PulteGroup Inc (PHM) Surpasses Analyst Revenue Forecasts with Strong Q1 2024 Performance

Earnings Per Share: Reported at $3.10, significantly surpassing the estimated $2.36.

Net Income: Reached $663 million, exceeding estimates of $504.55 million.

Revenue: Home sale revenues rose to $3.8 billion, outperforming the expected $3.58092 billion.

Home Sale Gross Margin: Increased to 29.6%, up 50 basis points year-over-year.

Net New Orders: Grew 14% to 8,379 homes, indicating strong market demand.

Backlog: Ended the quarter with 13,430 homes valued at $8.2 billion, ensuring robust future revenue potential.

Share Repurchase: Bought back $246 million of common shares, reflecting confidence in financial health and future prospects.

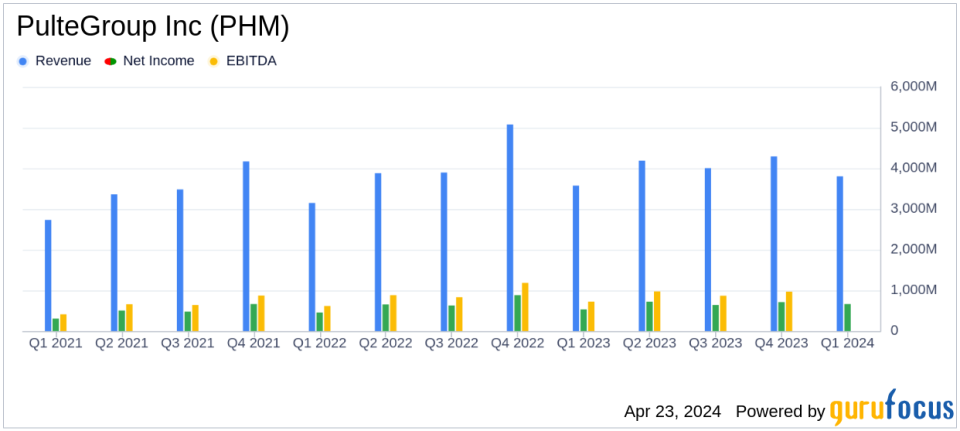

PulteGroup Inc (NYSE:PHM) released its 8-K filing on April 23, 2024, revealing a significant uptick in first-quarter financial results, surpassing analyst expectations in several key areas. The company, a leading homebuilder in the United States, reported a net income of $663 million, or $3.10 per share, outperforming the estimated earnings per share of $2.36 and net income of $504.55 million.

PulteGroup's home sale revenues saw a 10% increase to $3.8 billion, exceeding the anticipated $3.58 billion. This growth was driven by an 11% rise in closings, totaling 7,095 homes, and a strategic focus on diverse consumer segments including first-time, move-up, and active-adult buyers. The company's home sale gross margin also improved, reaching 29.6%, a 50 basis point increase from the previous year.

Financial Highlights and Operational Efficiency

The company's operational efficiency was evident in its reduced selling, general, and administrative expenses, which dropped to 9.4% of home sale revenues, inclusive of a $27 million pre-tax insurance benefit. This efficiency, coupled with a robust return on equity of 27.3%, underscores PulteGroup's strong financial management and market positioning.

During the quarter, PulteGroup also demonstrated its commitment to shareholder returns by repurchasing $246 million of its common shares. The company's strategic financial maneuvers have maintained a healthy balance sheet, with a quarter-end cash position of $1.8 billion and a conservative net debt-to-capital ratio of 1.7%.

Market Expansion and Future Outlook

CEO Ryan Marshall highlighted the structural shortage of homes in the U.S. as a significant growth opportunity for PulteGroup. The company's broad operating platform and diverse product portfolio position it well to capitalize on this demand and expand its market share. The increase in net new orders by 14% to 8,379 homes and a decrease in cancellation rates to 10% reflect strong market demand and consumer confidence in PulteGroup's offerings.

The company's financial services segment also saw a notable improvement, with pre-tax income rising to $41 million from $14 million in the prior year, benefiting from higher closing volumes and a favorable operating environment.

Strategic Analysis

PulteGroup's performance in Q1 2024 is not just a reflection of favorable market conditions but also of strategic operational adjustments and efficiency improvements. The company's ability to adapt to market needs and maintain financial robustness supports sustainable growth. With a solid increase in home closings and revenues, coupled with effective cost management, PulteGroup is poised for continued success in the competitive homebuilding market.

For detailed financial figures and further information, refer to PulteGroup's full earnings release available through their corporate website.

As PulteGroup continues to navigate the evolving real estate landscape, its strategic initiatives and strong market presence reinforce its position as a leader in the American homebuilding industry, ready to meet the ongoing demand for new housing.

Explore the complete 8-K earnings release (here) from PulteGroup Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance