Quarter of G4S investors snub £3bn takeover offer

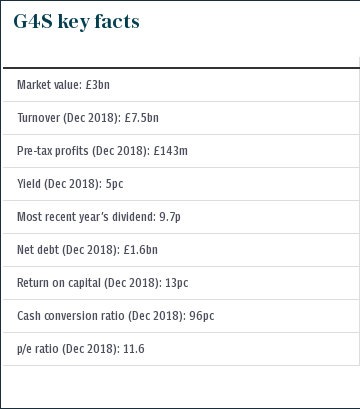

The three biggest investors in G4S that control more than a quarter of the security company’s shares have dismissed GardaWorld’s £3bn approach as being too low.

Schroders, which holds 10.6pc of G4S, labelled the 190p-a-share deal being proposed by Canada’s GardaWorld and backed by its 51pc-owner BC Partners as “materially undervaluing G4S and its prospects”.

This echoes the next two biggest investors, US-based Harris Associates with just under 10pc, and New York hedge fund Sachem Head Capital, which has about 5.7pc.

In response to GardaWorld going public on Monday with its approaches to G4S, which it claimed had been “summarily dismissed”, the US investors said they believed the price was too low.

That has now been backed up by Schroders, G4S’s largest single investor. Sue Noffke, Schroders’ head of UK equities, said it believed the bid "materially undervalues the company and its prospects. However, we are open to a deal at a fair price for G4S shareholders that more accurately reflects peer multiples, synergies and other strategic benefits that an acquirer will gain from.”

Harris and Sachem have both signalled they are not opposed to GardaWorld returning with an improved offer which better reflects G4S’s price.

Shares in G4S rose 1.4pc to 193.5p on Friday. They had soared earlier this week following news of the approach from GardaWorld to 182p.

Going public is seen as a strategy to force G4S to the negotiating table, but many believe the price is nowhere near enough to get management to engage, laying the ground for a hostile bid.

Graham Simpson, analyst at Canaccord’s Quest, called the offer “outrageously low” sand said his model valued G4S at 303p.

He added: “It is clear to us the 190p offer is opportunistic and very cheeky, hence the reason G4S management has rejected the takeover bid. If GardaWorld/BC Partners are not going to engage sensibly, we think they should stop distracting management after this third low-ball bid.”

Yahoo Finance

Yahoo Finance