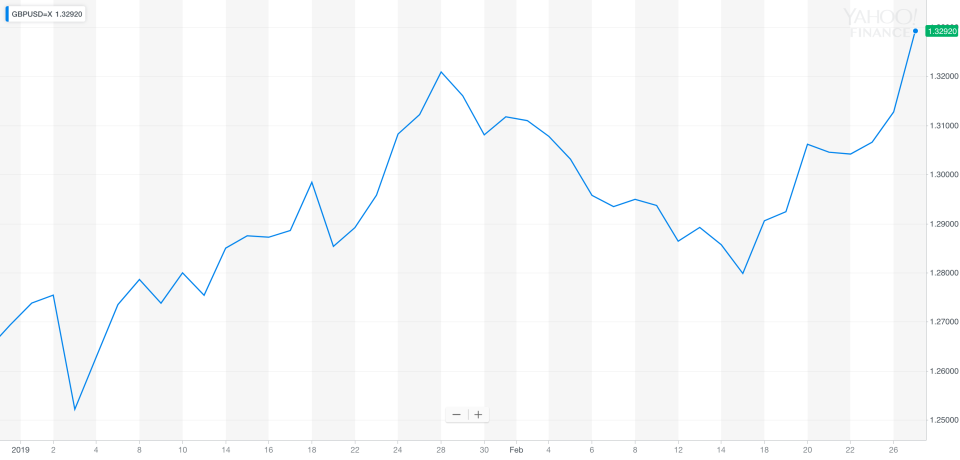

Pound's 5% rally of 2019 comes as no-deal Brexit risks ease

Traders are feeling much more upbeat about prospects for the pound these days as it looks increasingly likely that Brexit will be delayed and the risk of a messy no-deal Brexit will be taken off the table.

The pound (GBPUSD=X) has surged by 5% against the US dollar since the start of the year and is now trading at $1.33, its highest level since mid-2018.

Sterling has also jumped against the euro (GBPEUR=X) to trade near €1.17, its highest level since May 2017.

Fresh data from the Bank of England also showed that sterling on Wednesday rose to its strongest level in 10-months against a range of other international currencies.

All this enthusiasm is the result of the announcement by UK prime minister Theresa May on Tuesday that she will allow members of parliament (MPs) the chance to vote on delaying Brexit. And they’ll also get to vote on whether the country should avoid a chaotic no-deal departure from the European Union.

May’s decision to open up the possibility of delaying Brexit “came as a breath of fresh air for investors,” said Lukman Otunuga, a research analyst at the online broker FXTM.

But a continued upward trajectory is not a sure thing.

“While the pound is likely to extend gains amid the current optimism, the question if for how long? It is quite frightening how sensitive and explosively volatile the [currency] has become to Brexit headlines, and this is likely to intensify as the March 29 deadline looms,” said Otunuga.

Meanwhile, economists are warning that the latest moves by May could continue to hurt the British economy for months to come.

“Delaying the Brexit date without a proper resolution would merely extend the current uncertainty that is weighing heavily on domestic demand,” said Kallum Pickering, a senior economist at Berenberg bank.

Any rebound in the UK economy is now expected to be delayed until the back half of the year instead of the front half, Pickering said.

“This lowers our forecasts for UK real GDP to 1.4% from 1.7% in 2019,” he said.

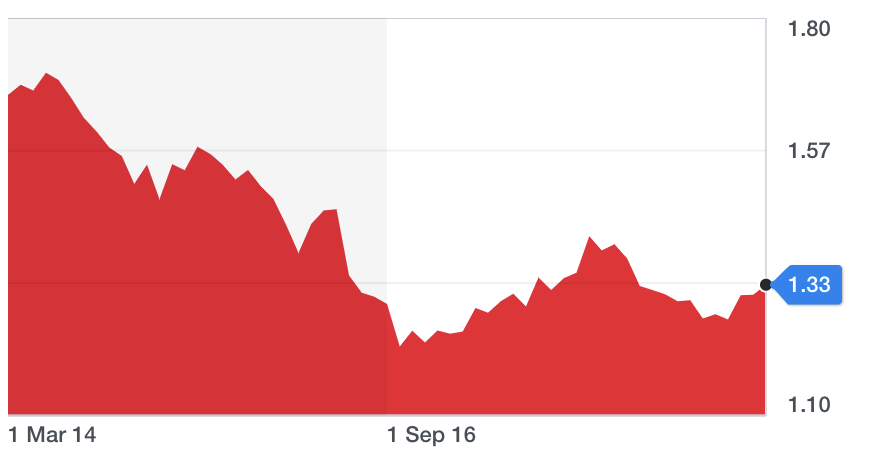

But sterling has a long way to go, if it is to recuperate from pre-referendum highs. It is still down over 20% against the US dollar from five years ago.

Yahoo Finance

Yahoo Finance