Progressive's (PGR) April Earnings Rise on Higher Premiums

The Progressive Corporation PGR reported earnings per share of 72 cents for April 2024, up 118.2% year over year. The improvement stemmed from higher revenues and lower expenses.

April Numbers in Detail

Progressive recorded net premiums written of $6.2 billion, up 1.7% from $6.1 billion in the year-ago month. Net premiums earned were about $5.6 billion, up 21% from $5.5 billion reported in the year-ago month.

Net realized loss on securities was $266.1 million against the year-ago income of $18.4 million.

Combined ratio — the percentage of premiums paid out as claims and expenses — improved 9701 basis points (bps) year over year to 89.

PGR’s operating revenues were $5.9 billion, improving 3.3% year over year, owing to a 2.1% increase in premiums, a 50.6% jump in investment income and 9.6% higher service revenues.

Total expenses decreased 6.9% to $5.1 billion, largely due to 11.1% lower losses and loss adjustment expenses and 4.9% lower policy acquisition costs.

In August, policies in force (PIF) were impressive for both Vehicle and Property businesses. In the Vehicle business, the Personal Auto segment recorded an increase of 7% year over year to 20.8 million policies. Special Lines policies increased 8% from the year-earlier month to 6.2 million.

In Progressive’s Personal Auto segment, Agency Auto PIF increased 5% to 8.7 million, while Direct Auto improved 8% to 12.1 million.

PGR’s Commercial Auto segment policies rose 2% year over year to 1.1 million.

The Property business had 3.3 million policies in force in the reported month, up 11% year over year.

The company’s book value per share was $36.92 as of Apr 30, 2024, up 29.1% from $28.60 on Apr 30, 2023.

In the trailing 12 months, the return on equity was 30.2%, having improved 2,300 bps from 7.2% in April 2023. The debt-to-total-capital ratio improved 280 bps year over year to 24.2 as of Apr 30, 2024.

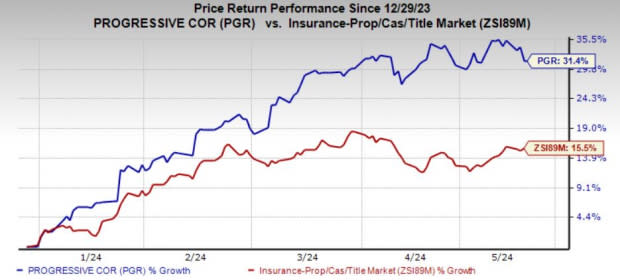

Price Performance

Progressive’s shares have gained 31.4% year to date, outperforming the industry’s growth of 15.5%.

Image Source: Zacks Investment Research

Zacks Rank

Progressive currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Other Stocks to Consider

Some other top-ranked stocks from the insurance space are The Allstate Corporation ALL, Arch Capital Group Ltd ACGL and RLI Corp RLI, each sporting a Zacks Rank #1.

Allstate delivered a four-quarter average earnings surprise of 41.88%. The stock has gained 21.6% year to date. The Zacks Consensus Estimate for ALL’s 2024 and 2025 earnings indicates a year-over-year increase of 1,479% and 13.8%, respectively.

Arch Capital delivered a four-quarter average earnings surprise of 28.41%. The stock has gained 31.9% year to date. The Zacks Consensus Estimate for ACGL’s 2024 and 2025 earnings indicates a year-over-year increase of 0.7% and 5.8%, respectively.

RLI delivered a four-quarter average earnings surprise of 132.49%. The stock has gained 9.6% year to date. The Zacks Consensus Estimate for RLI’s 2024 and 2025 earnings indicates a year-over-year increase of 18% and 2.6%, respectively.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

RLI Corp. (RLI) : Free Stock Analysis Report

The Allstate Corporation (ALL) : Free Stock Analysis Report

The Progressive Corporation (PGR) : Free Stock Analysis Report

Arch Capital Group Ltd. (ACGL) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance