Q2 Earnings Review: Leisure Products Stocks Led by American Outdoor Brands (NASDAQ:AOUT)

Earnings results often indicate what direction a company will take in the months ahead. With Q2 behind us, let’s have a look at American Outdoor Brands (NASDAQ:AOUT) and its peers.

Leisure products cover a wide range of goods in the consumer discretionary sector. Maintaining a strong brand is key to success, and those who differentiate themselves will enjoy customer loyalty and pricing power while those who don’t may find themselves in precarious positions due to the non-essential nature of their offerings.

The 15 leisure products stocks we track reported a slower Q2. As a group, revenues were in line with analysts’ consensus estimates while next quarter’s revenue guidance was 21.9% below.

The Fed cut its policy rate by 50bps (half a percent) in September 2024, the first in roughly four years. This marks the end of its most pointed inflation-busting campaign since the 1980s. While CPI (inflation) readings have been supportive lately, employment measures have bordered on worrisome. The markets will be assessing whether this rate cut's timing (and more potential ones in 2024 and 2025) is ideal for supporting the economy or a bit too late for a macro that has already cooled too much.

In light of this news, leisure products stocks have held steady with share prices up 3.9% on average since the latest earnings results.

Best Q2: American Outdoor Brands (NASDAQ:AOUT)

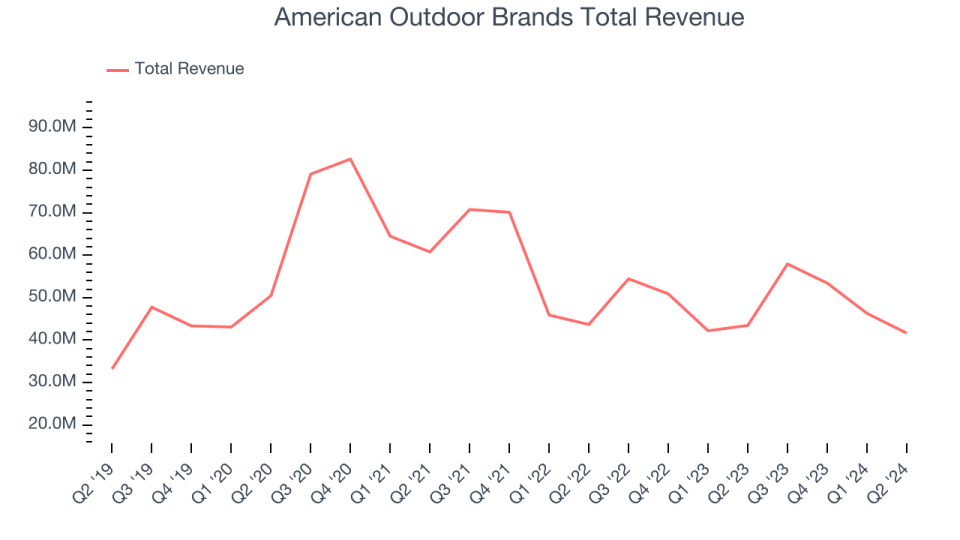

Spun off from Smith and Wesson in 2020, American Outdoor Brands (NASDAQ:AOUT) is an outdoor and recreational products company that offers firearms and firearm accessories.

American Outdoor Brands reported revenues of $41.64 million, down 4.1% year on year. This print exceeded analysts’ expectations by 1.4%. Overall, it was a very strong quarter for the company with an impressive beat of analysts’ earnings estimates.

Brian Murphy, President and Chief Executive Officer, said, "Net sales results for our first quarter came in as expected, declining slightly year-over-year, driven by a combination of order timing and recent trends in certain consumer markets. Nevertheless, I am pleased with our performance, which included a significant increase of more than 76% in Adjusted EBITDAS, and reflected a consumer preference for innovative products from our popular brands in Outdoor Lifestyle and Shooting Sports categories. New product innovation and expanded distribution opportunities are core to our long-term growth strategy, and both played a key role in our first quarter results.

Unsurprisingly, the stock is down 1.1% since reporting and currently trades at $9.08.

Is now the time to buy American Outdoor Brands? Access our full analysis of the earnings results here, it’s free.

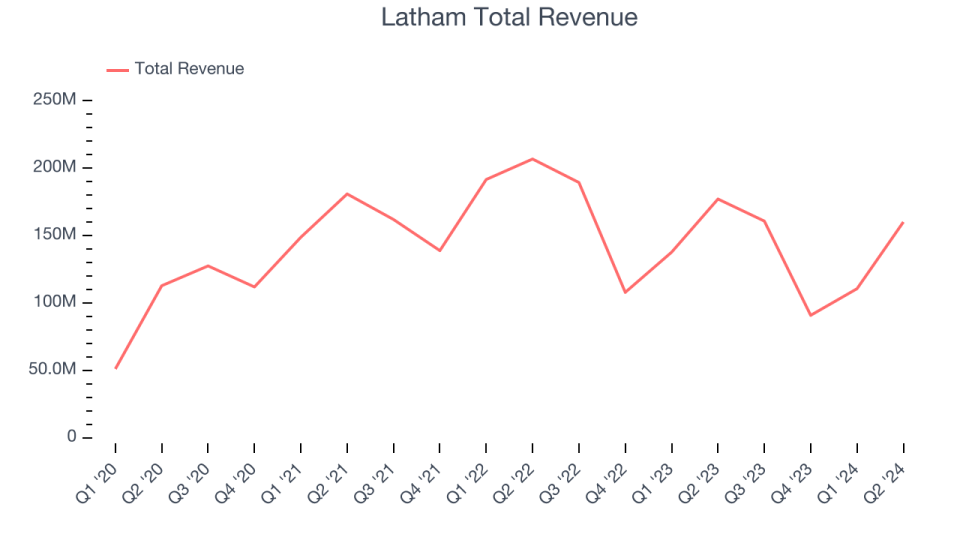

Latham (NASDAQ:SWIM)

Started as a family business, Latham (NASDAQ:SWIM) is a global designer and manufacturer of in-ground residential swimming pools and related products.

Latham reported revenues of $160.1 million, down 9.6% year on year, outperforming analysts’ expectations by 2.2%. The business had a very strong quarter with an impressive beat of analysts’ earnings estimates.

Latham delivered the highest full-year guidance raise among its peers. The market seems happy with the results as the stock is up 115% since reporting. It currently trades at $6.64.

Is now the time to buy Latham? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Smith & Wesson (NASDAQ:SWBI)

With a history dating back to 1852, Smith & Wesson (NASDAQ:SWBI) is a firearms manufacturer known for its handguns and rifles.

Smith & Wesson reported revenues of $88.33 million, down 22.7% year on year, falling short of analysts’ expectations by 13.8%. It was a disappointing quarter as it posted a miss of analysts’ earnings estimates.

Smith & Wesson delivered the weakest performance against analyst estimates in the group. As expected, the stock is down 9.4% since the results and currently trades at $12.87.

Read our full analysis of Smith & Wesson’s results here.

Brunswick (NYSE:BC)

Formerly known as Brunswick-Balke-Collender Company, Brunswick (NYSE: BC) is a designer and manufacturer of recreational marine products, including boats, engines, and marine parts.

Brunswick reported revenues of $1.44 billion, down 15.2% year on year. This print lagged analysts' expectations by 6.9%. It was a disappointing quarter as it also logged revenue guidance for next quarter missing analysts’ expectations and underwhelming earnings guidance for the next quarter.

The stock is up 12.1% since reporting and currently trades at $82.38.

Read our full, actionable report on Brunswick here, it’s free.

Malibu Boats (NASDAQ:MBUU)

Founded in California in 1982, Malibu Boats (NASDAQ:MBUU) is a manufacturer of high-performance sports boats and luxury watercrafts.

Malibu Boats reported revenues of $158.7 million, down 57.4% year on year. This print surpassed analysts’ expectations by 1.1%. Zooming out, it was a softer quarter as it produced a miss of analysts’ earnings estimates.

The stock is up 13.7% since reporting and currently trades at $39.70.

Read our full, actionable report on Malibu Boats here, it’s free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.