Q1 Earnings Highlights: U-Haul (NYSE:UHAL) Vs The Rest Of The Ground Transportation Stocks

Looking back on ground transportation stocks' Q1 earnings, we examine this quarter's best and worst performers, including U-Haul (NYSE:UHAL) and its peers.

The growth of e-commerce and global trade continues to drive demand for shipping services, especially last-mile delivery, presenting opportunities for ground transportation companies. The industry continues to invest in data, analytics, and autonomous fleets to optimize efficiency and find the most cost-effective routes. Despite the essential services this industry provides, ground transportation companies are still at the whim of economic cycles. Consumer spending, for example, can greatly impact the demand for these companies’ offerings while fuel costs can influence profit margins.

The 14 ground transportation stocks we track reported an ok Q1; on average, revenues beat analyst consensus estimates by 1%. Stocks--especially those trading at higher multiples--had a strong end of 2023, but 2024 has seen periods of volatility. Mixed signals about inflation have led to uncertainty around rate cuts, but ground transportation stocks have shown resilience, with share prices up 6.1% on average since the previous earnings results.

Weakest Q1: U-Haul (NYSE:UHAL)

Started in a garage, U-Haul (NYSE:UHAL) provides rental trucks and storage facilities for individuals and businesses seeking moving solutions.

U-Haul reported revenues of $1.10 billion, down 7.8% year on year, falling short of analysts' expectations by 6.1%. Overall, it was a weak quarter for the company with a miss of analysts' earnings estimates.

U-Haul delivered the weakest performance against analyst estimates of the whole group. The stock is up 2.7% since reporting and currently trades at $64.58.

Read our full report on U-Haul here, it's free.

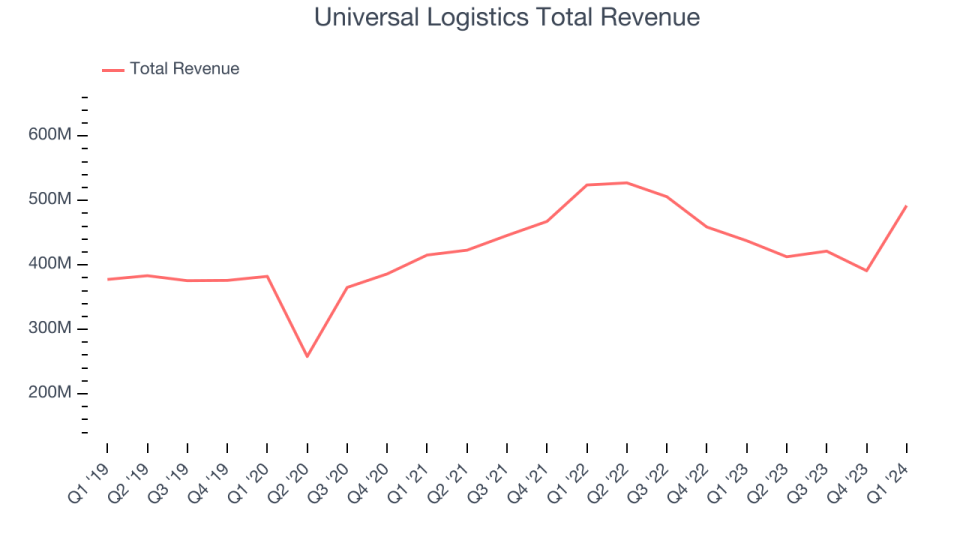

Best Q1: Universal Logistics (NASDAQ:ULH)

Founded in 1932, Universal Logistics (NASDAQ:ULH) is a provider of transportation and logistics solutions.

Universal Logistics reported revenues of $491.9 million, up 12.5% year on year, outperforming analysts' expectations by 18.1%. It was an incredible quarter for the company with an impressive beat of analysts' earnings estimates.

Universal Logistics achieved the biggest analyst estimates beat among its peers. The market seems happy with the results as the stock is up 25.9% since reporting. It currently trades at $41.13.

Is now the time to buy Universal Logistics? Access our full analysis of the earnings results here, it's free.

Schneider National (NYSE:SNDR)

Established after the founder sold the family car, Schneider National (NYSE:SNDR) is a transportation and logistics company offering a portfolio of truckload, intermodal, and logistics solutions.

Schneider National reported revenues of $1.32 billion, down 7.7% year on year, falling short of analysts' expectations by 1.9%. It was a weak quarter for the company with a miss of analysts' earnings estimates and a miss of analysts' Logistics revenue estimates.

Interestingly, the stock is up 15.4% since the results and currently trades at $24.32.

Read our full analysis of Schneider National's results here.

Old Dominion Freight Line (NASDAQ:ODFL)

Founded by a husband and wife, Old Dominion Freight Line (NASDAQ:ODFL) specializes in less-than-truckload shipping services, offering logistical and supply chain management solutions.

Old Dominion Freight Line reported revenues of $1.46 billion, up 1.2% year on year, in line with analysts' expectations. Zooming out, it was a slower quarter for the company with a miss of analysts' volume and earnings estimates.

The stock is down 13.4% since reporting and currently trades at $190.10.

Read our full, actionable report on Old Dominion Freight Line here, it's free.

Covenant Logistics (NASDAQ:CVLG)

Started with 25 trucks and 50 trailers, Covenant Logistics (NASDAQ:CVLG) is a provider of expedited long haul freight services, offering a range of logistics solutions.

Covenant Logistics reported revenues of $278.8 million, up 4.5% year on year, in line with analysts' expectations. Taking a step back, it was a very strong quarter for the company with an impressive beat of analysts' Freight revenue revenue estimates and a decent beat of analysts' earnings estimates.

The stock is up 13.4% since reporting and currently trades at $49.92.

Read our full, actionable report on Covenant Logistics here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.