Q1 Earnings Highlights: Howmet (NYSE:HWM) Vs The Rest Of The Aerospace Stocks

Let's dig into the relative performance of Howmet (NYSE:HWM) and its peers as we unravel the now-completed Q1 aerospace earnings season.

Aerospace companies often possess technical expertise and have made significant capital investments to produce complex products. It is an industry where innovation is important, and lately, emissions and automation are in focus, so companies that boast advances in these areas can take market share. On the other hand, demand for aerospace products can ebb and flow with economic cycles and geopolitical tensions, which can be particularly painful for companies with high fixed costs.

The 14 aerospace stocks we track reported a decent Q1; on average, revenues beat analyst consensus estimates by 4%. while next quarter's revenue guidance was 1.8% above consensus. Stocks--especially those trading at higher multiples--had a strong end of 2023, but 2024 has seen periods of volatility. Mixed signals about inflation have led to uncertainty around rate cuts, but aerospace stocks have performed well, with the share prices up 15% on average since the previous earnings results.

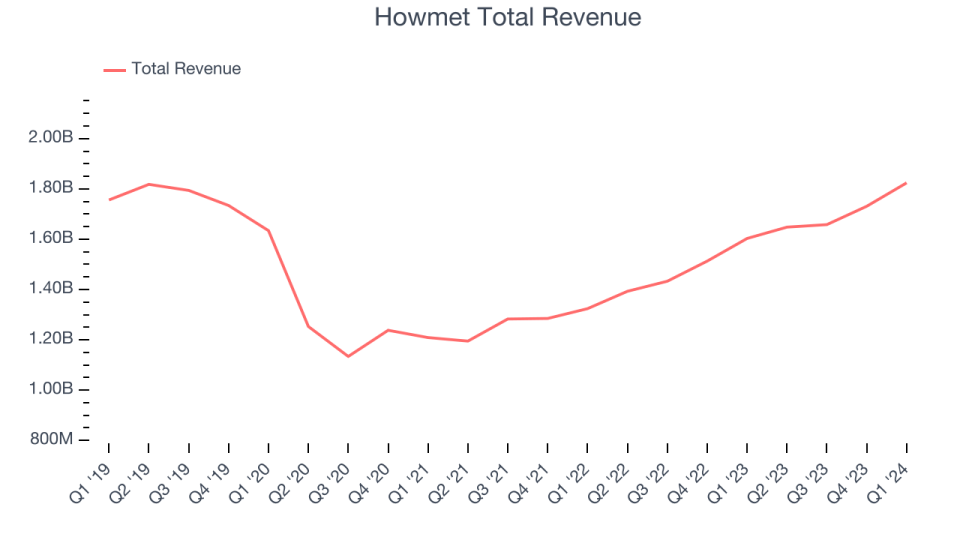

Howmet (NYSE:HWM)

Inventing the first forged aluminum truck wheel, Howmet (NYSE:HWM) specializes in lightweight metals engineering and manufacturing multi-material components used in vehicles.

Howmet reported revenues of $1.82 billion, up 13.8% year on year, exceeding analysts' expectations by 5.1%. Overall, it was an impressive quarter for the company with a solid beat of analysts' revenue estimates and a decent beat of analysts' earnings estimates.

The stock is up 19.4% since reporting and currently trades at $79.73.

We think Howmet is a good business, but is it a buy today? Read our full report here, it's free.

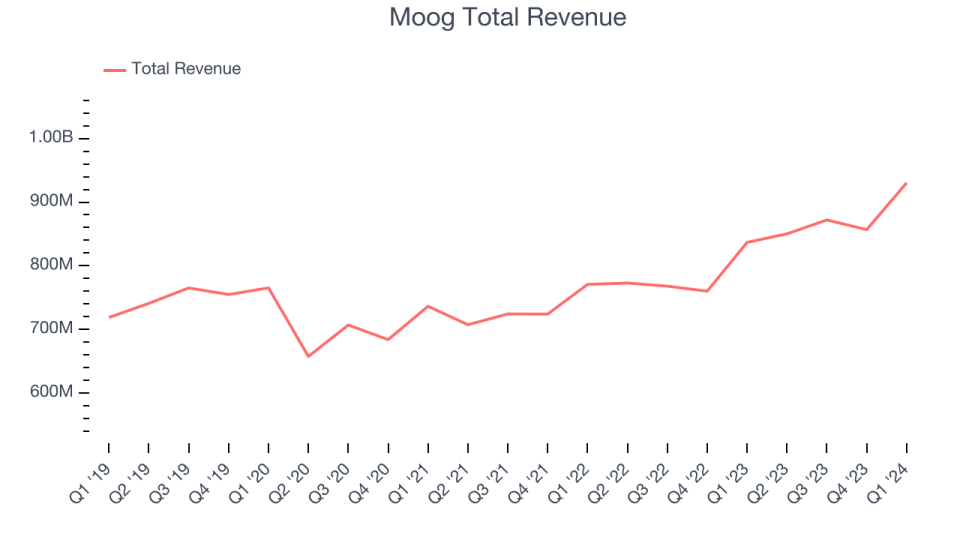

Best Q1: Moog (NYSE:MOG.A)

Responsible for the flight control actuation system integrated in the B-2 stealth bomber, Moog (NYSE:MOG.A) provides precision motion control solutions used in aerospace and defense applications.

Moog reported revenues of $930.3 million, up 11.2% year on year, outperforming analysts' expectations by 6.5%. It was an incredible quarter for the company, with an impressive beat of analysts' estimates.

The market seems happy with the results as the stock is up 9.6% since reporting. It currently trades at $172.33.

Is now the time to buy Moog? Access our full analysis of the earnings results here, it's free.

Weakest Q1: Textron (NYSE:TXT)

Listed on the NYSE in 1947, Textron (NYSE:TXT) provides products and services in the aerospace, defense, industrial, and finance sectors.

Textron reported revenues of $3.14 billion, up 3.7% year on year, falling short of analysts' expectations by 4%. It was a weak quarter for the company with a miss of analysts' organic revenue and earnings estimates.

Textron had the weakest performance against analyst estimates in the group. As expected, the stock is down 8.2% since the results and currently trades at $86.31.

Read our full analysis of Textron's results here.

Curtiss-Wright (NYSE:CW)

Formed from a merger of 12 companies, Curtiss-Wright (NYSE:CW) provides a range of products and services to the aerospace, industrial, electronic, and maritime industries.

Curtiss-Wright reported revenues of $713.2 million, up 13% year on year, surpassing analysts' expectations by 7.4%. More broadly, it was a very strong quarter for the company with a solid beat of analysts' earnings estimates and full-year revenue guidance slightly topping analysts' expectations.

The stock is up 9.7% since reporting and currently trades at $281.58.

Read our full, actionable report on Curtiss-Wright here, it's free.

AAR (NYSE:AIR)

The first third-party MRO approved by the FAA for Safety Management System Requirements, AAR (NYSE:AIR) is a provider of aircraft maintenance services.

AAR reported revenues of $567.3 million, up 8.9% year on year, in line with analysts' expectations. Overall, it was an ok quarter for the company with a decent beat of analysts' earnings estimates.

The stock is up 14% since reporting and currently trades at $72.89.

Read our full, actionable report on AAR here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.