Poundland could be sold off in £3.6bn deal

The parent company of Poundland could be sold off or floated in the coming months, according to multiple reports.

The Times reported on Friday that Pepkor Europe, the company that owns Poundland, met bankers to discuss a possible sale or initial public offering (IPO) of the business. It follows a similar report from South Africa’s Business Day earlier this month.

Pepkor Europe is owned by Steinhoff (SNH.DE), a South African retail group that has been struggling to recover from a €6bn (£5.5bn) accounting scandal. The group is now under the control of its creditors and seeking to offload assets in a bid to pay off its debts.

Steinhoff said in an investor presentation earlier this week that “divestments are being considered” but CEO Louis du Preez said no decision had been taken on the future of Pepkor.

READ MORE: Poundland to stop charging £1 for everything

A spokesperson for Steinhoff told Yahoo Finance UK: “We are currently evaluating all options but no decision has been made.”

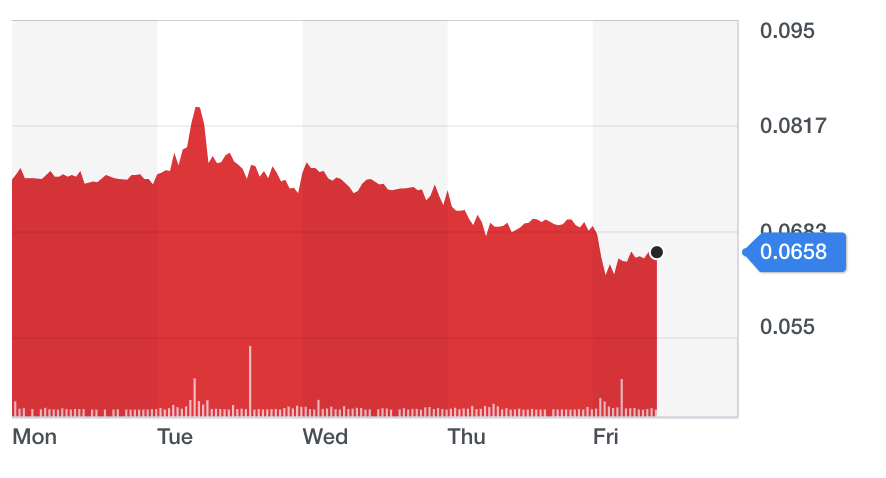

Shares in Steinhoff were down by 7% in Germany on Friday.

Steinhoff acquired Poundland for £610m in 2016 and combined it with its European discount chain Pepkor.

The Times said that Pepkor Europe recently refinances some debt as part of preparations for a transaction. The company could be valued at around €4bn in any deal. Business Day reported that Steinhoff is considering listing Pepkor in either London or Warsaw.

Pepkor, which also owns the Dealz chain, recently reported half-year sales up 13.3% to €1.7bn. Poundland accounted for €920m of the total.

Earlier this week, Poundland announced that it was relaxing its iconic pricing policy to include more items priced between 50p and £5. 75% of its products will still sell for £1, however.

Yahoo Finance

Yahoo Finance