Previewing Burlington's and Nordstrom's Upcoming Earnings

Earnings season continues to chug along, with an extensive list of companies pulling the curtain back and unveiling what’s transpired behind the scenes.

Now, Nordstrom JWN and Burlington Stores BURL are slated to do the same. Both companies will reveal their quarterly results on March 2nd.

How do the companies stack up heading into the releases? We can use results from a peer, The TJX Companies TJX, as a small gauge. Let’s take a closer look.

The TJX Companies

TJX posted somewhat mixed quarterly results, precisely meeting the $0.89 Zacks Consensus EPS Estimate and growing 14% year-over-year.

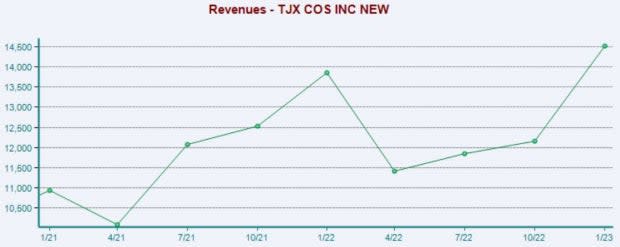

Quarterly revenue totaled $14.5 billion, nearly 3% ahead of expectations and growing 5% year-over-year. Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

TJX’s U.S. comparable store sales grew 4% year-over-year, exceeding the company’s expectations. Further, strong sales within apparel and accessories categories helped comparable store sales at Marmaxx climb 7% from the year-ago quarter.

Additionally, operating cash flow totaled $3 billion, and the company returned roughly $791 million to shareholders.

And to top it off, the company announced a 13% increase to its quarterly cash dividend, payable in June 2023.

Now, onto JWN and BURL.

Nordstrom

Quarterly Estimates –

Analysts have been bearish for JWN’s quarter to be reported, with ten negative earnings estimate revisions coming in over the last several months. The Zacks Consensus EPS Estimate of $0.65 indicates a 47% Y/Y pullback in earnings.

Image Source: Zacks Investment Research

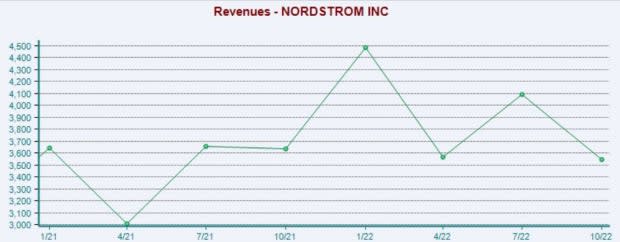

Our consensus revenue estimate stands at $4.3 billion, 4% lower than year-ago quarterly sales of $4.5 billion.

Quarterly Performance –

JWN has been on an impressive earnings streak as of late, exceeding both earnings and revenue estimates in four consecutive quarters.

The company delivered big in its latest release, penciling in a sizable 43% EPS beat and a positive 2% revenue surprise. Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

Burlington Stores

Quarterly Estimates –

Analysts have taken a bullish stance on the company’s outlook, with two positive earnings estimate revisions hitting the tape. The Zacks Consensus EPS Estimate of $2.72 suggests a 7.5% year-over-year uptick in earnings.

Image Source: Zacks Investment Research

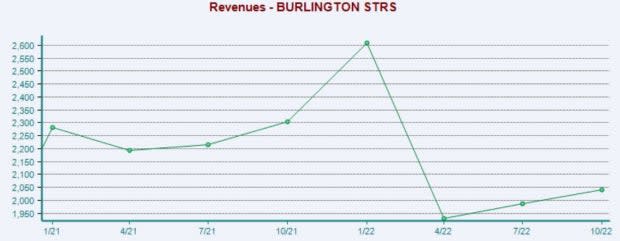

Further, the Zacks Consensus Sales Estimate of $2.6 billion for the quarter reflects a marginal 0.3% pullback in revenue year-over-year.

Quarterly Performance –

BURL has struggled to exceed quarterly estimates as of late, falling short of the Zacks Consensus EPS Estimate in three of its last four quarters.

Just in its latest release, Burlington reported bottom line results 17% under expectations and delivered a marginal revenue miss.

Image Source: Zacks Investment Research

Putting Everything Together

We’ve got just a few weeks left in earnings season.

Soon, we’ll hear from Nordstrom JWN and Burlington Stores BURL.

A peer, The TJX Companies TJX, already reported its quarterly results, with the company posting EPS in line with expectations but exceeding revenue forecasts.

Heading into their releases, Nordstrom is a Zacks Rank #5 (Strong Sell) and Burlington is a Zacks Rank #2 (Buy).

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The TJX Companies, Inc. (TJX) : Free Stock Analysis Report

Nordstrom, Inc. (JWN) : Free Stock Analysis Report

Burlington Stores, Inc. (BURL) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance