over Labour keeps shrinking. pic.twitter.com/56YIg46cBK

— Holger Zschaepitz (@Schuldensuehner) May 26, 2017

FTSE 250's rise between 19,000-20,000 takes less than three months

It's only taken the FTSE 250 less than three months to make the 1,000 point climb from 19,000 to 20,000.

The mid-cap index broke 19,000 on March 3 and today it broke 20,000 for the first time ever, hitting a new all-time high of 20,020.07.

It's previous 1,000 point climb took almost two years, May 2015 - March 2017.

FTSE 250 scales new peaks

It's not just the FTSE 100 hitting new highs this morning, the mid-cap index has also charged to a new record peak.

It climbed by as much as 52.49 points, or 0.26pc, to 20,020.07 this morning, surpassing its previous all-time high of 19,994.34.

Pound could extend losses in short-term if election wobbles persist

With the pound floundering at a two-week low against the US dollar after the latest YouGov poll showed the Conservatives' lead is down to just 5 percentage points over the opposition Labour Party, Michael Hewson, of CMC Markets, reckons a move below $1.2840 could well see further losses towards the $1.2750 area in the short-term if the election wobbles don't stabilise.

He added: "The recent sterling losses do appear to reflect some signs that the recent optimism around sterling’s recent rally is giving way to increased nervousness, about the UK’s ability to agree any sort of Brexit deal, when none of the parties appears to have either a coherent plan for a post Brexit Britain, or any vision of a coherent leadership.

Pound falls after poll suggests Theresa May's lead has narrowed to 5 percentage points https://t.co/Qmtp3RoKRZpic.twitter.com/e4ye7XaD9n

— Bloomberg Brexit (@Brexit) May 26, 2017

"Theresa May still remains the favourite to win on June 8th, but recent events have taken their toll, which means the Conservatives need to get their act together, otherwise the perception will be that any win on June 8th is likely to be down to the poor quality of the opposition, and not a vote of confidence in her. That’s not a particularly healthy state of affairs to be in at a time when Brexit talks are due to start at the end of next month."

Europe's Stoxx 600 hits day's low as oil stocks weigh

Europe's Stoxx 600 hits day's low as banks and energy stocks lead the index lower.

Energy stocks were among the biggest fallers in the region after Opec extended output cuts but disappointed investors who were betting on deeper supply cuts.

It is currently down 0.35pc at 390.78.

A confused pound

Jeremy Cook, of World First, reckons the move to push sterling lower is "an interesting one".

He explains: "The move in sterling following the announcement of a general election was broadly positive and centred, we think erroneously, on the belief that a larger mandate for Theresa May increases the chances of a ‘softer Brexit’. The Labour party, under Jeremy Corbyn, voted with the Conservatives to trigger Article 50 and start the clock on Brexit and noted in their manifesto that they would end the free movement of people that is integral to membership of the single market. It therefore stands to reason that the fall in sterling is not about Brexit per se, but more about the increased odds of a hung parliament or a slimmer than previous Tory majority."

However, Mr Cook flags that this is only one poll.

"It will likely mean an increase in campaigning and a few more nerves on the night of the vote which is less than a fortnight away now," he concludes.

Corbyn gains, pound pains - World First Morning Update May 26th - https://t.co/8UfAvdWYBfpic.twitter.com/vvHBFfiU8N

— World First (@World_First) May 26, 2017

FTSE 100 hits new record high

Boom! The FTSE 100 has just set a new record high.

It touched 7,534.45, surpassing its previous record high of 7,533.70 which it set on May 16.

MUFG: Poll jitters undermine the pound

We have learnt from years of experience in the markets to be always wary of very strong consensuses, says Derek Halpenny, European Head of Global Markets Research at MUFG.

He added: "Perhaps one of the strongest consensus in the market at present is that PM May will win a strong mandate in the general election on 8th June by increasing significantly her current working majority in parliament of just 17. Not so fast!

"A YouGov/Times opinion poll published today shows a notable narrowing in the lead for the Conservatives, from 9ppts to now just 5ppts with the Conservatives on 43pc and Labour on 38pc. That’s the smallest lead for the government since April 2016 when Cameron was PM. The 38pc total for Labour is the best since October 2014."

Mr Halpenny points out that the latest poll has the potential to prompt some further pound selling over the short-term.

He said: "The consensus of a clear victory for PM May has been very strong and that in itself might be enough for further weakness over the shortterm. However, we are very sceptical of the idea that Labour will scupper the government from increasing its majority. You may recall the polling data for the 2015 general election were nearly all signalling Labour winning a majority of seats that implied another hung parliament. The popularity of the party leader is always important as was shown in 2015 and on that point PM May is so far ahead of Jeremy Corbyn that we suspect this bounce in the polls will either fade quickly or prove once again to be entirely inaccurate!

"Any pound depreciation on this issue is unlikely to last!"

FTSE 100 flirts with record highs

The pound weakness is propelling the FTSE 100 back towards record highs.

With 60pc of FTSE 100 revenues coming from outside the UK, Sterling weakness tends to boost the UK’s relative performance.

As a result, the blue chip index has gained 10.35 points, or 0.14pc, to 7,527.58 - just shy of an all-time record high of 5,733.70.

Why has sterling tumbled

Connor Campbell, of SpreadEx, explains why the pound has suffered a sharp fall this morning:

"The latest election poll, conducted by YouGov for The Times, has seen the Tories’ lead slashed to just 5 points, with Labour continuing to mount a post-manifesto release comeback.

"Any growth managed by sterling since April has largely been predicated on the assumption that the Conservatives would secure a landslide victory. That this presently doesn’t seem to be the case has helped further erode confidence in the currency’s current position."

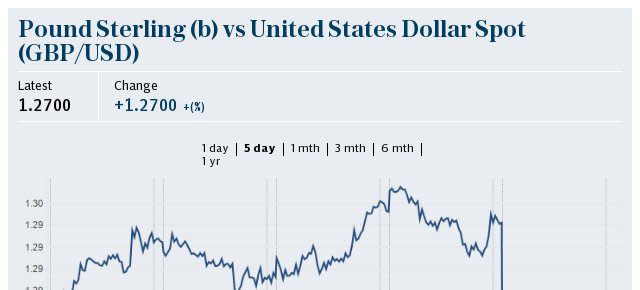

Pound flounders at two-week low against dollar, two-month low against euro

The pound tumbled to its lowest level in two this morning after a poll showed that the Conservatives' lead had narrowed sharply ahead of next month's general election.

According to the YouGov poll published late on Thursday, the first since a suicide bombing killed 22 people in Manchester, May's party was on 43 percent, down 1 percentage point compared to a week ago, while Labour was up 3 points on 38pc.

Exclusive: Tory lead over Labour down to FIVE points in new YouGov/Times poll conducted Wed/ Thu this week, down from 9 points last Thur/Fri pic.twitter.com/sNIkbnspqd

— Sam Coates Times (@SamCoatesTimes) May 25, 2017

The pound fell by as much as 0.76pc to $1.2860 against the US dollar, marking its lowest level since May 12.

Against the euro, the pound fell by as much as 0.67pc to €1.1474, its lowest level since March 29.

Polls had put May's Conservatives on course for a big victory after she called the snap election in April but her lead slipped in the days before the attack after both sides published their election manifestos.

General Election 2017: Latest news, polls and analysis

Our political correspondent Jack Maidment is tracking the latest news, polls and analysis on the General Election campaign:

Jeremy Corbyn will today link Britain's involvement in military action abroad to terrorist attacks such as the Manchester suicide bomb as General Election campaigning formally gets back underway.

National campaigning has been suspended since the terror attack which cost the lives of 22 people and Mr Corbyn will deliver a speech in London in which he will point to "the connections between wars the Government has supported or fought in other countries and terrorism here at home".

Mr Corbyn’s speech comes after a poll showed that Labour had cut the Conservatives’ lead to just five points.

Elsewhere, Theresa May will today urge her G7 partners at a summit in Sicily to bring Facebook and other online companies to book as she warns that the fight against terror is moving “from the battlefield to the internet".

Head over to our live politics blog for more: General Election 2017: Latest news, polls and analysis

FTSE 100 outperforms its European peers as sterling slides

European shares fell in early trade, while the FTSE 100 crawled higher after the pound slumped to a two-week low.

The pound came under pressure after the latest YouGov poll showed the Conservatives' lead has narrowed ahead of next month's election.

Here's a snapshot of the current state of play:

Mike van Dulken, of Accendo Markets, said: "A flat opening call comes after more record highs on Wall St and despite a negative session to close the weak in Asia. The FTSE outperforms peers thanks to overnight GBP weakness that helps offset oil prices -6% as traders are left underwhelmed by the OPEC decision.

"The negative oil reaction to a 9-month OPEC production cut extension is a prime example of ‘buy the rumour, sell the fact’. With nine months having become the baseline - prices +17pc in the run-up, hoping for longer and maybe even deeper cuts - potential for an upside surprise was already limited."

Agenda: Pound skids to two-week low as Conservatives' lead narrows

Good morning and welcome to our live markets blog.

Oil prices are edging up this morning following yesterday's sharp fall after an OPEC agreement to extend cuts in crude production for a further nine months disappointed investors who had bet on bigger output cuts.

FINAL UPDATED: #OPEC extends cuts for 9 months to end glut -- but #oil plunges below $50 a barrel https://t.co/D2aYgteOL5#OOTT#SaudiArabiapic.twitter.com/XybKGUtbmT

— Javier Blas (@JavierBlas2) May 25, 2017

Overnight, China stocks reversed earlier losses to end the week in positive territory after a surprise rating downgrade by Moody's earlier in the week. For the week, CSI300 advanced 2.3pc, while the SSEC gained 0.6pc.

Good morning! Asia stocks edge lower as risk-off sentiment takes hold following plunge in #oil. Bond yields continue to drop. Pound slides. pic.twitter.com/v2JPJZbY03

— Holger Zschaepitz (@Schuldensuehner) May 26, 2017

On currency markets, the pound slipped to its lowest level in two weeks, after a YouGov poll showed Britain's opposition Labour Party had reduced the lead of Prime Minister May's Conservatives to five points, less than a fortnight before a national election.

Yesterday, the local currency suffered its biggest one-day slide in over three weeks following the release of the poll.

Only one poll etc, but at 38% Corbyn would secure Labour's 3rd biggest share of the vote in over 40 years, incl more than Blair's 2005 win. pic.twitter.com/rSnylZhtev

— Jamie McGeever (@ReutersJamie) May 26, 2017

Meanwhile, the economic and corporate calendar is relatively quiet as we head towards the bank holiday weekend:

Full-year results: Volvere

Interim results: IXICO

Trading update: Intertek Group, Spectris, Restaurant Group

AGM: The Restaurant Group, Circassia Pharmaceuticals, Spectris

Economics: Core durable goods orders m/m (US), preliminary GDP q/q (US), preliminary GDP price index q/q (US), durable goods orders m/m (US), revised UoM inflation expectations (US), revised UoM consumer sentiment (US)

Yahoo Finance

Yahoo Finance