Progress Software's (PRGS) Q3 Earnings & Revenues Top Estimates

Progress Software PRGS reported its third-quarter fiscal 2022 non-GAAP earnings of $1.00 per share, which beat the Zacks Consensus Estimate by 3.09% but decreased 15.3% year over year.

Non-GAAP revenues of $153.1 million surpassed the consensus mark by 3.42% and increased 0.3% year over year, driven by strong demand for Chef, OpenEdge, DataDirect and Sitefinity solutions.

The reported figure was better than management’s guided range of $147-$150 million.

On a constant-currency basis, annualized recurring revenues came in at $495 million, up 13% year over year.

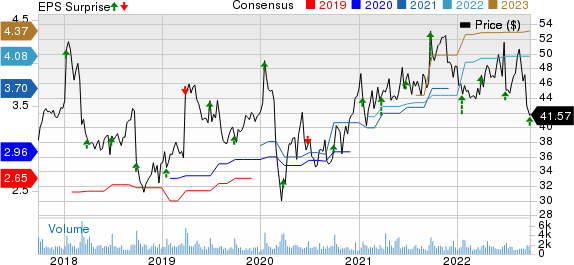

Progress Software Corporation Price, Consensus and EPS Surprise

Progress Software Corporation price-consensus-eps-surprise-chart | Progress Software Corporation Quote

Quarter Details

Software license revenues were $47.6 million, down 8.3% year over year. Maintenance and service revenues were $103.6 million, up 8.5% year over year.

Sales and marketing expenses, as a percentage of revenues, increased 270 basis points (bps) from the year-ago quarter’s level to 22.9%.

Product development expenses, as a percentage of revenues, increased 160 bps from the year-ago quarter’s tally to 18.9%.

General and administrative expenses, as a percentage of revenues, increased 220 bps from the year-ago quarter’s level to 13.3%.

Progress reported a non-GAAP operating margin of 39.2%, which contracted 740 bps year over year.

Balance Sheet

As of Aug 31, 2022, cash and cash equivalents (and short-term investments) were $225.9 million compared with $225.9 million as of May 31, 2022.

Progress Software generated $39.2 million in adjusted free cash flow compared with $68 million in the previous quarter.

Guidance

For fourth-quarter fiscal 2022, Progress Software expects non-GAAP revenues between $158 million and $166 million. The Zacks Consensus Estimate for revenues is currently pegged at $148.01 million, indicating a decline of 3.01% from the year-ago quarter’s reported figure.

Progress Software expects non-GAAP earnings to be in the range of $1.06-$1.10 per share. The consensus mark is currently pegged at 97 cents per share, indicating a decline of 17.8% from the year-ago quarter’s reported figure.

For fiscal 2022, non-GAAP revenues are projected between $609 million and $617 million compared with $557 million reported in fiscal 2021.

Non-GAAP operating margin is expected between 39% and 40% compared with 41% reported in fiscal 2021.

Non-GAAP earnings are projected between $4.08 and $4.12 per share compared with $3.87 reported in fiscal 2021.

The Zacks Consensus Estimate for fiscal 2022 revenues and earnings is currently pegged at $611.86 million and $4.08 per share, respectively.

Zacks Rank & Stocks to Pick

Progress Software currently has a Zacks Rank #3 (Hold).

Investors interested in the Zacks Computer & Technology sector are eagerly awaiting earnings releases from players like ASGN ASGN, Amkor Technology AMKR and F5 FFIV.

ASGN, a Zacks Rank #2 (Buy) stock, is likely to release third-quarter 2022 results on Oct 26. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for ASGN’s third-quarter 2022 earnings has been steady at $1.78 per share in the past 30 days.

Amkor, carrying a Zacks Rank #2, is set to report third-quarter 2022 results on Oct 24.

The Zacks Consensus Estimate for AMKR’s third-quarter 2022 earnings is pegged at 92 cents per share, unchanged in the past 30 days.

F5, another Zacks Rank #2 stock, is likely to report fourth-quarter fiscal 2022 results on Oct 25.

The consensus mark for F5 earnings is pegged at $2.54 per share, unchanged in the past 30 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

F5, Inc. (FFIV) : Free Stock Analysis Report

Amkor Technology, Inc. (AMKR) : Free Stock Analysis Report

Progress Software Corporation (PRGS) : Free Stock Analysis Report

ASGN Incorporated (ASGN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance