Q1 Rundown: Norfolk Southern Corporation (NYSE:NSC) Vs Other Transportation and Logistics Stocks

The end of an earnings season can be a great time to discover new stocks and assess how companies are handling the current business environment. Let’s take a look at how Norfolk Southern Corporation (NYSE:NSC) and the rest of the transportation and logistics stocks fared in Q1.

The growth of e-commerce and global trade continues to drive demand for shipping services, presenting opportunities for transportation and logistics companies. The industry continues to invest in advanced technologies such as automated sorting systems and real-time tracking solutions to enhance operational efficiency. Companies that win in this space boast speed, reach, reliability, and last-mile efficiency while those who do not see their market shares diminish. Like other industrials companies, transportation and logistics companies are at the whim of economic cycles. Consumer spending, for example, can greatly impact the demand for these companies’ offerings while fuel costs influence profit margins.

The 21 transportation and logistics stocks we track reported an ok Q1; on average, revenues were in line with analyst consensus estimates. Stocks--especially those trading at higher multiples--had a strong end of 2023, but 2024 has seen periods of volatility. Mixed signals about inflation have led to uncertainty around rate cuts, and transportation and logistics stocks have held roughly steady amidst all this, with share prices up 4.9% on average since the previous earnings results.

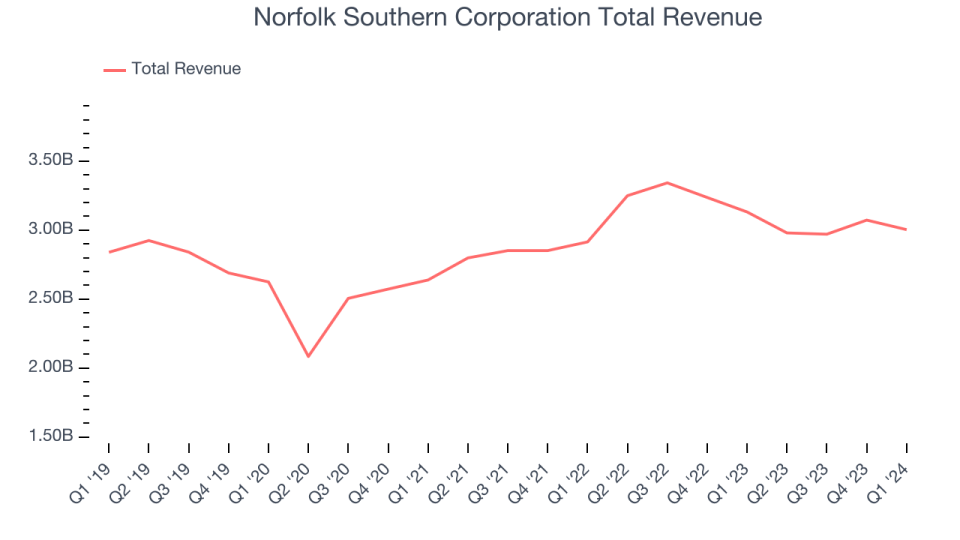

Norfolk Southern Corporation (NYSE:NSC)

Starting with a single route from Virginia to North Carolina, Norfolk Southern (NYSE:NSC) is a freight transportation company operating a major railroad network across the eastern United States.

Norfolk Southern Corporation reported revenues of $3.00 billion, down 4.1% year on year, falling short of analysts' expectations by 0.5%. It was a mixed quarter for the company, with a decent beat of analysts' volume estimates but a miss of analysts' earnings estimates.

The stock is down 11.9% since the results and currently trades at $215.86.

Read our full report on Norfolk Southern Corporation here, it's free.

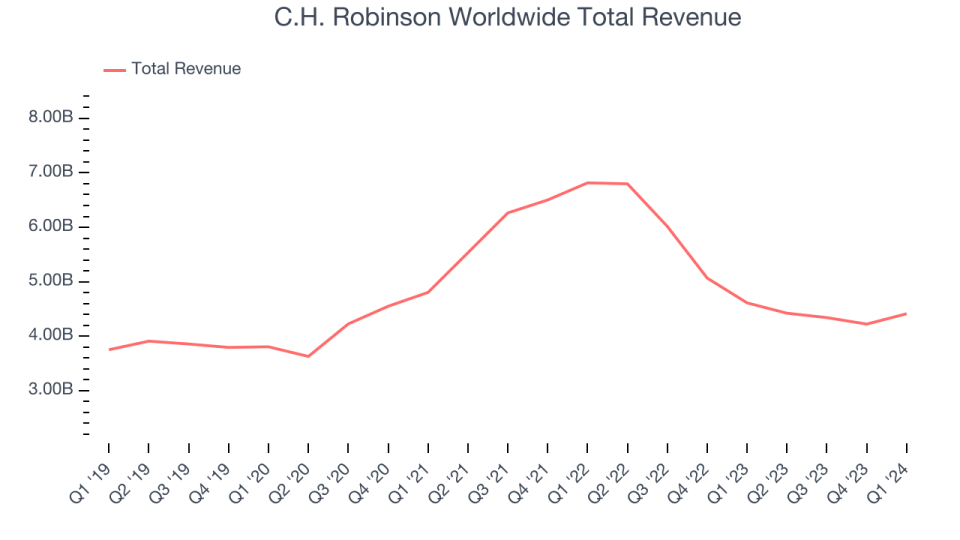

Best Q1: C.H. Robinson Worldwide (NASDAQ:CHRW)

Originally a wholesale produce brokerage house, C.H. Robinson (NASDAQ:CHRW) is a global logistics company providing transportation and supply chain solutions.

C.H. Robinson Worldwide reported revenues of $4.41 billion, down 4.3% year on year, outperforming analysts' expectations by 3.1%. It was a stunning quarter for the company, with an impressive beat of analysts' earnings estimates and a solid beat of analysts' Global Forwarding revenue estimates.

C.H. Robinson Worldwide scored the biggest analyst estimates beat among its peers. The stock is up 21.5% since the results and currently trades at $87.51.

Is now the time to buy C.H. Robinson Worldwide? Access our full analysis of the earnings results here, it's free.

Slowest Q1: Schneider National (NYSE:SNDR)

Established after the founder sold the family car, Schneider National (NYSE:SNDR) is a transportation and logistics company offering a portfolio of truckload, intermodal, and logistics solutions.

Schneider National reported revenues of $1.32 billion, down 7.7% year on year, falling short of analysts' expectations by 1.9%. It was a weak quarter for the company, with a miss of analysts' earnings estimates and revenue estimates.

The stock is up 14% since the results and currently trades at $24.03.

Read our full analysis of Schneider National's results here.

Scorpio Tankers (NYSE:STNG)

Operating one of the youngest fleets in the industry, Scorpio Tankers (NYSE: STNG) is an international provider of marine transportation services, specializing in the shipment of refined petroleum.

Scorpio Tankers reported revenues of $389.8 million, up 3.3% year on year, surpassing analysts' expectations by 2.1%. It was a very strong quarter for the company, with revenue and EPS exceeding analysts' expectations.

The stock is up 5.4% since the results and currently trades at $79.45.

Read our full, actionable report on Scorpio Tankers here, it's free.

Expeditors (NYSE:EXPD)

Founded in Seattle, Expeditors (NYSE:EXPD) specializes in global logistics, offering transportation, supply chain, and distribution services.

Expeditors reported revenues of $2.21 billion, down 14.9% year on year, falling short of analysts' expectations by 0.6%. It was a mixed quarter for the company, with a miss of analysts' revenue estimates. On the other hand, EPS came in ahead of expectations.

The stock is up 7% since the results and currently trades at $123.85.

Read our full, actionable report on Expeditors here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.