Proofpoint (PFPT) Tops Q1 Earnings Estimates, Lifts '18 View

Maintaining its positive surprise history, Proofpoint Inc. PFPT reported solid results for first-quarter 2018, marking the ninth consecutive quarter of better-than-expected performance for the top and bottom lines. Also, revenues and earnings came in ahead of the company’s guided ranges. This apart, Proofpoint witnessed significant year-over-year improvement on both the counts.

The company reported non-GAAP earnings of 30 cents, marking an impressive year-over-year jump of 36%. Earnings also outpaced the Zacks Consensus Estimate of 16 cents, as well as the company’s guidance of 15-17 cents per share.

Quarter in Detail

Proofpoint reported total revenues of $162.5 million, up 40.5% year over year, mainly driven by customer additions, improved add-on-sales and strong renewal rate. The company’s revenue figure also surpassed the Zacks Consensus Estimate of $152 million, as well as came in above management’s guided range of $149-$151 million.

Total billings during the quarter also climbed 35% year over year to $186.2 million. Also, renewal rates remained well more than 90% during the reported quarter.

Non-GAAP gross profit advanced 40.3% from the year-ago quarter to $125.2 million, primarily driven by higher sales. However, non-GAAP gross margin remained flat year over year at 77.1%, but was above management’s expectation of 77%.

Total non-GAAP operating expenses flared up 41% year over year to $108.5 million, mainly due to increased spending on hiring sales personnel. As a percentage of revenues, it increased to 30 basis points (bps) 66.8%.

Proofpoint’s non-GAAP operating income for the quarter increased to $16.7 million from $12.3 million reported in the year-ago quarter. However, non-GAAP operating margin contracted 40 bps to 10.3%, as elevated operating expenses as a percentage of sales more than offset the benefit of higher revenues.

Non-GAAP net income increased to $17.1 million from $11.8 million reported in the prior-year quarter. It also came in above the company’s guidance of $8-$9 million.

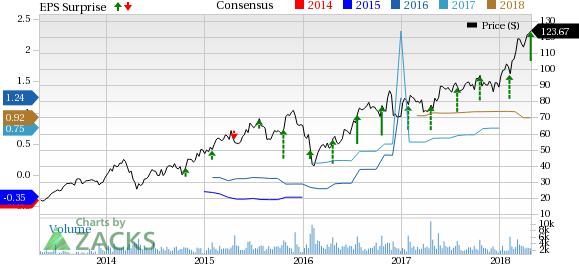

Proofpoint, Inc. Price, Consensus and EPS Surprise

Proofpoint, Inc. Price, Consensus and EPS Surprise | Proofpoint, Inc. Quote

Balance Sheet & Cash Flow

Proofpoint exited the first quarter with cash and cash equivalents, and short-term investments of approximately $117.2 million, down from the previous-quarter balance of $331.6 million. The decline was mainly due to cash used for the purpose of completing the Wombat acquisition. Accounts receivable were $119 million compared with $107.7 million reported at the end of the previous quarter.

During the reported quarter, the company generated operating cash flow of $34.9 million. Free cash flow for the quarter came in at $26.4 million, way above management’s guidance of $22-$24 million.

Guidance

The company revised its full-year 2018 projections, wherein it raised the revenue and non-GAAP earnings expectations. Proofpoint now expects revenues of $702-$706 million (mid-point $704 million), up from $691-$696 million (mid-point $693.5 million) predicted earlier. The Zacks Consensus Estimate is currently pegged at $684.7 million. Billings expectations have also been raised to $866-$870 million from $864-$869 million projected earlier.

Non-GAAP net income is now estimated in the range of $55–$60 million, up from the previous forecast of $46-$50 million. Similarly, non-GAAP earnings per share are now anticipated in the band of $1.00-$1.09 (mid-point $1.05), up from the previous guidance of 84-91 cents (mid-point 87.5 cents). Analysts polled by Zacks anticipate earnings of 92 cents.

The company continues to estimate non-GAAP gross margins of 77% in 2018.

Free cash flow for the year is now expected in the range of $141–$143 million, up from the $138-$140 million predicted earlier. Capital expenditure is likely to be approximately $45 million.

The company also initiated outlook for the second quarter. Proofpoint anticipates revenues of $168-170 million, and billings between $194 million and $196 million. Currently, the Zacks Consensus Estimate for revenues is pegged at approximately $163.4 million.

GAAP and non-GAAP gross margins are estimated to be 69% and 76%, respectively. Non-GAAP net income is projected at $8-$9 million, or 15-17 cents per share. Currently, the Zacks Consensus Estimate is pegged at 17 cents.

Free cash flow is forecast in the range of $15-$17 million, while capital expenditure will likely be $10 million in the second quarter.

Currently, Proofpoint has a Zacks Rank #4 (Sell).

Some better-ranked stocks in the broader technology sector are Mellanox Technologies, Ltd. MLNX, Fortinet, Inc. FTNT and Varonis Systems, Inc. VRNS. While Mellanox Technologies sports a Zacks Rank of 1 (Strong Buy), Fortinet and Varonis Systems carry a Zacks Rank of 2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Mellanox Technologies, Fortinet and Varonis Systems have expected long-term EPS growth rates of 15%, 16.8% and 20%.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Fortinet, Inc. (FTNT) : Free Stock Analysis Report

Varonis Systems, Inc. (VRNS) : Free Stock Analysis Report

Proofpoint, Inc. (PFPT) : Free Stock Analysis Report

Mellanox Technologies, Ltd. (MLNX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance