Premium Bonds for children: benefits and how to buy

Premium Bonds have long been extremely popular with UK savers – with many parents, grandparents and other relatives opting to purchase them for young children in the family.

They were introduced in 1956 and currently, a huge £123bn is held in these accounts.

Unlike conventional savings accounts, the bonds do not pay interest. Instead, each £1 is entered into a monthly prize draw for a chance to win tax-free prizes ranging from £25 to £1m.

(If you’re lucky enough to bag the jackpot, you’ll get a visit in person from Agent Million who will turn up to tell you the good news).

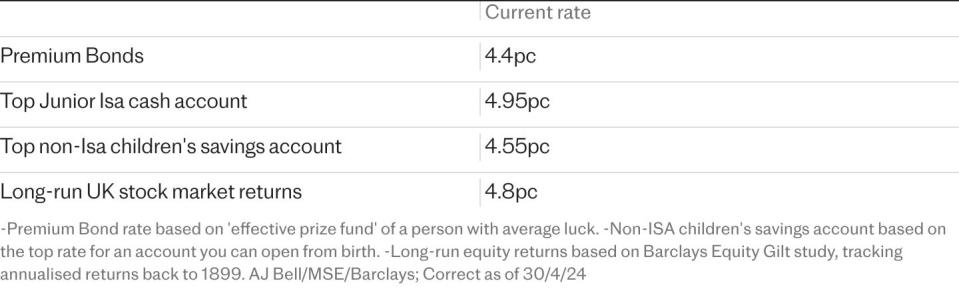

Premium Bonds don’t pay interest as such, but have what is called the “prize fund rate” – an indication of the sort of return you could expect to get if you have “average luck”. This currently stands at 4.4pc, but the rate can change (and does frequently).

National Savings & Investments (NS&I), which runs the Premium Bonds draw, is an arm of the Government. The money raised through its various products are used by the state as a form of funding. The rate offered by NS&I accounts changes based on market conditions and what fund-raising targets the government sets.

While you might like the idea of taking a flutter on these bonds on behalf of a child, it’s important to go in with your eyes open. Here we take a closer look.

What are the rules on buying Premium Bonds for your children?

Anyone can purchase bonds for a child under 16. You just need to open an account, much like a bank account, with NS&I either online or by post.

Laura Suter, director of personal finance at AJ Bell, said: “Setting your child up with Premium Bonds is relatively easy. The minimum is £25 and you can save all the way up to £50,000 per child.”

The key thing you need to know is that the investment must be looked after by a parent or guardian.

NS&I will need to contact that person directly to ask for proof of ID and address. All correspondence and confirmation about transactions or prizes will be sent to the parent or guardian until the child turns 16.

Managing your child’s Premium Bonds

It’s simple to manage your child’s bonds. You can do this online or over the phone. You can pay money in and will be notified of any prize winnings. You can also check online here.

You are able to cash in the bonds at any time without penalty.

Once the child turns 16, they can then access and manage the bonds for themselves.

Benefits of Premium Bonds for children

If you’re looking to save money for a little one in a “safe” way, Premium Bonds can seem appealing, as they are government-backed. This makes them a very secure investment, with the added bonus that they might make your child or grandchild a millionaire.

At the same time, as the prizes are tax-free, you get to keep 100pc of your winnings – if you’re lucky enough to win, that is.

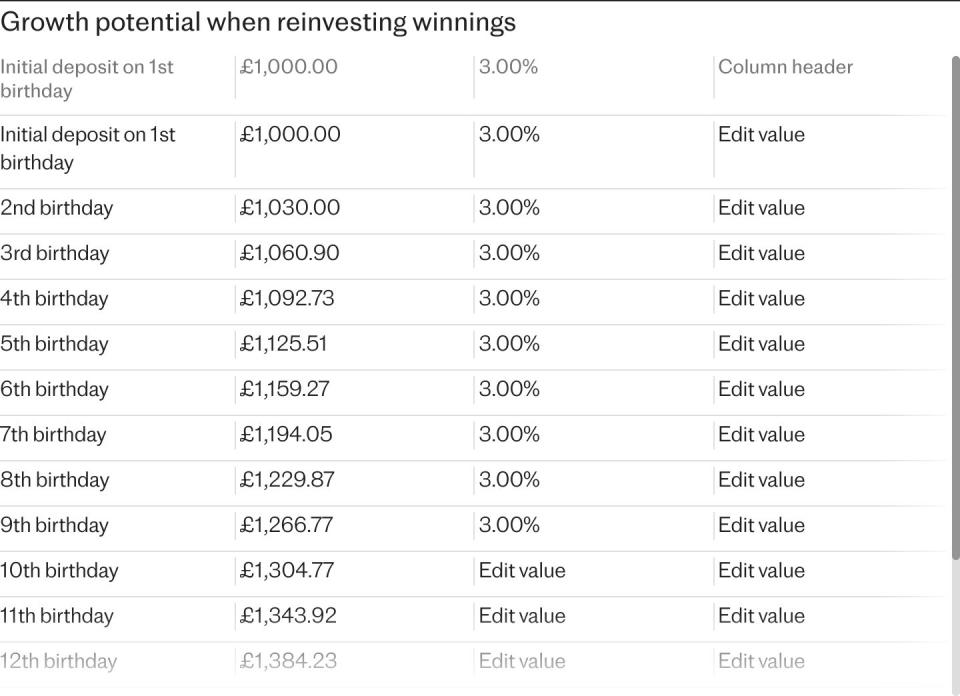

If you bought £1,000 of Premium Bonds for your child on their first birthday and reinvested all of their winnings until they were 16, they could end up with a pot of £1,558 by the time they turn 16, according to Anna Bowes from Savings Champion.

This is based on a fixed prize fund rate of 3pc and the person purchasing the bonds having average luck.

How to buy Premium Bonds for your children

Parents, grandparents and other family members can buy bonds for under-16s, starting from as little as £25, and ranging up to as much as £50,000. The child’s parent or guardian must be nominated to hold them until they turn 16.

Bonds will usually need to be held for a full month before they’re eligible for the monthly draw.

Risks and considerations

While Premium Bonds can be a safe and fun way to save for a child, the issue is, they don’t pay interest – and the odds of winning a big prize are quite slim.

There’s also the chance the bonds will earn nothing at all, meaning your son or daughter won’t get any return on their money.

Anna Bowes, from Savings Champion, said: “The key risk is you never win any prizes, and there are plenty of people for whom this is true.”

There are ways you can improve your chances.

Ms Bowes added: “Although each £1 bond has the same chance to win a prize – the odds are 21,000 to one – if you have many more £1 bonds to enter into the draw, the chance of winning something increases.”

That said, as you don’t get any interest, the money you’ve slotted away can quickly lose value if you don’t bag enough prizes to counter inflation.

Ms Suter said: “With inflation having been high that means the spending power of your cash will be eroded year on year. This is particularly the case if the bonds are held for a long time.”

Given that rates on standard savings accounts are now a lot higher than they were a year ago, you need to think carefully before ploughing too much money into Premium Bonds.

So should I buy them for my children – or not?

Ultimately, the decision as to whether or not to purchase Premium Bonds for a child is down to personal choice.

Ms Bowes said: “It’s best to assume you’ll never win one of the big prizes – and there’s always the possibility you won’t win anything at all. But you just never know, which is why the bonds remain so popular.”

The bottom line is that for some people, it’s still the thrill of what could happen which keeps them invested.

Ms Bowes added: “What you need to consider is how important it is if you were to miss out on the interest you could earn elsewhere if you win no prizes.

“With interest rates as they currently stand, someone with a holding of £1,000 could be missing out on earning £50 a year gross before tax in one of the top dedicated children’s easy-access accounts currently available.”

Ultimately, the decision about whether to buy bonds for a little one comes down to how lucky you think you will be.

Yahoo Finance

Yahoo Finance