Q1 Earnings Roundup: Photronics (NASDAQ:PLAB) And The Rest Of The Semiconductor Manufacturing Segment

Let's dig into the relative performance of Photronics (NASDAQ:PLAB) and its peers as we unravel the now-completed Q1 semiconductor manufacturing earnings season.

The semiconductor industry is driven by demand for advanced electronic products like smartphones, PCs, servers, and data storage. The need for technologies like artificial intelligence, 5G networks, and smart cars is also creating the next wave of growth for the industry. Keeping up with this dynamism requires new tools that can design, fabricate, and test chips at ever smaller sizes and more complex architectures, creating a dire need for semiconductor capital manufacturing equipment.

The 14 semiconductor manufacturing stocks we track reported a mixed Q1; on average, revenues beat analyst consensus estimates by 1.3%. while next quarter's revenue guidance was in line with consensus. Stocks, especially growth stocks where cash flows further in the future are more important to the story, had a good end of 2023. But the beginning of 2024 has seen more volatile stock performance due to mixed inflation data, but semiconductor manufacturing stocks have performed well, with the share prices up 20.1% on average since the previous earnings results.

Photronics (NASDAQ:PLAB)

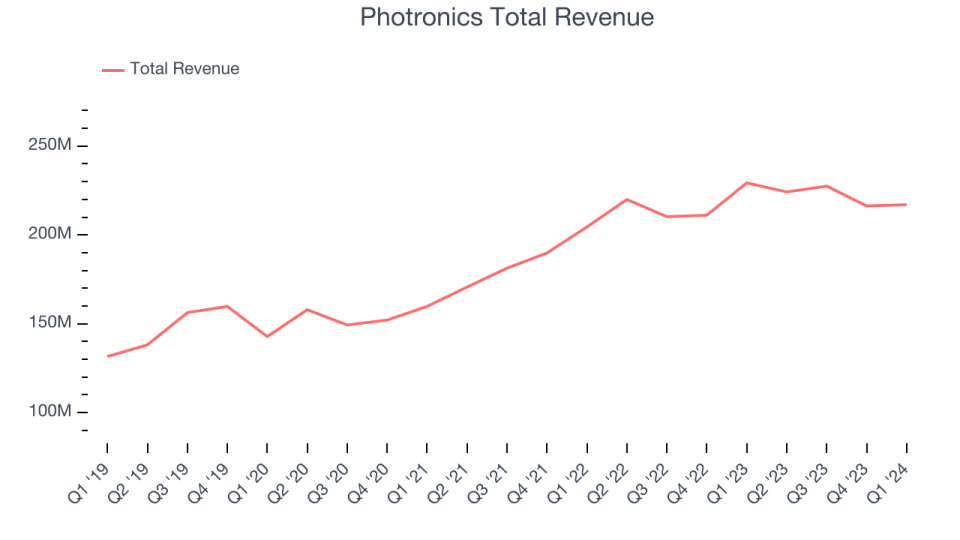

Sporting a global footprint of facilities, Photronics (NASDAQ:PLAB) is a manufacturer of photomasks, templates used to transfer patterns onto semiconductor wafers.

Photronics reported revenues of $217 million, down 5.4% year on year, falling short of analysts' expectations by 6.1%. It was a weak quarter for the company with underwhelming revenue guidance for the next quarter and a miss of analysts' EPS estimates.

“Second quarter revenue and gross margin were in line with the first quarter as positive seasonality trends were offset by business headwinds primarily related to temporary soft demand following the Chinese New Year holiday and the impact from earthquakes in Taiwan beginning in early April,” said Frank Lee, chief executive officer.

Photronics delivered the weakest performance against analyst estimates of the whole group. The stock is down 8.8% since reporting and currently trades at $25.77.

Read our full report on Photronics here, it's free.

Best Q1: Lam Research (NASDAQ:LRCX)

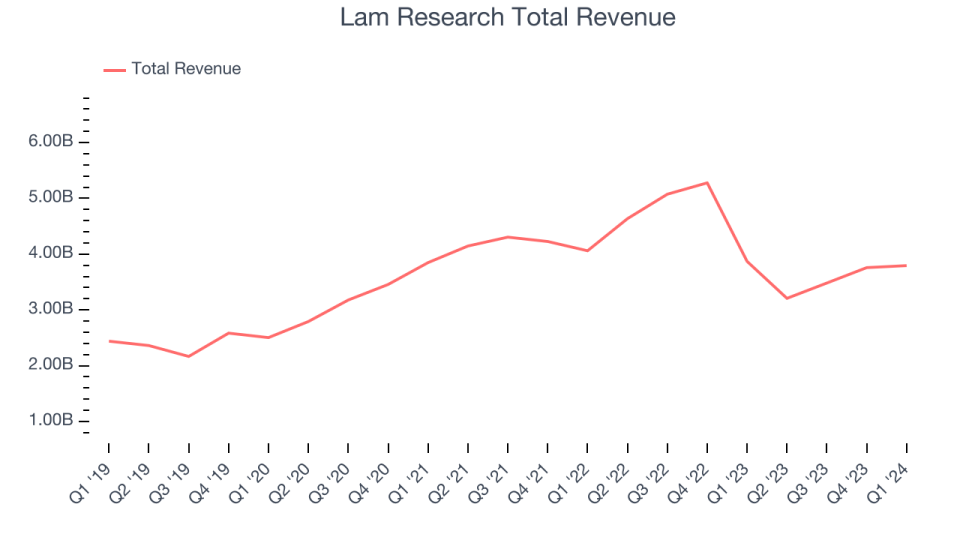

Founded in 1980 by David Lam, who pioneered semiconductor etching technology, Lam Research (NASDAQ:LCRX) is one of the leading providers of the wafer fabrication equipment used to make semiconductors.

Lam Research reported revenues of $3.79 billion, down 2% year on year, outperforming analysts' expectations by 1.7%. It was a strong quarter for the company with a significant improvement in its gross margin and an impressive beat of analysts' EPS estimates.

The market seems happy with the results as the stock is up 27.3% since reporting. It currently trades at $1,125.61.

Is now the time to buy Lam Research? Access our full analysis of the earnings results here, it's free.

Kulicke and Soffa (NASDAQ:KLIC)

Headquartered in Singapore, Kulicke & Soffa (NASDAQ: KLIC) is a provider of production equipment and tools used to assemble semiconductor devices

Kulicke and Soffa reported revenues of $172.1 million, flat year on year, falling short of analysts' expectations by 1.2%. It was a weak quarter for the company with underwhelming revenue guidance for the next quarter and a decline in its operating margin.

Interestingly, the stock is up 12.3% since the results and currently trades at $49.71.

Read our full analysis of Kulicke and Soffa's results here.

Amkor (NASDAQ:AMKR)

Operating through a largely Asian facility footprint, Amkor Technologies (NASDAQ:AMKR) provides outsourced packaging and testing for semiconductors.

Amkor reported revenues of $1.37 billion, down 7.2% year on year, in line with analysts' expectations. Looking more broadly, it was a strong quarter for the company with a significant improvement in its gross margin and an impressive beat of analysts' EPS estimates.

The stock is up 38.5% since reporting and currently trades at $43.65.

Read our full, actionable report on Amkor here, it's free.

KLA Corporation (NASDAQ:KLAC)

Formed by the 1997 merger of the two leading semiconductor yield management companies, KLA Corporation (NASDAQ:KLAC) is the leading supplier of equipment used to measure and inspect semiconductor chips.

KLA Corporation reported revenues of $2.36 billion, down 3% year on year, surpassing analysts' expectations by 1.7%. Looking more broadly, it was a strong quarter for the company with a solid beat of analysts' EPS estimates and optimistic revenue guidance for the next quarter.

The stock is up 32.3% since reporting and currently trades at $892.7.

Read our full, actionable report on KLA Corporation here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.