PRIMECAP Management's Strategic Reduction in iRobot Corp Holdings

Overview of the Recent Transaction

On August 31, 2024, PRIMECAP Management (Trades, Portfolio) executed a significant transaction involving the sale of 23,900 shares of iRobot Corp (NASDAQ:IRBT), a renowned consumer robot company. This trade was conducted at a price of $7.32 per share, reducing the firm's total holdings in iRobot to 1,448,163 shares. Despite this reduction, PRIMECAP Management (Trades, Portfolio) maintains a 4.79% ownership in iRobot, reflecting a nuanced shift in its investment strategy towards the company.

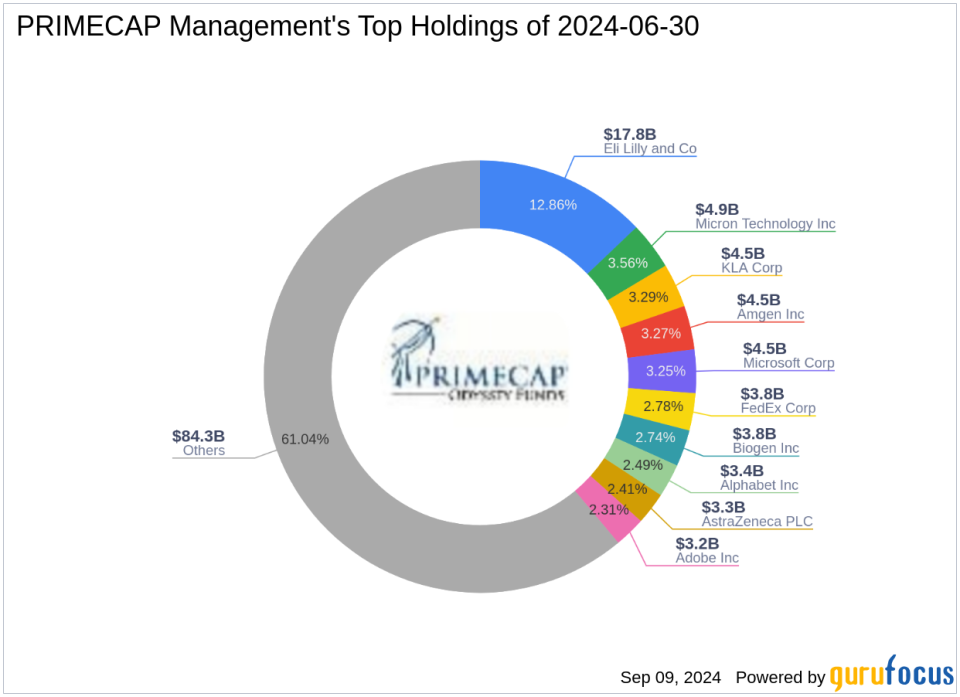

Profile of PRIMECAP Management (Trades, Portfolio)

Founded in 1983 and based in Pasadena, CA, PRIMECAP Management (Trades, Portfolio) is an independent investment management firm known for its disciplined approach to equity investment. The firm emphasizes long-term results through fundamental research, individual decision-making, and a focus on value, particularly in sectors that are temporarily out of favor. PRIMECAPs investment philosophy is geared towards identifying undervalued stocks that promise superior performance over a three to five-year horizon. Currently, the firm manages a diverse portfolio with a strong emphasis on technology and healthcare sectors, holding significant positions in major companies like Amgen Inc (NASDAQ:AMGN) and Microsoft Corp (NASDAQ:MSFT).

Introduction to iRobot Corp

iRobot Corp, headquartered in the USA, has been a pioneer in the consumer robotics sector since its IPO in 2005. The company specializes in designing and building robots that assist with both indoor and outdoor tasks. Despite its innovative product line, iRobot has faced financial challenges, as reflected in its current market capitalization of $183.503 million and a significant drop in stock price by 17.08% since the transaction date. The company's financial health shows mixed signals with a profitability rank of 7/10 but a concerning growth rank of 1/10.

Analysis of the Trade's Impact

The recent sale by PRIMECAP Management (Trades, Portfolio) has slightly altered its investment stance in iRobot, reducing its portfolio position to a mere 0.01%. This move could be indicative of reduced confidence in iRobot's short-term market performance, especially considering the company's current valuation issues and its designation as a possible value trap. However, PRIMECAP's remaining stake suggests a wait-and-see approach, aligning with its philosophy of patience and long-term value realization.

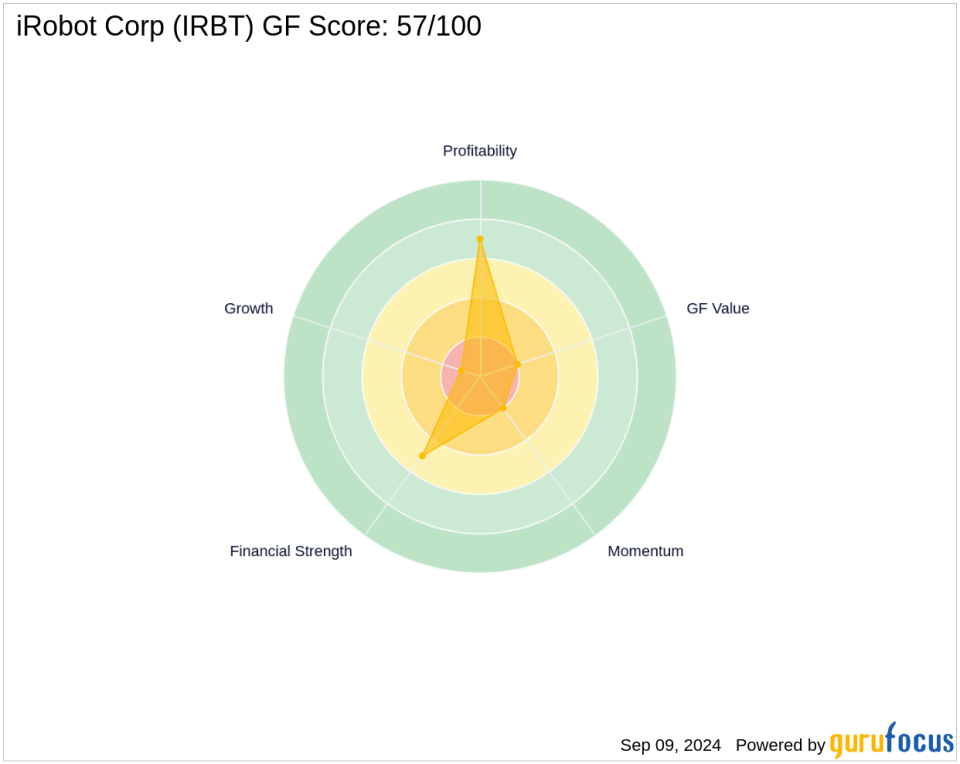

Market Performance and Financial Health of iRobot Corp

iRobot's market performance has been underwhelming with a year-to-date price decline of 84.25% and an 80.03% drop since its IPO. The company's financial metrics such as the GF-Score of 57/100 and a Financial Strength rank of 5/10 further depict a precarious position. The Altman Z score of 0.40 is particularly alarming, indicating potential bankruptcy risk in the near future.

Sector and Market Context

The transaction occurs within a broader market context where technology and healthcare sectors, where PRIMECAP predominantly invests, show varying degrees of volatility and opportunity. The firms strategic reduction in iRobot holdings might reflect a broader realignment towards more stable or promising investments within these sectors.

Conclusion

PRIMECAP Management (Trades, Portfolio)s recent adjustment in its iRobot Corp holdings aligns with its cautious yet opportunistic investment approach. While the firm has scaled back its exposure to iRobot, it continues to monitor the company, possibly awaiting more favorable market conditions to reinforce its positions. This strategic move underscores PRIMECAPs commitment to value realization, even in the face of challenging market dynamics.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.