Proofpoint (PFPT) Beats Q3 Earnings & Revenue Estimates

Proofpoint Inc. PFPT reported third-quarter 2020 non-GAAP earnings of 59 cents per share, outpacing the Zacks Consensus Estimate by 35.9%. Moreover, the figure increased 20.4% year over year.

Revenues came in at $266.7 million in the third quarter, which beat the consensus mark of $261.8 and increased 17% year over year as well.

This upside can be attributed to strong demand for its next-generation cloud security and compliance platform, ongoing migration to the cloud, solid international growth, and high renewal rates.

Top Line Details

Total billings during the reported quarter grew 6% year over year to $294.4 million.

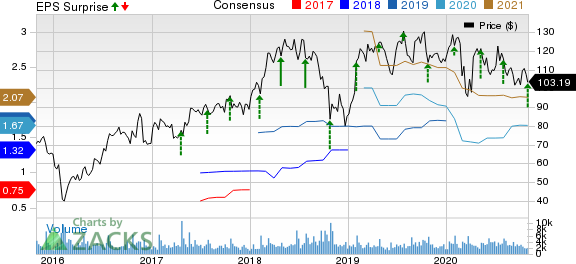

Proofpoint, Inc. Price, Consensus and EPS Surprise

Proofpoint, Inc. price-consensus-eps-surprise-chart | Proofpoint, Inc. Quote

Subscription revenues came in at $260.7 million, up 16.2% from the year-ago quarter. In addition, hardware and service revenues surged 92.8% year over year to $6 million.

The company has stopped reporting results for its advanced threat and compliance-oriented products as it believes the data is not informative in terms of measuring business performance.

Proofpoint continues to expand globally. Its international business grew 23% year over year, accounting for 21% of total revenues during the September-end quarter.

Operating Details

Non-GAAP gross profit climbed 18.8% from the year-ago quarter to $215 million. Non-GAAP gross margin expanded 100 basis points (bps) to 81% on impressive revenue performance.

Proofpoint’s non-GAAP operating income jumped 38.3% to $46.9 million.

Balance Sheet & Cash Flow

As of Sep 30, 2020, the company’s cash, cash equivalents and short-term investments were $1.02 billion compared with $973.3 million as of Jun 30, 2020.

The company generated operating cash flow of $86 million compared with the $30.6 million reported in the previous quarter. Free cash flow was $64.6 million compared with the prior quarter’s $18.8 million.

Guidance

Proofpoint updated its 2020 revenue guidance. The company now expects revenues of $1.043-$1.045 billion, up from the previous projection of $1.035-$1.037 billion.

Non-GAAP gross margin is still expected to be 80%.

Non-GAAP earnings per share are anticipated in the band of $1.88-$1.91, higher than its previous guidance of $1.64-$1.70.

Free cash flow is estimated in the range of $166.2-$168.2 million, up from the prior forecast of $130-$140 million.

Capital expenditures are now expected to be $72.6 million, down from the $75 million projected earlier.

For the December-end quarter, Proofpoint anticipates revenues of $268-$270 million.

Non-GAAP gross margin is estimated to be 80%. Non-GAAP earnings per share are predicted in the band of 41-44 cents.

Free cash flow is estimated in the range of $3 million to $5 million.

Capital expenditures are expected to be approximately $27 million for the ongoing quarter, including $19.4 million for building Proofpoint’s new headquarters.

Zacks Rank and Stocks to Consider

Proofpoint currently carries a Zacks Rank #3 (Hold).

Better-ranked stocks in the broader technology sector include Zoom Video Communications ZM, Viasat VSAT and CDW Corporation CDW, all sporting a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The long-term earnings growth rate for Zoom, Viasat and CDW is currently pegged at 25%, 19%, and 13.1%, respectively.

Have You Seen Zacks’ 2020 Election Stock Report?

The upcoming election could be a massive buying opportunity for savvy investors. Trillions of dollars will shift into new market sectors after the election. The question is, which sectors will soar for each candidate? Zacks has put together a new special report to help readers like you target big profits.

The 2020 Election Stock Report reveals specific stocks you’ll want to own immediately after the results are announced – 6 if Trump wins, 6 if Biden wins. Past election reports have led investors to gains of +71%, +83%, even +185% in the following months. This year’s picks could be even more lucrative.

Check out Zacks’ 2020 Election Stock Report >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Viasat Inc. (VSAT) : Free Stock Analysis Report

Proofpoint, Inc. (PFPT) : Free Stock Analysis Report

CDW Corporation (CDW) : Free Stock Analysis Report

Zoom Video Communications, Inc. (ZM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance