Principal Financial (PFG) Q2 Earnings Beat, Revenues Fall Y/Y

Principal Financial Group, Inc.’s PFG second-quarter 2022 operating net income of $1.65 per share beat the Zacks Consensus Estimate by 18.7%. The bottom line however decreased 2.9% year over year.

Principal Financial witnessed higher revenues in Principal Global Investors and Principal Global Investors and lower expenses, offset by lower assets under management (AUM).

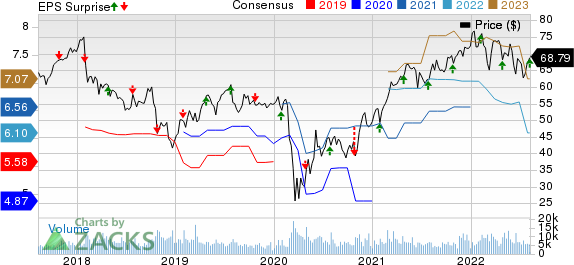

Principal Financial Group, Inc. Price, Consensus and EPS Surprise

Principal Financial Group, Inc. price-consensus-eps-surprise-chart | Principal Financial Group, Inc. Quote

Behind the Headlines

Operating revenues decreased 12.6% year over year to $3.1 billion due to lower net investment income and fees and other revenues.

Total expenses decreased 11.1% year over year to $2.8 billion due to lower benefits, claims and settlement expenses and dividends to policyholders.

Principal Financial’s AUM as of Jun 30, 2022 amounted to $631.7 billion, down 9.4% year over year.

Segment Update

Retirement and Income Solution: Revenues decreased 20% year over year to about $1.3 billion due to lower premiums and other considerations, higher fees and other revenues and net investment income.

Pre-tax operating earnings decreased 8.7% year over year to $255.9 million due to lower net revenue, higher DAC amortization expense and impacts from the reinsurance transaction.

Principal Global Investors: Revenues of $463.6 million were up 2.2% from the prior-year quarter, driven by higher fees and other revenues.

Pre-tax operating earnings decreased 2.4% year over year to $180 million as higher operating revenues less pass-through expenses were offset by higher operating expenses.

Principal International: Revenues increased 43.4% year over year to $439.1 million in the quarter due to higher net investment income.

Operating earnings increased 93.1% year over year to $92.1 million due to higher combined net revenue.

U.S. Insurance Solution: Revenues decreased 23.1% year over year to $908.6 million due to lower net investment income, fees and other revenues.

Operating earnings of $151.7 million increased 19.8% year over year, mainly due to improved performance at the Specialty Benefits Insurance business, offset by poor performance at the Individual Life Insurance.

Corporate: Operating loss of $152.9 million was wider than the $82.7 million loss incurred a year ago. This downside was due to higher operating expenses and unfavorable variable investment income.

Financial Update

As of Jun 30, 2022, cash and cash equivalents were $3.2 billion, up 31.3% year over year.

At second-quarter end, debt was $4.3 billion, unchanged from 2021-end.

As of Jun 30, 2022, book value per share (excluding AOCI other than foreign currency translation adjustment) was $50.27, up 3.3% year over year.

Dividend and Share Repurchase Update

Principal Financial paid out $161.7 million in dividends and deployed $239.9 million to buy back 2.9 million shares in the quarter under review.

The board of directors approved third-quarter dividend of 64 cents per share. The dividend will be paid out on Sep 30, 2022, to shareholders of record as of Sep 8, 2022.

Zacks Rank

Principal Financial currently carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Finance Stocks

Of the finance stocks that have reported second-quarter results so far, Lazard Ltd LAZ, Affiliated Managers Group Inc. AMG and Ameriprise Financial, Inc. AMP beat the respective Zacks Consensus Estimate for earnings.

Lazard’s adjusted net income per share of 92 cents surpassed the Zacks Consensus Estimate of 87 cents. The reported figure reflects a 28% decline year over year. Adjusted net income in the reported quarter was $96 million, down 34% year over year. In the second quarter, adjusted operating revenues totaled $675.91 million, down 18% year over year. This downside resulted from a decrease in asset management revenues. Nonetheless, the reported figure beat the Zacks Consensus Estimate of $674 million.

Lazard’s adjusted compensation and benefits expenses were down 19% on a year-over-year basis to $395 million. Non-compensation expenses in the quarter were $130.9 million, up 10%. The ratio of adjusted compensation expenses to operating revenues was 58.5%, down from the year-earlier quarter’s 59.5%. The ratio of non-compensation expenses to operating revenues was 19.4%, up from the year-ago quarter’s 14.5%.

Affiliated Managers’ second-quarter 2022 economic earnings of $4.03 per share surpassed the Zacks Consensus Estimate of $4.00. The bottom line was on par with the prior-year number. Our estimate for economic earnings per share was $4.27. Economic net income was $160.5 million, down 6.3% from the prior-year quarter.

Affiliated Managers’ total revenues rose 3% year over year to $604.1 million. Also, the top line beat the Zacks Consensus Estimate of $592.4 million. Adjusted EBITDA was $213.4 million, down 6.1% from the year-ago quarter. Our estimate for the same was $218.9 million. As of Jun 30, 2022, the total AUM was $690.9 billion, which declined 8.6% year over year. Net client cash outflows in the quarter were $11.4 billion.

Ameriprise Financial reported second-quarter 2022 results. Adjusted operating earnings per share of $5.81 surpassed the Zacks Consensus Estimate of $5.73. The bottom line reflects a rise of 10.2% from the year-ago quarter.

On an operating basis, adjusted total net revenues were $3.48 billion, up 2.7% year over year. The top line lagged the Zacks Consensus Estimate of $3.51 billion. On a GAAP basis, net revenues were $3.51 billion, up 2.6%. Adjusted operating expenses totaled $2.64 billion, up 1.3% from the prior-year quarter.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ameriprise Financial, Inc. (AMP) : Free Stock Analysis Report

Principal Financial Group, Inc. (PFG) : Free Stock Analysis Report

Lazard Ltd (LAZ) : Free Stock Analysis Report

Affiliated Managers Group, Inc. (AMG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance