QUALCOMM Incorporated, (NASDAQ:QCOM) a Dividend Stock with an In-Demand Product Line

This article was originally published on Simply Wall St News

Could QUALCOMM Incorporated (NASDAQ:QCOM) be an attractive dividend share to own for the long haul? Investors are often drawn to strong companies with the idea of reinvesting the dividends. Unfortunately, it's common for investors to be enticed in by the seemingly attractive yield, and lose money when the stock goes down. That is why we need to find both an attractive dividend and a growing stock

In the case of QUALCOMM, we are looking for opportunities of growth in the semiconductor industry, as well as hoping that the company capitalizes on the chip shortage crisis, which is estimated to last well into 2023.

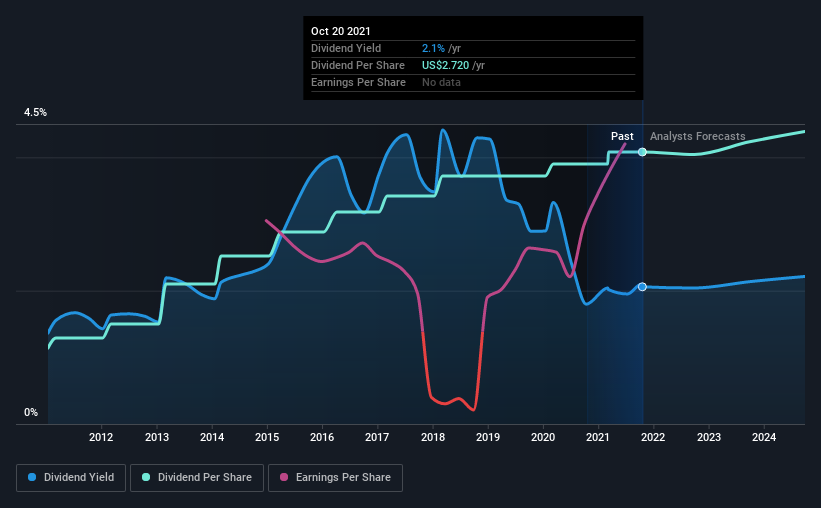

When analyzing dividends, we start at the yield, which shows us the estimated return from dividends we get by buying the stock today. Yields can (mathematically) increase in two ways. One, if the stock drops, and two, if the company increases the dividend per share.

With a 2.1% yield, many investors might overlook QUALCOMM. But there are some good underlying fundamentals to take a deeper-dive in the stock.

The long payment history suggests QUALCOMM has some staying power

The company also returned around 2.0% of its market capitalization to shareholders in the form of stock buybacks over the past year

QUALCOMM announced a US$10b buyback program of its shares. This is a good way to deliver returns to shareholders by keeping the stock stable and increasing

The company is mature but projected to keep growing with 6.3% annual revenue and 2.2% annual earnings growth

QUALCOMM has been growing its earnings per share at 19% a year over the past five years

When buying stocks for their dividends, you should always run through the checks below, to see if the dividend looks sustainable.

Explore this interactive chart for our latest analysis on QUALCOMM!

Payout ratios

QUALCOMM paid out 32% of its profit as dividends, over the trailing twelve month period.

This is a medium payout level that leaves enough capital in the business to fund opportunities that might arise, while also rewarding shareholders. One of the risks is that management reinvests the retained capital poorly instead of paying a higher dividend.

We also measure dividends paid against a company's levered (after debt payments) free cash flow, to see if enough cash was generated to cover the dividend.

Of the free cash flow it generated last year, QUALCOMM paid out 32% as dividends, suggesting the dividend is affordable.

Key Takeaways

When we look at a dividend stock, we need to form a judgement on whether the dividend will grow, if the company is able to maintain it in a wide range of economic circumstances, and if the dividend payout is sustainable. It's great to see that QUALCOMM is paying out a low percentage of its earnings and cash flow.

Sometimes, a stable company with an in-demand product is a solid investment strategy. QUALCOMM seems to offer both as the company has the products, moat and capital to navigate the next few years of demand.

The dividend yield is at a modest 2.1%, but the company has the fundamentals to sustain the rate long-term.

It is good that QUALCOMM has been delivering solid improvement in its earnings per share, and relatively consistent dividend payments. Overall, we think there are a lot of positives to QUALCOMM from a dividend perspective.

If you need more dividend stocks, take a look at our list of global stocks with a market capitalization above $1bn and yielding more 3%.

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance