Will PTC's AWS Partnership to Enhance Onshape Drive Stock Upward?

PTC Inc. PTC has inked a Strategic Collaboration Agreement with Amazon Web Services (“AWS”) to boost the growth of its Onshape solution. This collaboration aims to enhance Onshape's capabilities, promote customer adoption and advance AI initiatives, all intended to help designers and engineers create high-quality products more swiftly and efficiently.

Onshape is PTC’s inaugural cloud-native product development platform that provides professional-grade CAD capabilities alongside advanced product data management, enabling agile design processes at reduced costs. With Onshape, users can rapidly innovate while collaborating with stakeholders in real-time or asynchronously from any web-connected device.

The Onshape team will partner with AWS on key product and go-to-market initiatives, including the Onshape Discovery Program, which enables qualified users to try Onshape Professional free for up to six months. This program enables engineering teams to experience the platform's unique speed and collaborative benefits before deciding on adoption.

Another key initiative is the Onshape AI Advisor, which will help users speed up product design by organizing the extensive resource library of documentation and videos. Users can ask questions in conversational language, and the AI Advisor will provide answers or recommendations, linking to relevant resources. This feature, running on Amazon Bedrock, is expected to launch by the end of 2024.

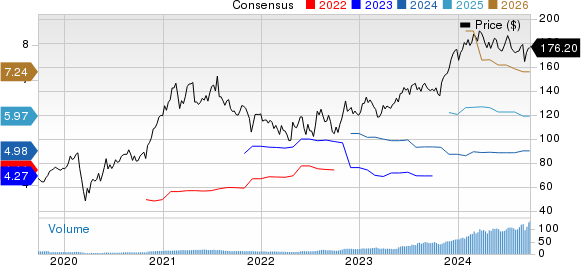

PTC Inc. Price and Consensus

PTC Inc. price-consensus-chart | PTC Inc. Quote

The collaboration will enhance Onshape's data migration tools, making it easier for companies to transition by preserving key features and information of CAD models during the switch. Onshape is also expanding its offerings for government clients to ensure compliance with The International Traffic in Arms Regulations and The Federal Risk and Authorization Management Program security requirements.

AWS highlighted that this collaboration with PTC will enhance the Onshape cloud-native CAD and PDM solution using AWS-powered technology, delivering new AI/ML capabilities and value propositions in a scalable and cost-effective manner for businesses globally and the next generation of users in education.

PTC’s Onshape Gains Traction

Onshape's growth is driven by its commitment to helping companies transition to a cloud-native CAD and PDM solution, alongside increased commercial adoption and significant uptake in the education space. Notable brands like Trek Bikes, Garmin, K2, Garrett Motion and AURA AERO are leveraging Onshape for their product designs. In the education sector, Onshape is experiencing rapid growth, with more than one million new signups annually from K-12 to university levels.

Prestigious institutions such as Ohio State University, the Rochester Institute of Technology, the University of Washington and Penn State University are incorporating Onshape into their engineering programs. On June 10, 2024, PTC's Onshape App Store was used by SyBridge Technologies to unveil a manufacturing insights application called SyBridge Studio on the PTC app.

With its three-week release cycles, Onshape has introduced features like Render Studio, PCB Studio and Onshape Simulation and improved modeling capabilities, along with the Onshape-Arena connection for a seamless CAD-PDM-PLM experience.

PTC’s CAD product suite includes Onshape. Strength in its differentiated product portfolio, notably the CAD solutions, is driving the company’s performance. In the fiscal third quarter, CAD ARR was $824 million, rising 8% year over year. Improving demand for CAD software, particularly 3D CAD, bodes well for PTC.

The global 3D CAD software market is set to reach $18.16 billion by 2031 at a CAGR of 6.2% between 2024 and 2031, per Verified Market Research report. Solid demand for precision in design, complex prototyping and digitalization of construction is expected to drive demand for 3D-CAD offerings in the automotive, aerospace, manufacturing, healthcare and defense verticals. These latest innovations in Onshape will strengthen its uptake and boost its revenues, propelling the stock upward.

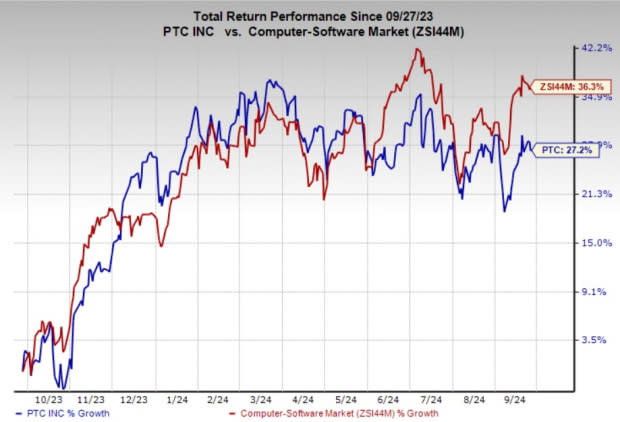

PTC’s Zacks Rank & Stock Price Performance

PTC currently carries a Zacks Rank #3 (Hold). Shares of the company have rallied 27.2% in the past year compared with the sub-industry's growth of 36.3%.

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks from the broader technology space are Seagate Technology Holdings plc STX, ANSYS, Inc. ANSS and American Software, Inc. AMSWA. STX presently sports a Zacks Rank #1 (Strong Buy), whereas ANSS and AMSWA each carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Seagate Technology delivered an earnings surprise of 80.9%, on average, in three of the trailing four quarters. In the last reported quarter, STX pulled off an earnings surprise of 40%. The Zacks Consensus Estimate for STX has increased 18% to $7.41 in the past 60 days.

ANSYS delivered an earnings surprise of 4.8%, on average, in three of the trailing four quarters. In the last reported quarter, ANSS pulled off an earnings surprise of 28.9%. It has a long-term earnings growth expectation of 6.4%.

American Software delivered an earnings surprise of 84.5%, on average, in the trailing four quarters. In the last reported quarter, AMSWA pulled off an earnings surprise of 71.4%. The Zacks Consensus Estimate for AMSWA has increased 8.6% to 38 cents in the past 60 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Seagate Technology Holdings PLC (STX) : Free Stock Analysis Report

ANSYS, Inc. (ANSS) : Free Stock Analysis Report

American Software, Inc. (AMSWA) : Free Stock Analysis Report

PTC Inc. (PTC) : Free Stock Analysis Report