Pricesmart Inc (PSMT) Earnings Beat Estimates with Strong Q2 Performance

Earnings Per Share (EPS): PSMT reported $1.31 EPS for the quarter, surpassing the analyst estimate of $1.04.

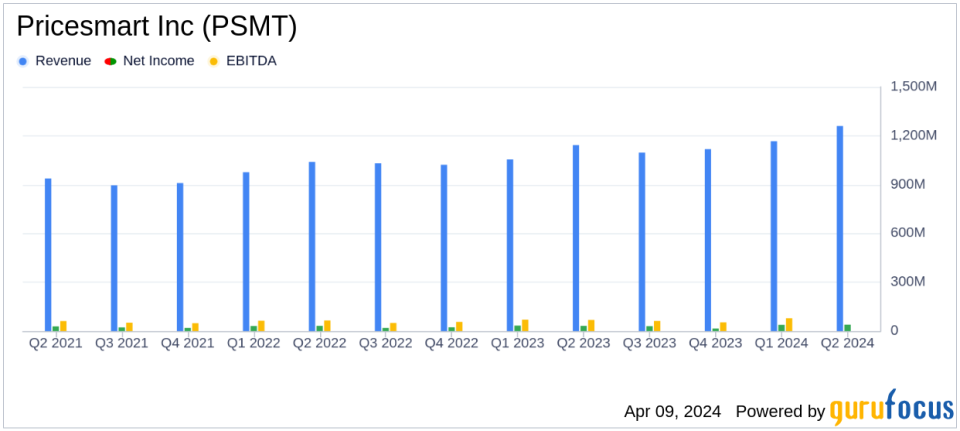

Revenue: The company's revenue reached $1.29 billion, a 13.1% increase, exceeding the estimated $1.20 billion.

Net Income: PSMT's net income rose 25.3% to $39.3 million, reflecting a strong financial position.

Comparable Net Merchandise Sales: An 8.8% increase in comparable net merchandise sales indicates robust same-store performance.

Special Dividend: PSMT announced a $1.00 per share special dividend, rewarding shareholders and signaling financial health.

New Warehouse Club: Plans for a ninth warehouse in Costa Rica demonstrate strategic growth initiatives.

On April 9, 2024, Pricesmart Inc (NASDAQ:PSMT) released its 8-K filing, announcing a robust performance for the fiscal second quarter of 2024. The company, known for its U.S.-style membership shopping warehouse clubs in Latin America and the Caribbean, reported a significant increase in both earnings per share (EPS) and revenue, surpassing analyst expectations. The reported EPS of $1.31 exceeded the estimated $1.04, while revenue climbed to $1.29 billion against an anticipated $1.20 billion.

Pricesmart Inc's strategic expansion is evident with plans to open its ninth warehouse club in Costa Rica, signaling confidence in its business model and growth trajectory. This move is part of the company's broader expansion efforts, which are essential in the Retail - Defensive industry to maintain competitive advantage and market share.

Financial Highlights and Company Growth

The company's net merchandise sales saw a 13.0% increase, reaching $1.26 billion, with constant currency sales up by 9.0%. This growth is attributed to both the opening of new warehouse clubs and an 8.8% increase in comparable net merchandise sales. The positive impact of foreign currency exchange rate fluctuations also contributed to the company's top-line growth.

Operating income for the quarter stood at $63.6 million, a notable improvement from $53.8 million in the prior year. The company's net income also saw a substantial rise, increasing 25.3% to $39.3 million. Adjusted EBITDA for the quarter was $84.1 million, up from $79.4 million in the same period last year, indicating a healthy earnings before interest, taxes, depreciation, and amortization margin.

Pricesmart Inc's financial achievements, including a 20.3% increase in net income to $77.3 million for the first six months of the fiscal year, are particularly important for a company in the competitive Retail - Defensive sector. These achievements not only demonstrate the company's ability to grow its bottom line but also its capacity to efficiently manage operations and costs.

Challenges and Market Position

Despite the strong performance, Pricesmart Inc faces challenges common to the retail industry, such as economic fluctuations, currency volatility, and competitive pressures. However, the company's robust financial results, including a strong balance sheet with $170.6 million in cash and cash equivalents, position it well to navigate these challenges.

The announcement of a $1.00 per share special dividend is a testament to Pricesmart Inc's financial stability and commitment to delivering shareholder value. This strategic financial decision underscores the company's prudent cash management and ability to generate excess cash flow.

As Pricesmart Inc continues to expand its footprint and adapt to market demands, its performance remains a key indicator of its resilience and strategic agility in the Retail - Defensive industry. With a focus on value and efficiency, PSMT is well-positioned to maintain its growth trajectory and continue delivering value to its shareholders.

For more detailed information on Pricesmart Inc's financial performance and strategic initiatives, investors and analysts are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from Pricesmart Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance