Pricey Beef Has Hog Farmers Betting Consumers Will Eat More Pork

(Bloomberg) -- American hog farmers are betting cash-strapped consumers will grill more pork and eat more pepperoni as beef prices surge, feeding a turnaround for an industry that’s been struggling for more than a year.

Most Read from Bloomberg

Southwest Plane Plunged Within 400 Feet of Ocean Near Hawaii

Wells Fargo Fires Over a Dozen for ‘Simulation of Keyboard Activity’

Bump Stock Ban Tossed Out by Supreme Court in Gun-Rights Win

Tesla Investors Get Behind Musk’s Fight for $56 Billion Pay Deal

The smallest US cattle herd since the 1950s is making beef too expensive for shoppers who have seen prices climb month after month and mostly exhausted savings from the pandemic. With a lot of pork to go around, producers are now banking on consumers ordering more sausage and pepperoni pizzas and on rising demand during the grilling season, with the July 4th holiday approaching.

Pork producers have been under pressure as meat demand hasn’t kept pace with supplies and higher crop prices made it more expensive to feed herds. Still, attendees at the World Pork Expo in Des Moines, Iowa, last week expect the industry’s fortunes to start turning, with more demand giving them the bump needed to further improve margins.

“I would ask that every American go out and buy as many pork chops as they can and share with their neighbors,” said Bryan Humphreys, chief executive officer of the National Pork Producers Council, a trade group representing hog farmers.

At the trade show, meat packers such as JBS SA grilled balsamic-drizzled pork skewers while Smithfield Foods Inc. served up a lunch of tacos al pastor along with live music. The event, which saw a 15% increase in attendance to more than 12,000 people, came as the industry is reaching an inflection point.

Hog producers are seeing the beginnings of a turnaround after a pork glut sent profits plunging over the past year. For operators who bulk up pigs from farrowing to slaughter weight, margins in April turned profitable for the first time in seven months, according to Iowa State University data. Helping the situation is improved demand that’s lifted how much meat packers are willing to pay for hogs.

Pork packers can make about $11 per hog, compared to losing about $21 per hog a year ago, according to HedgersEdge LLC.

However, other fixed costs such as labor, construction and machinery remain stubbornly high, limiting the potential for recovery. “Our fixed input cost per pig was around $40 about five or six years ago. Now we’re closer to $80,” said Humphreys, who grew up on a family pig farm.

Tyson Foods Inc., the biggest US meat company, decided earlier this year to close a pork plant in Iowa as it continues to streamline operations — a move that will limit slaughter capacity in the country. While its pork business has improved, the company’s margins are still relatively compressed.

Hormel Foods Corp., the maker of deli meats, warned in May that full-year pork input costs are expected to be above five-year averages. But Chief Executive Officer James Snee said earlier this month that the American consumer has been “incredibly resilient” and the company expects mid-single-digit growth for the balance of the year.

Easy Choice

Faced with the continuing pressures, the pork industry needs to find ways to increase demand to deplete supplies and sustain the recovery.

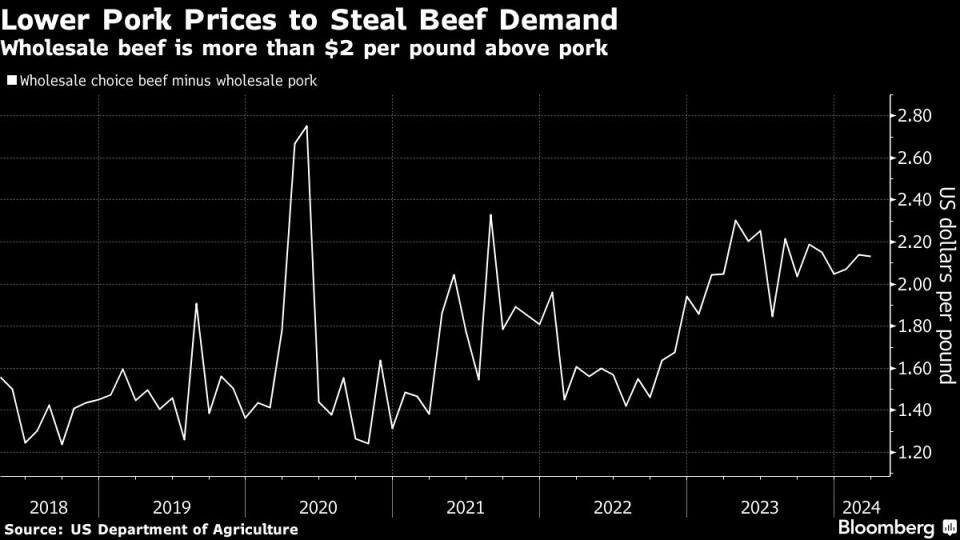

Cheaper pork will help. Wholesale beef is currently about $2 a pound more expensive than pork, creating an easy choice for consumers shopping for a bargain.

There are other positive signs, including demand for hams in Mexico. Record pork shipments to the US’s southern neighbor boosted overall American pork exports in April to $778.8 million, the third-highest ever, according to the US Meat Export Federation.

At home, analysts say more demand should come from pizzas topped with pepperoni or sausage — a favorite among consumers most sensitive to inflation and increasing debt levels.

“Every time that things get tough, people eat more pizza,” said Christine McCracken, senior animal protein analyst at Rabobank, an agricultural lender. Ground pork is also a “really tasty alternative” to ground beef, she added. “I think that is a huge area of growth for the industry.”

Most Read from Bloomberg Businessweek

Grieving Families Blame Panera’s Charged Lemonade for Leaving a Deadly Legacy

Israeli Scientists Are Shunned by Universities Over the Gaza War

The World’s Most Online Male Gymnast Prepares for the Paris Olympics

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance