Proofpoint (PFPT) Soaring on Impressive Q4 Results & Buyout

Shares of Proofpoint Inc. PFPT rallied to a new 52-week high of $116.04, eventually closing at $115.51 on Mar 5.

It has been four weeks since Proofpoint reported fourth-quarter 2017 results. The stock has been on the rise following the release. To some investors, choosing the stock may appear to be a no-brainer because right after an earnings release, a company is almost always on investors’ radar.

While better-than-expected results make the stock a good pick, lower-than-expected results dampen investors’ spirit. So, the period following earnings releases is often marked by high market activity. Since its last quarterly results announcement on Feb 6, Proofpoint has gained 12.6% so far.

The company delivered non-GAAP earnings of 29 cents for the recently reported quarter, recording an impressive year-over-year jump of 61%. Earnings also came in ahead of the Zacks Consensus Estimate of 21 cents as well as management’s guidance of 19-21 cents per share.

The company reported total revenues of $145.4 million, up 36.1% year over year, primarily driven by customer additions, improved add-on-sales and strong renewal rate. The company’s revenues also surpassed the Zacks Consensus Estimate of $140 million and also exceeded the guidance range of $138-$140 million.

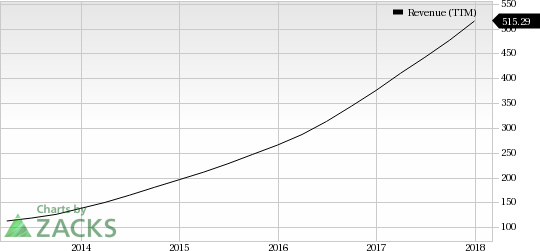

Proofpoint, Inc. Revenue (TTM)

Proofpoint, Inc. Revenue (TTM) | Proofpoint, Inc. Quote

We believe the company’s sustained focus on launching new products like Domain Discover and acquisitions with the likes of Cloudmark and Weblife.io have helped it perform well. The company also maintains a high renewal rate of more than 90% which signifies that it has a better product portfolio and loyal customers.

Moreover, the last reported quarter witnessed improvement in margins, driven by higher sales and efficiency improvements across the company’s cloud operations. Further, it was aided by decreased operating expenses as a percentage of sales.

Additionally, the company raised full-year 2018 revenue guidance. Proofpoint now expects revenues in the range of $660-$665 million (mid-point $662.5 million), up from $644-$648 million (mid-point $646 million) predicted earlier.

Apart from strong quarterly results, the recent optimism surrounding the stock can also be attributed to the acquisition of Wombat Security Technologies. The acquired entity is a prominent name in the security awareness and the phishing simulation industry. Consequently, its integration is anticipated to be a top-line booster.

We believe all these have positively impacted the company’s share price momentum. Notably, investors are optimistic about the stock’s prospects. Proofpoint’s stock has gained 47.2% over the last year, substantially outperforming the 29.3% rally of the industry it belongs to.

Zacks Rank and Stocks to Consider

Proofpoint has a Zacks Rank #3 (Hold).

Some top-ranked stocks in the space include NVIDIA NVDA, Lam Research LRCX and Paycom Software PAYC, all of which sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth rate for NVIDIA, Lam Research and Paycom is currently pegged at 10.25%, 14.85% and 25.75%, respectively.

Wall Street’s Next Amazon

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Paycom Software, Inc. (PAYC) : Free Stock Analysis Report

Proofpoint, Inc. (PFPT) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Lam Research Corporation (LRCX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance