PVR INOX And 2 Other Companies That May Be Undervalued On The Indian Exchange

The Indian stock market has experienced significant growth, rising 45% over the past 12 months, despite a flat performance in the last week. In this context, identifying stocks that may be undervalued can be particularly compelling, especially when earnings are forecast to grow by 16% annually.

Top 10 Undervalued Stocks Based On Cash Flows In India

Name | Current Price | Fair Value (Est) | Discount (Est) |

Shyam Metalics and Energy (NSEI:SHYAMMETL) | ₹679.80 | ₹1024.11 | 33.6% |

HEG (NSEI:HEG) | ₹2108.05 | ₹3285.15 | 35.8% |

Updater Services (NSEI:UDS) | ₹308.25 | ₹537.78 | 42.7% |

Vedanta (NSEI:VEDL) | ₹449.70 | ₹743.32 | 39.5% |

Rajesh Exports (NSEI:RAJESHEXPO) | ₹311.15 | ₹506.77 | 38.6% |

Strides Pharma Science (NSEI:STAR) | ₹915.90 | ₹1664.05 | 45% |

Mahindra Logistics (NSEI:MAHLOG) | ₹530.95 | ₹906.88 | 41.5% |

Delhivery (NSEI:DELHIVERY) | ₹378.40 | ₹742.39 | 49% |

PVR INOX (NSEI:PVRINOX) | ₹1476.95 | ₹2566.74 | 42.5% |

Godrej Properties (NSEI:GODREJPROP) | ₹3262.00 | ₹5641.79 | 42.2% |

Here we highlight a subset of our preferred stocks from the screener.

PVR INOX

Overview: PVR INOX Limited operates as a theatrical exhibition company in India and Sri Lanka, focusing on the exhibition, distribution, and production of movies with a market capitalization of approximately ₹144.92 billion.

Operations: The company generates revenue primarily from movie exhibition, contributing ₹60.71 billion, and other activities including movie production and distribution, adding another ₹3.17 billion.

Estimated Discount To Fair Value: 42.5%

PVR INOX is significantly undervalued based on discounted cash flow, priced at ₹1476.95 against a fair value of ₹2566.74, representing a 42.5% discount. Despite slower revenue growth projections at 11% annually compared to the broader Indian market's 9.7%, its earnings are expected to surge by over 53% annually over the next three years, outpacing average market growth rates significantly. However, its forecasted Return on Equity in three years is low at 9.3%. Recent expansions across India and strategic alliances aim to bolster its market presence and operational scale further.

Rajesh Exports

Overview: Rajesh Exports Limited operates in India as a gold refiner and deals in the manufacturing, wholesale, and retail of gold and diamond jewelry, along with various other gold products, boasting a market capitalization of approximately ₹91.87 billion.

Operations: The company generates its revenue primarily from gold products, amounting to ₹28.09 billion.

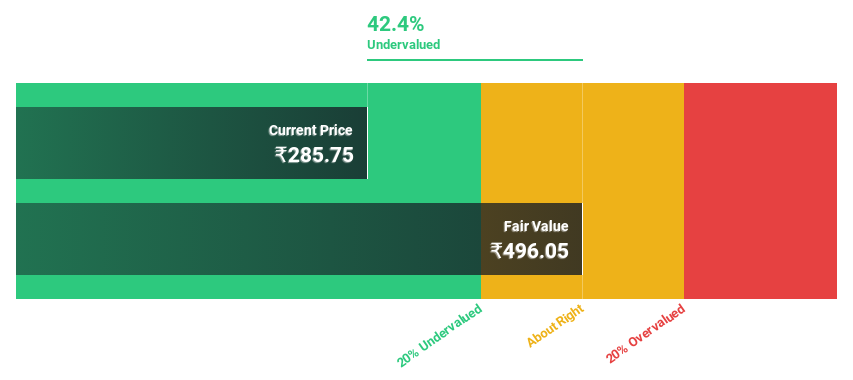

Estimated Discount To Fair Value: 38.6%

Rajesh Exports, priced at ₹311.15, is trading 38.6% below its fair value of ₹506.77, indicating significant undervaluation based on cash flows. The company's earnings are expected to grow by 31.7% annually over the next three years, outstripping the Indian market's average of 15.8%. However, its profit margins have declined from last year and its forecasted Return on Equity in three years is a low 8.2%, suggesting some operational challenges ahead despite robust growth projections and competitive positioning.

Texmaco Rail & Engineering

Overview: Texmaco Rail & Engineering Limited is an engineering and infrastructure company based in India with operations worldwide, boasting a market capitalization of approximately ₹114.91 billion.

Operations: The company generates revenue through three primary segments: the Freight Car Division (₹27.50 billion), Infra - Electrical (₹2.26 billion), and Infra - Rail & Green Energy (₹5.27 billion).

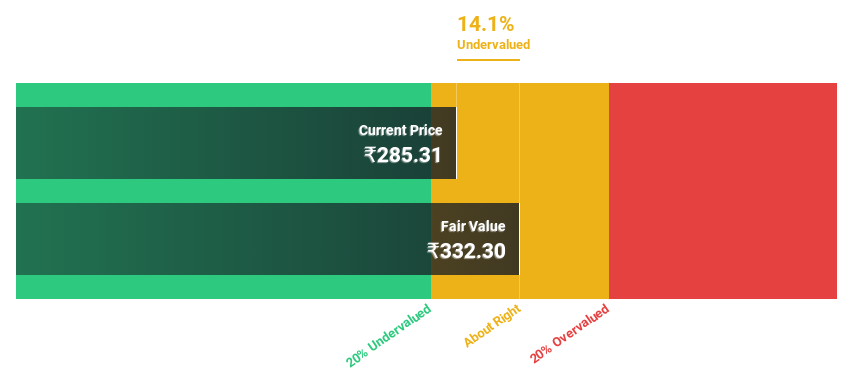

Estimated Discount To Fair Value: 12.8%

Texmaco Rail & Engineering, valued at ₹287.67, is considered undervalued with a fair value of ₹329.94. Its earnings have surged by 335% in the past year and are expected to grow by 28.9% annually over the next three years, outpacing the Indian market's growth rate of 15.9%. Despite this growth, its Return on Equity is projected to remain low at 9.4%. Additionally, recent corporate actions include a dividend announcement and an extraordinary shareholders meeting to appoint a new independent director.

Turning Ideas Into Actions

Take a closer look at our Undervalued Indian Stocks Based On Cash Flows list of 19 companies by clicking here.

Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NSEI:PVRINOX NSEI:RAJESHEXPO and NSEI:TEXRAIL.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com