Pure Cycle Corp (PCYO) Posts Positive Net Income for 19th Consecutive Quarter

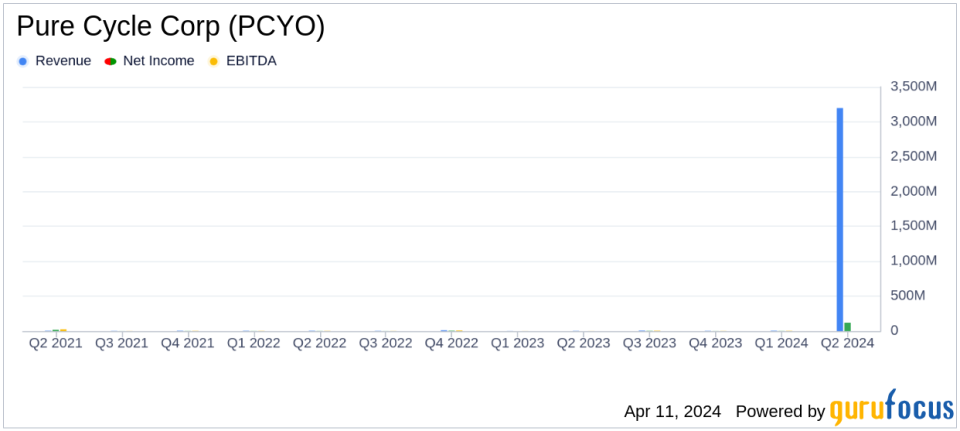

Net Income: $118 thousand for Q2 2024 and $2.183 million for the first half of fiscal 2024.

Revenue: $3.2 million for Q2 2024, with a notable increase in water and wastewater revenue.

EBITDA: $778 thousand for Q2 2024 and $4.198 million for the six months ended February 29, 2024.

Water and Wastewater Tap Sales: 723 taps sold at Sky Ranch in Phases 1 and 2A, projecting significant future revenue.

Working Capital: Reported $19.9 million as of February 29, 2024, with $20.4 million in cash and cash equivalents.

Single-Family Rental Business: 14 homes built and rented, with 17 more forecasted for construction in Phase 2B.

Pure Cycle Corp (NASDAQ:PCYO) released its 8-K filing on April 10, 2024, announcing financial results for the three and six months ended February 29, 2024. The company continued its impressive streak with its nineteenth consecutive fiscal quarter of positive net income. Pure Cycle, a diversified land and water resource development company, is actively progressing with its Sky Ranch Master Planned Community, working on multiple phases of development.

Pure Cycle's core business segments include water and wastewater resource development and land development, which have been significant revenue generators. The company also operates a single-family rental business, which adds to its diversified income streams and customer base for its water services.

Financial and Operational Performance

The company's financial highlights for the second quarter and year-to-date 2024 include a 25% increase in water and wastewater revenue for the quarter and a 127% increase for the six months compared to the prior year. This surge was primarily driven by an increase in water sales to oil and gas customers. Despite no water or wastewater tap sales in the second quarter, the company sold 15 taps in the first half of 2024, contributing to its revenue.

CEO Mark Harding expressed optimism about the accelerated delivery of lots to home builder customers and the strong outlook for water sales to oil and gas customers. CFO Marc Spezialy also highlighted the strong demand and continuous lot deliveries expected in the second half of 2024 and into fiscal 2025.

Challenges and Opportunities

While Pure Cycle reported positive net income, the company faced challenges with tap sales in Q2 and year-to-date 2024 due to the timing of closings at Sky Ranch. Additionally, lot sales revenue decreased slightly in Q2 2024 compared to the same period in 2023, again due to timing in the development of Sky Ranch. However, the company anticipates growth in residential water and wastewater service revenues as the community continues to develop.

With the development of the Sky Ranch community and the expansion of the single-family rental business, Pure Cycle is well-positioned to capitalize on the strong demand for its services. The company's ability to maintain a healthy working capital and a robust pipeline of development projects bodes well for its financial stability and future growth prospects.

Conclusion

Pure Cycle Corp (NASDAQ:PCYO) has demonstrated resilience and strategic growth in its operations, as evidenced by its consistent profitability and robust revenue growth in key segments. The company's focus on expanding its Sky Ranch community and enhancing its single-family rental offerings is expected to continue driving financial success. Investors and stakeholders can look forward to Pure Cycle's continued execution of its development plans and the potential for sustained revenue streams in the coming years.

For further details on Pure Cycle Corp's financial performance and operational updates, investors are encouraged to join the earnings call on April 11, 2024, or visit the company's website for more information.

Explore the complete 8-K earnings release (here) from Pure Cycle Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance