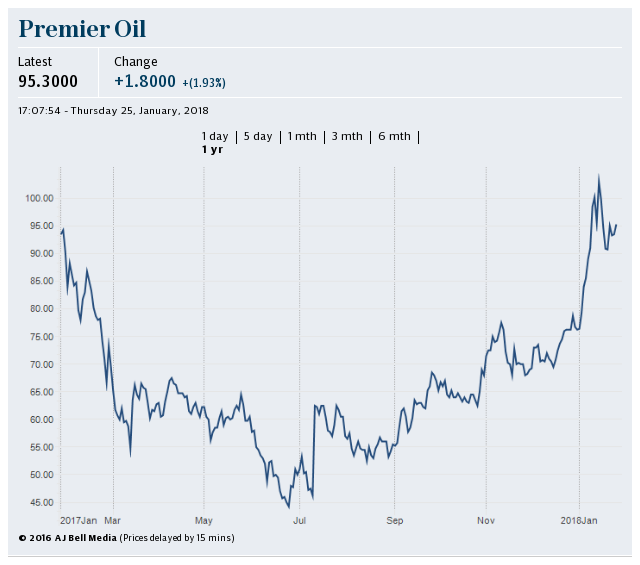

Premier Oil profits surge ahead of North Sea cash deluge

Premier Oil more than doubled its profits despite producing less oil and gas in the first half of this year as it prepares for a flood of cash into the business.

The oil market recovery helped the North Sea producer to a post-tax profit of $98.4m (£76.6m) compared to $40.7m in the first half of last year, even as production fell to an average of 76,200 barrels a day from 82,100 barrels.

Premier ramped up production from its Catcher oil project in the North Sea which is expected to open the floodgates of cash flow into the business to help to reduce its debt burden.

The lynchpin project is crucial for Premier, which hopes to slash between $300m to $400m of net debt from its balance sheet this year.

Tony Durrant, Premier’s chief executive, said it cut just $70m in the first six months of the year but that the next second months will bring a turnaround.

Premier’s cash flow dipped to $276.6m from $282.7m, in part because its production rates were lower but also because it hedged its production around a year in advance, when market prices were lower.

“At Catcher we were only shipping around one cargo a month, and now we’re at four,” said Mr Durrant of the lag between rising production and higher cash flows.

“We were always going to be weighted towards the second half of the year,” he said, and added that Premier is “very much on track” to cut meet its debt cutting targets.

In recent weeks Premier’s average production rate climbed to more than 86,000 barrels a day, and over the year as a whole the daily rate is likely to average 80,000 to 85,000 barrels.

At higher oil prices the extra barrels are likely to generate between $200m and $300m of cash for the business. Meanwhile, a convertible bond will release another $150m to help pay down the debt.

Earlier this week Premier set out its plans to keep its growth momentum running by agreeing to move forward with its Tolmount project in the southern North Sea.

Mr Durrant said the “high return” project marks “a major milestone for Premier and underpins our medium term UK production”.

“Tolmount is one of the largest undeveloped gas discoveries in the Southern North Sea and is, in barrel of oil equivalent terms, similar in size to our Catcher project. We have also secured an innovative financing structure for the project which minimises our capital expenditure whilst maintaining our exposure to the upside in the Greater Tolmount Area,” he said.

Yahoo Finance

Yahoo Finance