New Products and New Customers Drive Atlassian's Strong First Quarter

Collaboration and productivity software provider Atlassian (NASDAQ: TEAM) reported its fiscal first-quarter results after the market closed on Thursday. Revenue surged by more than 40% as the company continued to win new customers, although earnings growth remained sluggish by comparison. Here's what investors need to know.

Atlassian: The raw numbers

Metric | Q1 2018 | Q1 2017 | Year-Over-Year Change |

|---|---|---|---|

Revenue | $193.8 million | $136.8 million | 41.7% |

IFRS net income | ($14.0 million) | ($2.6 million) | N/A |

Non-IFRS net income | $29.9 million | $22.7 million | 31.7% |

Non-IFRS earnings per share | $0.12 | $0.10 | 20% |

Data source: Atlassian. IFRS = International Financial Reporting Standards.

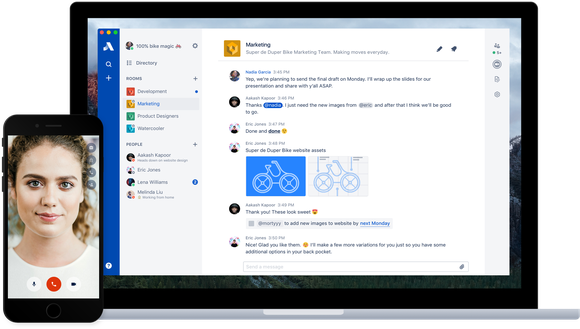

Atlassian's Stride app. Image source: Atlassian.

What happened with Atlassian this quarter?

Atlassian had 107,746 customers on active subscriptions or maintenance agreements at the end of the quarter, up from 89,237 at the end of fiscal Q4. The company added 4,246 net new customers, and it gained 14,263 additional customers due to a one-time pricing change for its Bitbucket Cloud product. (Those additional customers did not meet its definition of customer prior to the change.)

Subscription revenue was $84.4 million, up 67% year over year.

Maintenance revenue was $76.3 million, up 23.6% year over year.

Perpetual license revenue was $19.9 million, up 13.9% year over year.

Other revenue was $13.2 million, up 73.3% year over year.

Cash, cash equivalents, and short-term investments rose to $613.5 million, up from $549.9 million at the end of the previous quarter.

Atlassian generated $65.2 million of operating cash flow, along with $62.7 million of free cash flow. Free cash flow was up 140% year over year.

Atlassian launched Stride, a complete cloud-based team communication solution.

The company provided the following financial targets for its fiscal Q2 and full fiscal year:

For Q2 2018: Revenue between $203 million and $205 million, up 37% year over year; non-IFRS EPS of $0.12, up from $0.09 in the prior-year period; non-IFRS gross margin of 84%; and non-IFRS operating margin of 19%.

For the full year: Revenue between $841 million and $847 million, up 36%; non-IFRS EPS between $0.46 and $0.47; non-IFRS gross margin of 84%; and non-IFRS operating margin of 19%.

Atlassian expects full-year free cash flow of between $250 million and $260 million.

What management had to say

In response to an analyst question on the conference call, co-CEO Mike Cannon-Brookes described the company's take-it-slow approach with Trello, a recent acquisition:

We've shared quite clearly that our main objective there is to have the team, the Trello team, continue to do the things that has made them successful as a team, as a product. And our [primary] focus is on the momentum that [exists] within Trello; we aren't rushing into cross-selling and cross to base between Trello and the other Atlassian family and vice versa.

In Atlassian's shareholder letter, the company discussed Stride, its newest product:

Stride brings all the ways teams communicate (text, voice, video, emoji, screen sharing, app notifications, and file sharing) into one place. Teams can mark important messages as Actions or Decisions so they're easy to find later, and jump from typing to talking without leaving the app through the built-in meetings feature for 1:1 and group video.

Looking ahead

Atlassian continues to expand its product portfolio, both organically with products like Stride and through acquisitions like Trello. Customers are flocking to the platform, and with the company focused on serving all businesses, big and small, there's plenty of room for growth.

Earnings growth is lagging revenue growth, and IFRS earnings are becoming more negative as revenue ramps up. Long-term investors who believe in Atlassian's growth story shouldn't be too concerned, but it's something to keep an eye on.

Atlassian is proving to be one of the most exciting growth stories in software. With strong guidance for fiscal 2018, that story will continue to play out in the coming year.

More From The Motley Fool

Why You're Smart to Buy Shopify Inc. (US) -- Despite Citron's Report

6 Years Later, 6 Charts That Show How Far Apple, Inc. Has Come Since Steve Jobs' Passing

NVIDIA Scores 2 Drone Wins -- Including the AI for an E-Commerce Giant's Delivery Drones

Timothy Green has no position in any of the stocks mentioned. The Motley Fool recommends Atlassian. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance