ProPetro (PUMP) Q3 Earnings Miss on Soft Demand, Sales Beat

ProPetro Holding Corp. PUMP reported third-quarter net income per share of 33 cents, missing the Zacks Consensus Estimate of 48 cents and below the year-ago period's bottom-line figure of 53 cents. The underperformance stems from tepid demand for the company’s services as clients – the upstream energy players – take a cautious approach to capital spending amid depressed oil and gas prices.

ProPetro’s revenues of $541.8 million improved 24.8% year over year and came above the Zacks Consensus Estimate of $509 million, driven by impressive operating efficiency and contribution from Pioneer Natural Resources’ PXD pressure pumping assets in the Permian Basin.

Adjusted EBITDA in the third quarter amounted to $131.9 million, increasing from $103.4 million a year ago.

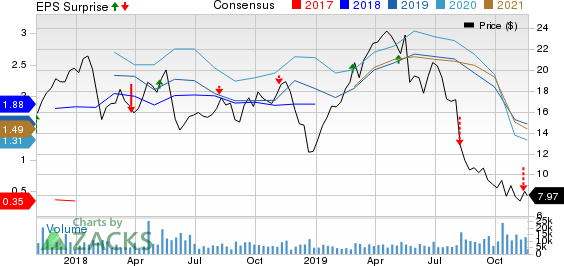

ProPetro Holding Corp. Price, Consensus and EPS Surprise

ProPetro Holding Corp. price-consensus-eps-surprise-chart | ProPetro Holding Corp. Quote

Pressure Pumping Division

ProPetro, through its Pressure Pumping division, provides hydraulic fracturing, cementing and acidizing functions. The business accounted for 97.6% of the company's total revenues in the quarter under review.

Costs & Expenses

ProPetro reported cost of services of $396.9 million in third-quarter 2019, 24% higher than the year-ago quarter. Meanwhile, general and administrative expenses came in at $27.6 million, up from $12.8 million in the year-ago period.

Balance Sheet & Capital Expenditure

As of Sep 30, ProPetro had cash and cash equivalents of $109.2 million while its long-term debt was $130 million – for a negative net cash position. The company’s debt-to-capitalization ratio was 12.1%. ProPetro also has $64.3 million available under the revolving credit facility.Capital expenditure for the three months reached $87 million, up 17.3% compared to the third quarter of 2018. Payments toward the new-build DuraStim hydraulic fracturing fleets accounted for the rise in outlay.

Guidance & Electric Fracking Foray

ProPetro expects an average of 18-20 effective fleets in the fourth quarter, down from 25.1 in the third quarter of 2019. The fall in utilization is due to slowdown in customer spending, seasonality and a general lack of demand.

Importantly, the company is making its foray in the electric fracking technology and plans to employ one such DuraStim fleet by late 2019/early 2020 and two more subsequently in 2020. The 36,000 horsepower DuraStim fleets – boasting of fuel efficiency and lower costs – will be deployed under dedicated agreements with existing clients.

During the third quarter, ProPetro also added a unit to its cementing fleet, which brought the cementing fleet count to 23.

Zacks Rank & Stock Picks

ProPetro currently carries a Zacks Rank #5 (Strong Sell). Meanwhile, investors interested in the energy space could look at some better options like Murphy USA Inc. MUSA and Phillips 66 PSX that carry a Zacks Rank #1 (Strong Buy) and Zacks Rank #2 (Buy), respectively.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Murphy USA Inc. (MUSA) : Free Stock Analysis Report

Phillips 66 (PSX) : Free Stock Analysis Report

Pioneer Natural Resources Company (PXD) : Free Stock Analysis Report

ProPetro Holding Corp. (PUMP) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance