How to protect yourself against scams, from phishing to romance fraud

Scams are on the rise in Britain and the most costly ones involve being asked to send money yourself. Less than half of these cons are reimbursed by banks.

The frauds play out in a myriad of ways, but following a few simple rules will help keep you away from trouble. Largely, this involves a suspicious and patient mindset and keeping your data secure.

All the examples below are real scams suffered by Telegraph readers.

How to protect yourself from fraud

1. Be suspicious of questions and forms

Scammers rely on knowing things about you to pose as someone you trust and win you over. To pretend to be your bank or the police or someone at a government agency, they will need to know at least your name, your address and your phone number. The more data they have the more persuasive they can be.

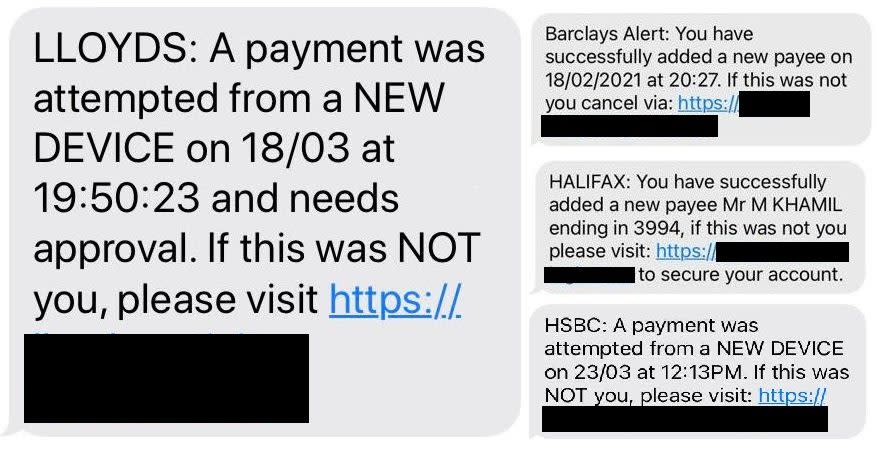

A common way of obtaining this information is to trick you into handing it over. And a common version of this method is to text or email you and ask for it under the guise of an official purpose, such as a payment for a parcel or to claim tax relief.

So, the first thing to do is to be very suspicious of text messages, emails and even phone calls where you are being asked for information that a real company would already know and to be suspicious of emails and texts containing links in general, especially if they lead to a form to fill in.

Sadly, we have been programmed by years of telephone-based customer services to confirm who we are by spilling the beans on certain personal data to pass security checks. But no-one from your bank will ring you out of the blue and ask your address, full passwords or card number.

And if you are rung about a potential fraud, you will be questioned on whether you have made a particular specific purchase or transaction and not your life history or full passwords or full passcodes.

Train yourself to ask: who is this and why do they not know what they are asking about me already?

And then perform your own security check by putting down the phone.

2. Hang up

Banks in particular are used to customers hanging up on them and ringing back. Any legitimate caller will understand this behaviour.

Make sure you have hung up fully and call your bank or other supplier using a phone number on a statement, bill, bank card or receipt.

It used to be the case that crooks could stay on the line while you did this but that particular loophole has been closed. Still, feel free to use another phone should you wish to.

3. Have a cup of tea and a think

Someone pressing you to act quickly and supplying you with information which is likely to panic you is probably trying to scam you.

Fraudsters do this deliberately to muddle you. Security experts call this type of manipulation "social engineering". If you are told something which sounds frightening or where speed could be of the essence, be suspicious.

This could be that your account is being raided, that a family member has been arrested, that a lucrative investment is about to disappear or that you could face a fine. Each of these lines has been tried on a Telegraph reader.

In all these scenarios, there will never be such a rush that you cannot hang up and call back.

4. If you are asked to do something, be suspicious

If you are being called by your bank about your account being emptied, why are they asking you to move the money rather than just doing something about it? If the police are truly worried about fraudsters at your bank, why are they asking you to move your savings rather than making arrests?

At some point in these scams, you will be asked to move your money, make a purchase or give up some information that means the criminals can, such as full passwords and pass codes.

5. Run it past a friend

Another set of ears will help in decoding whether something is a scam. Can it really be that your niece or nephew has been arrested in the US and immediate bail must be posted electronically? Probably not.

Like many scams this one seems ludicrous on paper, but knowing the name of a younger relative and knowing that they are abroad - perhaps through a social media post - can mean a scammer with a particularly hard nose can talk you into some poor decision making. Like other scams listed here it has also worked on someone.

Again, buy yourself some time by hanging up and ringing back to check.

6. Ask more questions than you are asked

Do this only if you feel confident; otherwise hang up.

Done well it will buy you a bit of time to think for yourself but you may be able to confirm your suspicions about your caller as well. Scammers will know the basics about the organisation they are impersonating, but not everything.

Where do they work? What town? When did they join? Where did they work before? How big is the office? How many people work there? There will be a point where they may give up.

Ask questions confidently and sound like you know the answer you ought to be given. Play the bad cop. Tell them you think they are a scammer and see how they react. Ordinary people will not be used to this, but a scammer will. If they have a pat answer and seem unruffled by the accusation, hang up.

This step is not foolproof as your scammer may be a better manipulator than you are an inquisitor. If you feel it is not working, hang up.

7. Make sure your data is secure

Once you have made yourself a bit more suspicious of cold callers and dodgy emails and texts, it’s time to make scammers’ jobs even harder.

It seems that every year a major organisation loses a large amount of user data. If this includes usernames and passwords, this could spell doom even if the breach is from a shop you only used once and forgot about.

This is because nearly all usernames are now email addresses, and many people use the same password for everything.

So make sure each account you have has a separate password. This may seem laborious, but it is critical to your security.

Michal Salat of online security company Avast said that he estimates that about 50pc of people will have a username and password of theirs for sale on the internet as a result of these leaks, although the exact numbers are very hard to discern.

“The more accounts you have, the more likely you are to have your some of your credentials breached,” he said. “That's one of the reasons why we always tell people never to reuse passwords.”

He said it is easy to do: his wife suffered this problem when an online store’s data was breached. She used the same password as her email address and criminals seized her email account. Luckily she was able to change the password and get it back.

8. Think like a spy

Shred anything sensitive before you bin it. Do not post facts about yourself such as your address or birthday online. If you do, make sure they are incomplete or slightly wrong. Encrypt your messages using apps such as Signal. Behave a bit more like a spy, keeping clues about yourself secret.

9. Not all of these tips will work for all scams

Investment and romance frauds follow quite different patterns. They are much slower because the fraudsters know that few targets will fall for the idea of an emergency investment or romance.

Still, you will eventually be asked for money and you will be discouraged from talking things through with your nearest and dearest.

Here, more general vigilance is needed and running things past someone else will help. It will also help to ask yourself some tough questions. Why is this bond paying 9pc? Why is it not available through more mainstream brokers? Why is this younger, attractive person interested in me? Why do they suddenly need money?

The simplest and most cynical answer to these questions is probably the correct one, even if it is also a sad or painful one.

10. If you spot a new scam, tell us about it

Scammers are inventive and frequently come up with new twists on old scams or make use of a new trend to scam people. As more people expected to receive shopping by post during the pandemic, for example, scammers made use of this by sending text messages about phantom packages to harvest personal data. Tell us and we can spread the word.

Send your scam experiences to: howard.mustoe@telegraph.co.uk

Yahoo Finance

Yahoo Finance