Pressure mounts on GlaxoSmithKline to pursue break-up

Britain's largest drugmaker GlaxoSmithKline is thought to be considering a break-up after facing pressure from some of its shareholders to focus on its pharmaceuticals operations.

GSK said questions were being raised by some of its shareholders over the structure of the group, ahead of its pharma R&D update and second quarter results next Wednesday, and said it was listening to what those shareholders had to say.

"Our No.1 priority for the group is improving performance in the pharmaceutical business, especially pharma R&D and next week we will set out our new approach to R&D," a spokesman said.

"We believe the 3-business structure of the group offers significant opportunities in the current healthcare environment and provides the group with more stability to our earnings and helps in free cash flow generation. But as we have consistently said this is subject to each business continuing to perform competitively and having access to capital."

Although pharma is the largest of the divisions, accounting for more than 50pc of revenue last year and dwarfing consumer health, at 25pc, and vaccines, at 17pc, revenue growth in the unit has stuttered.

For the first three months of the year, pharma sales were up 2pc at constant currency, having dipped in Europe and coming in much lower than vaccines at 13pc.

Emma Walmsley, who joined in September 2016, has taken steps to attempt to revive its fortunes, making a number of senior hires in the unit.

Speaking to The Financial Times, which first reported on the investor discussions, several top-ten shareholders urged a shake-up of operations, with one saying: "The logic of [splitting] the business is pretty clear . . . The financial dynamics of consumer and pharma are pretty different.”

Another told the newspaper: "It has been a question on the table for a long time. We have been asking ‘what are you? Are you pharma? Are you consumer goods’? Emma came in with a fresh pair of eyes — there is potential for thinking that [a spin-off] would make sense."

GSK has for years faced pressure to spin off the consumer healthcare business, although the chances of this happening had appeared less likely after it appointed Ms Walmsley to the top position in September 2016, given her background in consumer health.

At the time, Royal London Asset Management, one of the pharma giant’s top 30 investors, had said: “Choosing Emma Walmsley suggests a strategy of evolution rather than revolution. A big change in the firm’s corporate structure is less likely.”

However, she has stressed pharma is her "main priority", and has said she is seeking to put "science very much at the core of our business and prioritise the strengthening of the pharma pipeline".

GSK earlier this year, bought out its Swiss rival Novartis' stake in its consumer healthcare business in a $13bn (£9.2bn) deal, which would make it easier to spin off from the business.

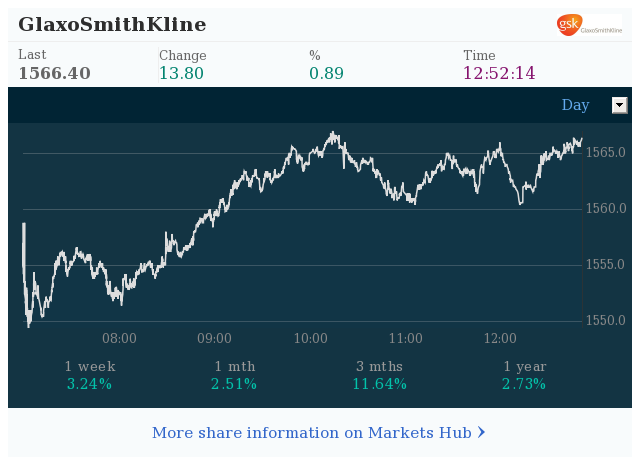

Yahoo Finance

Yahoo Finance