Productivity Software Stocks Q1 Teardown: Monday.com (NASDAQ:MNDY) Vs The Rest

Wrapping up Q1 earnings, we look at the numbers and key takeaways for the productivity software stocks, including Monday.com (NASDAQ:MNDY) and its peers.

Rising employee costs and the shift to more remote work has increased the ever-present pressure to improve corporate productivity, which in turn has driven rising demand for productivity software that enables remote work, streamline project management and automate business tasks.

The 11 productivity software stocks we track reported a mixed Q1; on average, revenues beat analyst consensus estimates by 1.6%. while next quarter's revenue guidance was in line with consensus. Stocks--especially those trading at higher multiples--had a strong end of 2023, but 2024 has seen periods of volatility. Mixed signals about inflation have led to uncertainty around rate cuts, and productivity software stocks have held roughly steady amidst all this, with share prices up 1.6% on average since the previous earnings results.

Monday.com (NASDAQ:MNDY)

Founded in Israel in 2014, and named after the dreaded first day of the work week, Monday.com (NASDAQ:MNDY) makes software as a service platforms that helps teams plan and track work efficiently.

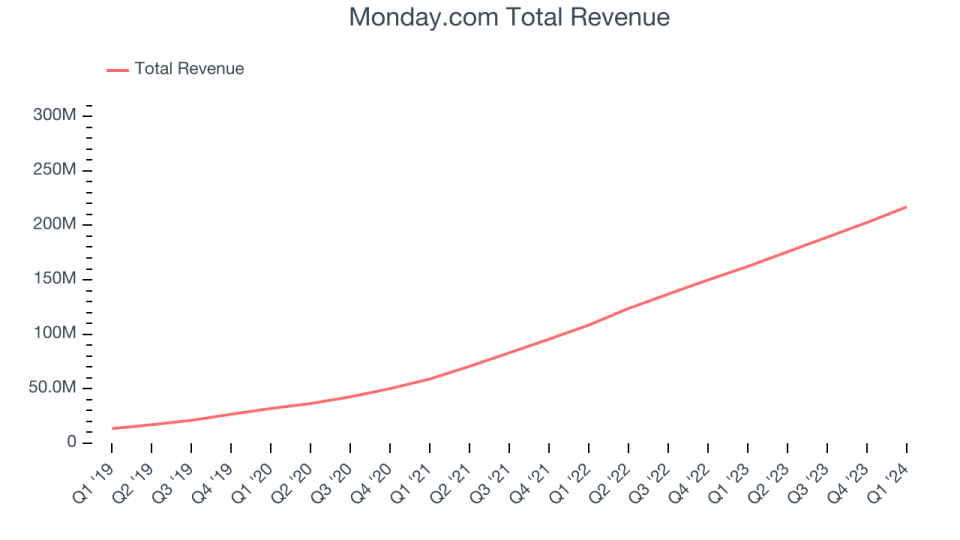

Monday.com reported revenues of $216.9 million, up 33.7% year on year, topping analysts' expectations by 3%. It was a strong quarter for the company, with a solid beat of analysts' ARR (annual recurring revenue) and billings estimates.

“Q1 represents another great step forward for monday.com, with strong revenue growth and profitability, as well as record free cash flow. These results are supported by recent adjustments made to our pricing model, which thus far have exceeded our initial expectations,” said Eliran Glazer, monday.com CFO.

Monday.com achieved the fastest revenue growth and highest full-year guidance raise of the whole group. The company added 196 enterprise customers paying more than $50,000 annually to reach a total of 2,491. The stock is up 34.2% since the results and currently trades at $243.66.

Best Q1: Atlassian (NASDAQ:TEAM)

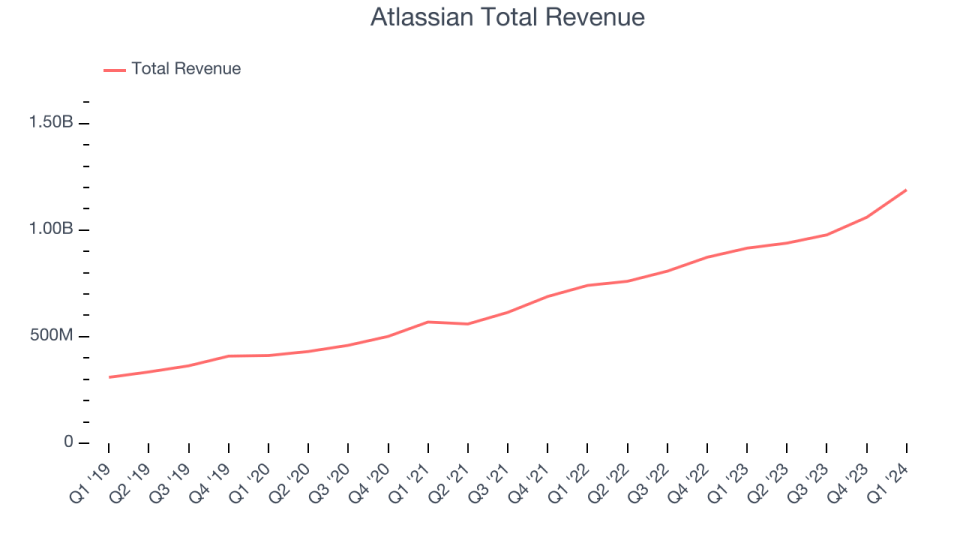

Founded by Australian co-CEOs Mike Cannon-Brookes and Scott Farquhar in 2002, Atlassian (NASDAQ:TEAM) provides software as a service that makes it easier for large teams of software developers to manage projects, especially in software development.

Atlassian reported revenues of $1.19 billion, up 29.9% year on year, outperforming analysts' expectations by 8.1%. It was a very strong quarter for the company, with an solid beat of analysts' billings estimates and an impressive beat of analysts' revenue estimates.

Atlassian achieved the biggest analyst estimates beat among its peers. The stock is down 14.9% since the results and currently trades at $169.

Is now the time to buy Atlassian? Access our full analysis of the earnings results here, it's free.

Weakest Q1: Pegasystems (NASDAQ:PEGA)

Founded by Alan Trefler in 1983, Pegasystems (NASDAQ:PEGA) offers a software-as-a-service platform to automate and optimize workflows in customer service and engagement.

Pegasystems reported revenues of $330.1 million, up 1.4% year on year, falling short of analysts' expectations by 2.1%. It was a weak quarter for the company, with a miss of analysts' revenue estimates and a decline in its gross margin.

Pegasystems had the weakest performance against analyst estimates in the group. The stock is up 1.1% since the results and currently trades at $59.5.

Read our full analysis of Pegasystems's results here.

RingCentral (NYSE:RNG)

Founded in 1999 during the dot-com era, RingCentral (NYSE:RNG) provides software as a service that unifies phone, text, fax, video calls and chat in one platform.

RingCentral reported revenues of $584.2 million, up 9.5% year on year, surpassing analysts' expectations by 1%. It was a mixed quarter for the company, with a decent beat of analysts' billings estimates but a miss of analysts' ARR (annual recurring revenue) estimates.

The stock is up 15.7% since the results and currently trades at $34.7.

Read our full, actionable report on RingCentral here, it's free.

Dropbox (NASDAQ:DBX)

Founded by the long-serving CEO Drew Houston and Arash Ferdowsi in 2007, Dropbox (NASDAQ:DBX) provides a file hosting cloud platform that helps organizations collaborate and share documents.

Dropbox reported revenues of $631.3 million, up 3.3% year on year, in line with analysts' expectations. It was a solid quarter for the company, with accelerating customer growth and a significant improvement in its gross margin.

The company added 40,000 customers to reach a total of 18.16 million. The stock is down 1.2% since the results and currently trades at $22.85.

Read our full, actionable report on Dropbox here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

Yahoo Finance

Yahoo Finance