Q1 Earnings Highlights: Boyd Gaming (NYSE:BYD) Vs The Rest Of The Casino Operator Stocks

Looking back on casino operator stocks' Q1 earnings, we examine this quarter's best and worst performers, including Boyd Gaming (NYSE:BYD) and its peers.

Casino operators enjoy limited competition because gambling is a highly regulated industry. These companies can also enjoy healthy margins and profits. Have you ever heard the phrase ‘the house always wins’? Regulation cuts both ways, however, and casinos may face stroke-of-the-pen risk that suddenly limits what they can or can't do and where they can do it. Furthermore, digitization is changing the game, pun intended. Whether it’s online poker or sports betting on your smartphone, innovation is forcing these players to adapt to changing consumer preferences, such as being able to wager anywhere on demand.

The 9 casino operator stocks we track reported a slower Q1; on average, revenues beat analyst consensus estimates by 0.5%. Inflation progressed towards the Fed's 2% goal at the end of 2023, leading to strong stock market performance. The start of 2024 has been a bumpier ride, as the market switches between optimism and pessimism around rate cuts due to mixed inflation data, and casino operator stocks have held roughly steady amidst all this, with share prices up 2.8% on average since the previous earnings results.

Boyd Gaming (NYSE:BYD)

Run by the Boyd family, Boyd Gaming (NYSE:BYD) is a diversified operator of gaming entertainment properties across the United States, offering casino games, hotel accommodations, and dining.

Boyd Gaming reported revenues of $960.5 million, flat year on year, in line with analysts' expectations. Overall, it was a weak quarter for the company with a miss of analysts' earnings estimates.

Keith Smith, President and Chief Executive Officer of Boyd Gaming, said: “After a record 2023, the first quarter of 2024 was a challenging start to the year. Severe winter weather had a significant impact on our Midwest & South segment early in the quarter while we also experienced increased competitive pressures in the Las Vegas Locals market. However, throughout our business, many of the positive trends from the fourth quarter continued into the new year. By focusing on our disciplined operating and marketing strategies, we have been able to maintain strong operating margins. Additionally, our significant cash flows and strong balance sheet allow us to continue returning capital to our shareholders through our ongoing share repurchases and quarterly dividend programs. Looking ahead, we remain confident in our ability to successfully navigate the current environment and deliver value to our shareholders.”

The stock is down 8.9% since reporting and currently trades at $57.25.

Read our full report on Boyd Gaming here, it's free.

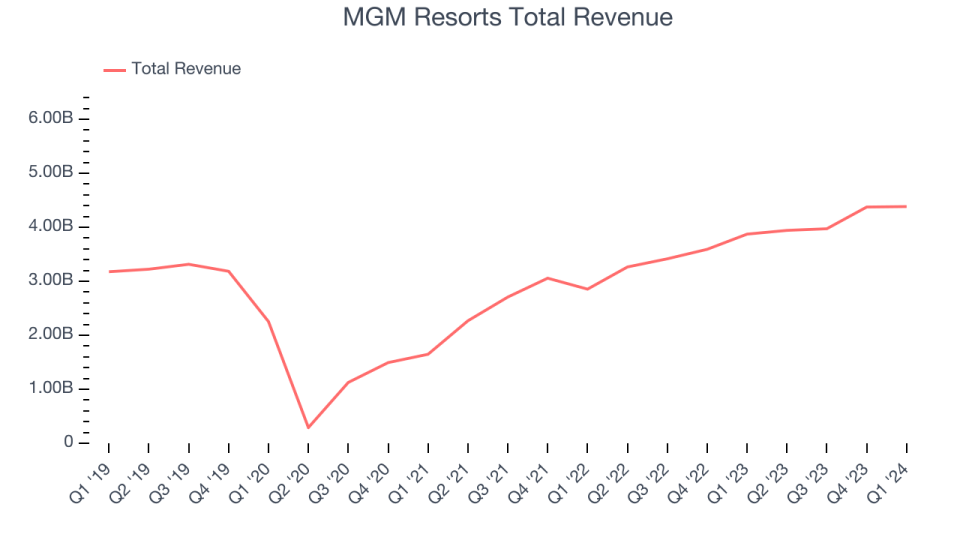

Best Q1: MGM Resorts (NYSE:MGM)

Operating several properties on the Las Vegas Strip, MGM Resorts (NYSE:MGM) is a global hospitality and entertainment company known for its resorts and casinos.

MGM Resorts reported revenues of $4.38 billion, up 13.2% year on year, outperforming analysts' expectations by 3.7%. It was a very strong quarter for the company with an impressive beat of analysts' earnings estimates and a decent beat of analysts' Casino revenue estimates.

MGM Resorts delivered the biggest analyst estimates beat among its peers. The market seems happy with the results as the stock is up 14.7% since reporting. It currently trades at $45.58.

Is now the time to buy MGM Resorts? Access our full analysis of the earnings results here, it's free.

Weakest Q1: Caesars Entertainment (NASDAQ:CZR)

Formerly Eldorado Resorts, Caesars Entertainment (NASDAQ:CZR) is a global gaming and hospitality company operating numerous casinos, hotels, and resort properties.

Caesars Entertainment reported revenues of $2.74 billion, down 3.1% year on year, falling short of analysts' expectations by 2.8%. It was a weak quarter for the company with a miss of analysts' earnings estimates.

Caesars Entertainment had the weakest performance against analyst estimates in the group. Interestingly, the stock is up 7.5% since the results and currently trades at $38.56.

Read our full analysis of Caesars Entertainment's results here.

Monarch (NASDAQ:MCRI)

Established in 1993, Monarch (NASDAQ:MCRI) operates luxury casinos and resorts, offering high-end gaming, dining, and hospitality experiences.

Monarch reported revenues of $121.7 million, up 4.3% year on year, in line with analysts' expectations. Taking a step back, it was a weaker quarter for the company with a miss of analysts' earnings estimates.

The stock is down 1.2% since reporting and currently trades at $68.58.

Read our full, actionable report on Monarch here, it's free.

Golden Entertainment (NASDAQ:GDEN)

Founded in 2001, Golden Entertainment (NASDAQ:GDEN) is a gaming company operating casinos, taverns, and distributed gaming platforms.

Golden Entertainment reported revenues of $174 million, down 37.4% year on year, surpassing analysts' expectations by 3.2%. Taking a step back, it was a very strong quarter for the company with an impressive beat of analysts' earnings estimates.

Golden Entertainment had the slowest revenue growth among its peers. The stock is down 4.7% since reporting and currently trades at $29.20.

Read our full, actionable report on Golden Entertainment here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.