Prosperity Bancshares (PB) Completes Lone Star Acquisition

Prosperity Bancshares, Inc. PB recently completed its merger with Lone Star State Bancshares, Inc. The deal, which was announced in October 2022, will expand PB’s footprint in West Texas to 49 banking centers.

Per the terms of the transaction, Prosperity Bancshares issued 2.38 million shares and paid $64.1 million in cash. The regulatory approvals necessary for the completion of the deal were received last month, while the Lone Star shareholders gave the consent in March 2023.

Alan Lackey, CEO of Lone Star, and Melisa Roberts, chief lending officer of Lone Star, will be leading Prosperity Bank’s West Texas Area department as president and vice president, respectively. They will be joining Mike Marshall, chairman of the West Texas department. Other members of Lone Star management will retain leadership roles in the combined entity.

Lone Star operates five banking offices located in West Texas, including one each in Brownfield, Midland, Odessa and Big Spring. As of Dec 31, 2023, Lone Star had total assets of $1.37 billion, total loans of $1.08 billion and total deposits of $1.21 billion.

The Lone Star banking network will continue to operate under its name until the operational integration, which is expected to be completed on Oct 28, 2024. Upon the completion of integration, Lone Star customers will be able to use any of PB’s combined 288 banking centers to avail services.

The acquisition will expand Prosperity Bancshares’ regional footprint as well as diversify its revenue streams and asset base.

PB has been actively engaged in opportunistic acquisitions. Since 1998, it has completed more than 30 deals. In May 2023, the company completed the acquisition of First Bancshares of Texas, Inc. This enhanced its footprint in Texas and helped penetrate the market, given the growth opportunities.

Management remains interested in pursuing strategic acquisitions on the back of a strong capital base, mergers and acquisition experience, and deepened relationships.

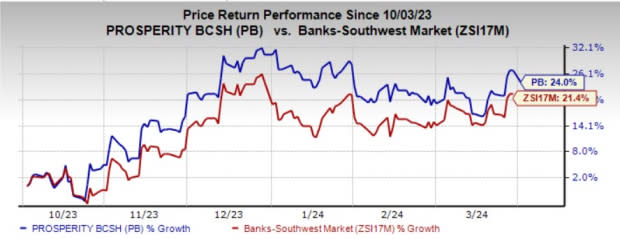

Over the past six months, shares of Prosperity Bancshares have gained 24% compared with the industry’s 21.4% growth.

Image Source: Zacks Investment Research

Currently, PB carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Acquisitions Completed by Other Financial Services Firms

Last month, Royal Bank of Canada RY completed the acquisition of HSBC Canada. The deal, announced in November 2022, was valued at C$13.5 billion.

The acquisition will expand RY’s international banking capabilities and enable it to connect Canadians to the global economy effectively. The combination keeps the bank well-positioned to cater to the needs of commercial clients and affluent clients through its global banking and wealth management offerings.

Similarly, Synchrony Financial SYF announced the completion of its acquisition of Ally Lending, a point-of-sale financing business, from Ally Financial Inc. ALLY. It included $2.2 billion of loan receivables.

The deal expands SYF’s multi-product strategy by accelerating the company’s ability to offer installment products to its merchants and contractors. This acquisition enables the company to create a distinguished solution in the industry through the simultaneous offerings of revolving credit and installment loans at the point of sale in the home improvement vertical. SYF expects the deal to be accretive to its 2024 earnings per share.

As far as Ally Financial is concerned, this transaction would enable it to invest resources in growing scale businesses and strengthen relationships with dealer customers and consumers.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Royal Bank Of Canada (RY) : Free Stock Analysis Report

Prosperity Bancshares, Inc. (PB) : Free Stock Analysis Report

Ally Financial Inc. (ALLY) : Free Stock Analysis Report

Synchrony Financial (SYF) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance