Premier League spending plummeted in shadow of stricter financial regulations

Premier League clubs’ spending in the most recent transfer was down to just £100m in total, as the spectre of penalties for financial regulations bites hard.

Clubs in England’s top football division were much more frugal due to a mixture of spending during the summer, and a number of harsh penalties dished out to offenders of strict spending rules in recent months.

This comes after Everton were docked 10 points for breaching spending rules last year, while Nottingham Forest were also fined for their spending habits, being dubbed the “poster boys for financial fair play.”

This week it was announced Everton will appeal their punishment, as the club slipped back into the relegation zone. Earlier in the month, it was reported the Premier League is considering scrapping the controversial Profit and Sustainability Rules which led to Everton being docked 10 points.

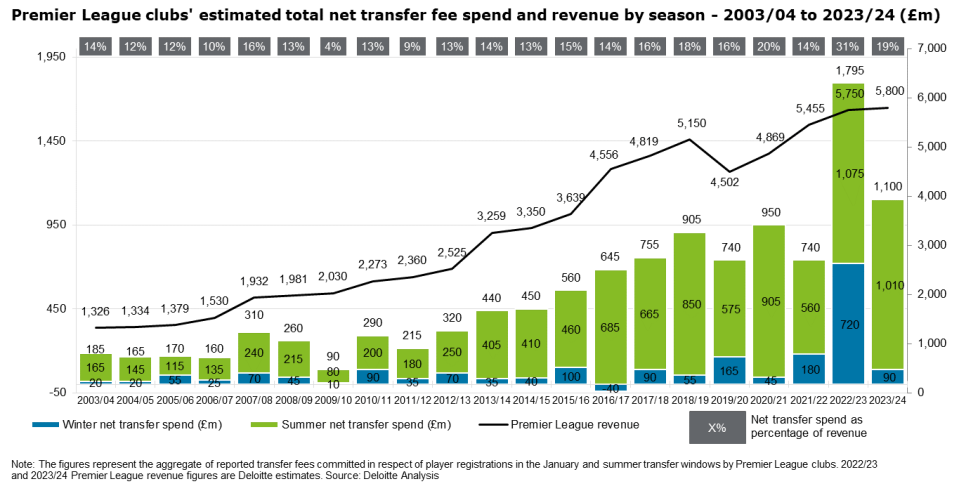

In the latest round of data published by Deloitte’s Sports Business Group, it was revealed the Premier League clubs’ gross spend was at £100m during the 2024 January transfer window.

This is a staggering £715m lower than the total spent in the 2023 January window (£815m), which was a record. The previous transfer window was largely driven by a spending spree by Chelsea, following the club’s purchase by US tycoon Todd Boehly.

Deloitte outlined that the total in this transfer window was the lowest, other than in January 2021, when activity was restricted due to the pandemic, and sat at just £60m. Aside from 2021, this marks the lowest Premier League gross transfer expenditure since January 2012, which was at £60m.

While the January window’s spend was low, overall clubs spent £2.5bn in the 2023/24 season, which is the second highest ever. The top figure was in 2022/23, at £2.7bn.

While Premier League spending took a major dent, across Europe’s other so-called ‘big five’ leagues, in Italy, Germany, France and Spain, splashing the Euros rose to €455m from €255m in January 2023.

Last week, it was also reported that Spanish giants Real Madrid have overtook Manchester City and regained the title of the world’s richest football club, according to Deloitte’s latest Football Money League.

The fresh data also showed the Premier League bucked some long-standing trends.

The January window was the first since 2019 in which the league did not have the highest expenditure in the world. It was also the first window since 2011, in which it was not the highest in Europe.

It also showed clubs at the top of the bottom of the Premier League were well short of previous levels. Just £2m was spent by three clubs in the relegation zone, compared to £130m from two of the three last January.

Only one of the top three teams in the table this January actually opened their wallet, spending £15m, compared to £110 last year.

The Women’s Super League (WSL) also experienced a dip, with a 14 per cent decline in transfer volumes last January, after the 2023/24 season saw 226 transfers, higher than the three previous seasons.

Tim Bridge, lead partner in Deloitte’s Sports Business Group, said: “After record-breaking spending in the last three transfer windows, Premier League clubs’ spending this January has been subdued.

“The more prudent approach is likely driven by the high level of spend invested during the summer window but may also have been influenced by a heightened awareness of the Premier League’s financial regulations and the potential repercussions of non-compliance.

“Securing the highest quality player talent remains pivotal for Premier League clubs, but we’ve seen in this window that retention has been of higher priority than attraction.”

Ligue 1 clubs had the most with €190m, an increase of €65m (53 per cent), while Serie A (€75m: 256 per cent), La Liga (€45m: 120 per cent) and the Bundesliga (€15m: 21 per cent) were also up.

Calum Ross, assistant director in Deloitte’s Sports Business Group, said: “The domino effect created by high-value transfers and a desire to improve on-pitch performance ahead of the final part of the season are usually key drivers of transfer spending, but this hasn’t been reflected in January’s subdued transfer window.

“As we move towards this summer’s window, and a new financial year, we expect to see spending return to similar levels we have seen in the last two record-breaking summer transfer windows.”

In the WSL, 44 transfers took place in January, with the volume down by 14 per cent on last year’s winter spending window.

In total of 226 transfers took place across the WSL in the 2023/2024 season, up from 196 in 2022/23, 215 in 2021/2022 and 179 in 2020/21.

Amy Clarke, women’s sport lead in Deloitte’s Sports Business Group, said: “The fact we are seeing WSL clubs acquire talent from a broader range of leagues, as well as a growing number of WSL players moving to play further afield, demonstrates the increasing globalisation of the women’s football market.

“This widening talent pathway is a positive indicator of the increased professionalisation of the women’s game.”

Yahoo Finance

Yahoo Finance