Primary Health Properties PLC (LON:PHP) Has Fared Decently But Fundamentals Look Uncertain: What Lies Ahead For The Stock?

Most readers would already know that Primary Health Properties' (LON:PHP) stock increased by 1.9% over the past month. Given that the stock prices usually follow long-term business performance, we wonder if the company's mixed financials could have any adverse effect on its current price price movement Particularly, we will be paying attention to Primary Health Properties' ROE today.

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors’ money. In short, ROE shows the profit each dollar generates with respect to its shareholder investments.

Check out our latest analysis for Primary Health Properties

How Do You Calculate Return On Equity?

The formula for ROE is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Primary Health Properties is:

7.9% = UK£112m ÷ UK£1.4b (Based on the trailing twelve months to December 2020).

The 'return' is the profit over the last twelve months. So, this means that for every £1 of its shareholder's investments, the company generates a profit of £0.08.

What Is The Relationship Between ROE And Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don’t share these attributes.

Primary Health Properties' Earnings Growth And 7.9% ROE

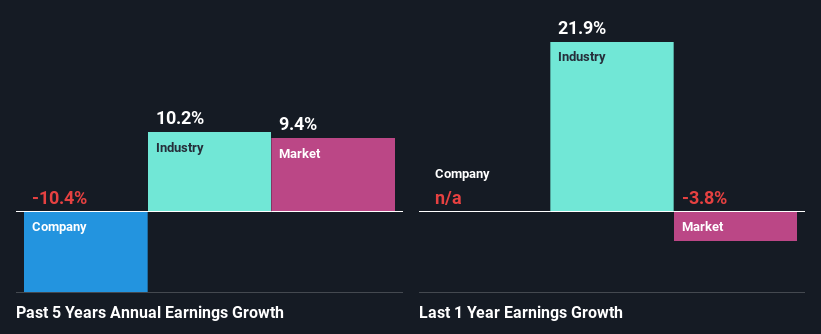

On the face of it, Primary Health Properties' ROE is not much to talk about. However, the fact that the its ROE is quite higher to the industry average of 5.7% doesn't go unnoticed by us. However, Primary Health Properties' five year net income decline rate was 10%. Bear in mind, the company does have a slightly low ROE. It is just that the industry ROE is lower. Therefore, the decline in earnings could also be the result of this.

That being said, we compared Primary Health Properties' performance with the industry and were concerned when we found that while the company has shrunk its earnings, the industry has grown its earnings at a rate of 10% in the same period.

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. Doing so will help them establish if the stock's future looks promising or ominous. Has the market priced in the future outlook for PHP? You can find out in our latest intrinsic value infographic research report.

Is Primary Health Properties Using Its Retained Earnings Effectively?

Primary Health Properties seems to be paying out most of its income as dividends judging by its three-year median payout ratio of 53% (meaning, the company retains only 47% of profits). However, this is typical for REITs as they are often required by law to distribute most of their earnings. Accordingly, this likely explains why its earnings have been shrinking.

In addition, Primary Health Properties has been paying dividends over a period of at least ten years suggesting that keeping up dividend payments is way more important to the management even if it comes at the cost of business growth. Looking at the current analyst consensus data, we can see that the company's future payout ratio is expected to rise to 98% over the next three years. Accordingly, the expected increase in the payout ratio explains the expected decline in the company's ROE to 5.0%, over the same period.

Summary

In total, we're a bit ambivalent about Primary Health Properties' performance. On the one hand, the company does have a decent rate of return, however, its earnings growth number is quite disappointing and as discussed earlier, the low retained earnings is hampering the growth. Having said that, looking at current analyst estimates, we found that the company's earnings growth rate is expected to see a huge improvement. To know more about the latest analysts predictions for the company, check out this visualization of analyst forecasts for the company.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance