Pure Storage (PSTG) Q1 Earnings & Revenues Surpass Estimates

Pure Storage Inc. PSTG reported non-GAAP loss of 2 cents per share in first-quarter fiscal 2021, narrower than the Zacks Consensus Estimate of a loss of 16 cents. The company had reported a loss of 11 cents per share in the year-ago quarter.

Total revenues improved 12% from the year-ago quarter’s level to $367.1 million. Moreover, the top line surpassed the Zacks Consensus Estimate by 7.5%.

Year-over-year increase in revenues can be attributed to strong FlashBlade and FlashBlade implementation and new deal win from a major national bank based in the United States. Moreover, robust adoption of subscription offerings, including Pure as-a-Service, Cloud Block Store, and Evergreen, contributed to growth.

Following stellar fiscal first-quarter results, shares of Pure Storage are up 4% in the pre-market on May 29.

Notably, the stock has fallen 1.9% year to date, compared with the industry’s decline of 23%.

Quarter Details

In the fiscal first quarter, Product revenues (contributed 67% to total revenues) of $246.9 million increased 3.4% on a year-over-year basis, primarily on the back of existing customers and continued expansion of customer base.

During the reported quarter, Pure Storage added more than 300 customers, bringing the total count to more than 7,800 organizations.

Robust adoption of strong product portfolio, including the likes of FlashArray, FlashStack and FlashBlade business segments, is a key catalyst.

Subscription revenues (33%) of $120.2 million surged 36.6% on a year-over-year basis, driven by the company’s ongoing support contracts and robust adoption of Pure as-a-Service, Cloud Block Store, and Evergreen subscription services.

Total revenues in the United States during the reported quarter came in at $264 million, up 15% year over year. Meanwhile, total International revenues of $103 million, improved 5% on a year-over-year basis.

Noteworthy Developments

Pure Storage rolled out third-generation all-NVMeFlashArray//X to provide customers with higher performance capabilities and enable faster time-to-market.

During the fiscal first quarter, Pure Storage strengthened Cloud Data Services portfolio to aid customers in deploying hybrid clouds effectively. The company expanded partnership with Google Cloud, and also joined Google Cloud's Anthos Ready Storage Initiative.

Further, the company expanded partnership with SAP SAP to drive better business outcomes for customers through joint technical support and deeper technology integrations between the two companies. Markedly, Pure Storage's FlashArray product, which is certified for SAP HANA, will help customers and service providers in deploying mission critical SAP workloads, and drive business value.

Margin Highlights

Non-GAAP gross margin expanded 380 basis points (bps) from the year-ago quarter’s level to 71.9%. The expansion in gross margin can be attributed to growth in revenues and margin expansion of Product and Subscription services.

Non-GAAP Product gross margin expanded 460 bps from the year-ago quarter’s level to 73.3%.

Non-GAAP Subscription gross margin came in at 68.9%, which expanded 260 bps on a year-over-year basis.

Total operating expenses climbed 8.9% year over year to $341.7 million. As a percentage of total revenues, the figure came in at 93.1%, which contracted 300 bps on a year-over-year basis.

Pure Storage reported a non-GAAP operating loss of 5.4 million in the fiscal first quarter, compared with operating loss of 31.2 million in the prior-year quarter.

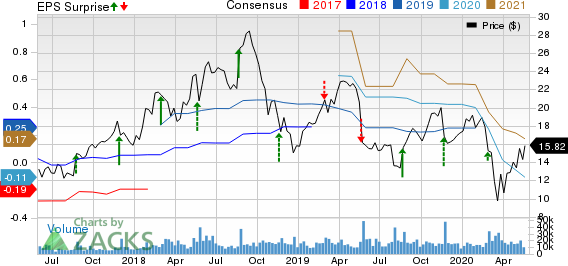

Pure Storage, Inc. Price, Consensus and EPS Surprise

Pure Storage, Inc. price-consensus-eps-surprise-chart | Pure Storage, Inc. Quote

Balance Sheet & Cash Flow

Pure Storage exited the quarter ended May 3, 2020 with cash, cash equivalents and marketable securities of $1.274 billion, compared with $1.299 billion as of Feb 2, 2020.

Cash flow from operations during the reported quarter was $35.1 million compared with $69.9 million in the fiscal fourth quarter.

Free cash flow came in at $11.3 million compared with $56.2 million in the prior quarter.

During fiscal first quarter, Pure Storage returned $70 million to shareholders via share repurchases of 5.96 million shares, with approximately $65 million remaining in share repurchase authorization.

Total deferred revenues in the fiscal first quarter came in at $706 million, compared with $697 million at the end of fiscal fourth quarter. The upside was led by growth in multiple subscription service offerings.

Guidance

Pure Storage, currently carrying a Zacks Rank #3 (Hold), withdrew guidance for fiscal 2021 and refrained from providing fiscal second-quarter outlook citing uncertainty in demand due to COVID-19-related business impact. You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Conclusion

Pure Storage delivered stellar fiscal first-quarter results. The company is banking on robust adoption of cloud storage solutions, including Cloud Block Store, ObjectEngine Cloud, and CloudSnap.

Moreover, the company continues to enhance all-flash portfolio including AIRI, FlashArray, FlashBlade and FlahStack offerings with new low-latency and high-bandwidth support capabilities to aid customers accelerate high-performance applications efficiently. The company also rolled out new remote install options for FlashArray and FlashBlade that enable the installation of systems with limited personnel amid ongoing coronavirus crisis-induced social distancing norms.

Furthermore, the company is well poised to benefit from incremental adoption of latest subscription-based Evergreen, Modern Data Experience and Pure as-a-Service solutions. The robust adoption of latest subscription services is anticipated to drive profitability in the days ahead. Markedly, ServiceNow NOW recently adopted Pure Storage’s flash storage solutions to drive performance and data management, and boost business value. Expanding customer base is expected to aid the company in driving revenues in the quarters ahead.

Nevertheless, coronavirus crisis-led uncertainty and tough business environment are likely to dampen growth. Further, growing expenses on product development amid stiff competition NetApp NTAP and Dell is a headwind.

The Hottest Tech Mega-Trend of All

Last year, it generated $24 billion in global revenues. By 2020, it's predicted to blast through the roof to $77.6 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NetApp, Inc. (NTAP) : Free Stock Analysis Report

SAP SE (SAP) : Free Stock Analysis Report

ServiceNow, Inc. (NOW) : Free Stock Analysis Report

Pure Storage, Inc. (PSTG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance